This week’s edition of Finovate Global highlights recent fintech news from India.

A strategic partnership between financial software applications and marketplace company Finastra and Tech Mahindra, announced today, will help corporate banks accelerate their digital transformation journeys. Specifically, the partnership will make Tech Mahindra the exclusive global implementation partner for Finastra’s Cash Management platform. Tech Mahindra will also become the preferred partner for Finastra’s Trade Innovation and Corporate Channels solutions in the U.S., Canada, and Europe.

“This is an important partnership that aligns closely with our commitment to helping our customers navigate today’s challenges and embrace much needed digitalization,” Finastra CEO Simon Paris said. “The broad portfolio of services and deep experience offered by Tech Mahindra are a valuable complement to our modern and open software. With this combination, we look forward to propelling the digital transformation of even more banks and financial institutions around the world.”

The partnership will enable the two companies to offer a variety of cross-functional solutions across digital advisory, system integration, integrated infrastructure, and cloud services. These solutions will help corporate and institutional banks streamline and digitalize their operations. Financial institutions will further benefit from faster time to value for customers courtesy of faster implementations and upgrades.

“This partnership brings together two global leaders in digital transformation and financial services applications to help corporate banks scale at speed,” said Tech Mahindra CEO and Managing Director Mohit Joshi. “We believe our joint efforts will redefine the way banks digitize to improve their profit margins.”

Founded in 1986, Tech Mahindra is an international IT services and consulting company, headquartered in Pune, India. Part of the Mahindra Group, Tech Mahindra has more than 147,000 employees in 90+ countries serving 1,100+ clients. The firm offers solutions and expertise in verticals ranging from banking, insurance, and telecommunications, to media, entertainment, and retail. The first Indian company to earn the Sustainable Markets Initiative’s Terra Carta Seal, Tech Mahindra is publicly traded on India’s National Stock Exchange (NSE) and has a market capitalization of $17.8 billion (₹1.5 trillion).

The product of a union between Finovate alum Misys and D+H in 2017, Finastra offers software and solutions for financial institutions across lending, payments, treasury and capital markets, as well as retail, digital, and commercial banking. The company’s technology for banks helps them develop their direct banking relationships and to grow through new channels such as Banking-as-a-Service and embedded finance. More than 8,000 institutions – including 45 of the world’s top 50 banks – rely on Finastra’s technology.

The Reserve Bank of India (RBI) has been making fintech, financial, and economic news of late. On the fintech side, the RBI has granted cross-border payment licenses to three fintechs: BillDesk, Amazon Pay, and Adyen. These licenses will enable these companies to operate as cross-border payment aggregators and, ultimately, to offer their customers payment services for both imports and exports.

The RBI has been actively encouraging many fintechs to secure payment aggregator licenses; more than 20 companies have been granted PA licenses to date. In many of these instances, the RBI has suggested that companies interested in cross-border payments in particular apply for these licenses. Another firm that recently secured its PA license for cross-border payments for import and export from the RBI is Cashfree Payments.

In order to secure PA licenses, fintechs must register under the Financial Intelligence Unit-India (FIU-IND) in order to become authorized to process transactions. Fintechs must also maintain a minimum net worth of Rs 15 Cr ($1.8 million) during application, a sum that will increase to Rs 25 Cr ($2.9 million) after March 2026.

Speaking of payments, the RBI is now a part of Project Nexus. The first project from the payments sector of the Bank for International Settlements (BIS), the project seeks to connect the Faster Payment Systems of four Association of Southeast Asian Nations (ASEAN) countries – Malaysia, the Philippines, Singapore, and Thailand – and India. While India’s RBI has collaborated with a number of other countries via its Unified Payments Interface (UPI) to support bilateral payments, RBI’s participation in Project Nexus is the first time the bank has officially joined a multilateral project of this scope.

Additional countries are expected to be added over time. The project will help small and medium-sized businesses in India make faster, less expensive, and more reliable cross-border payments. To this end, the project will also make it easier for Indian banks to offer cross-border payment services to a broader range of countries. Speed and greater transparency are also among the benefits highlighted by observers.

Are you a fan of CBDCs? This week, the RBI reported that its central bank digital currency (CBDC) pilot has five million users and 420,000 participating merchants as of June 30. According to Reuters, transactions in the digital rupee are running at a pace of 100,000 a day, significantly below lofty expectations and hopes of one million transactions a day by 2023. It has also been pointed out that the digital rupee may suffer from competition with the country’s popular faster payments system, UPI.

Nevertheless, the digital rupee may be getting a bit of a boost courtesy of cryptocurrency exchange Bybit, which launched digital rupee payments on its platform this week. According to Cointelegraph, the digital rupee will be available as a wallet-based payment option, along with the exchange’s payment options in rupees via bank transfer, third-parties such as Paytm, and India’s Unified Payments Interface (UPI).

“By incorporating the eRupee payment, Bybit aims to elevate the payment experience for INR (Indian rupee) users, fostering trust and reliability in every transaction,” said Bybit sales and marketing director Joan Han. “Furthermore, this initiative is expected to attract a wider pool of merchants to the platform, driving business growth and expanding the reach of Bybit’s services within the market.”

Founded in 2018, Bybit is the second-largest cryptocurrency exchange by trading volume in the world, with more than 37 million users.

Here is our look at fintech innovation around the world.

Middle East and Northern Africa

- Faye, an insurtech startup based in Israel, raised $31 million in Series B funding.

- Egyptian B2B platform Cartona secured $8.1 million in a Series A extension round led by Algebra Ventures.

- Israel-based financial crime detection company ThetaRay acquired screening company Screena.

Central and Southern Asia

- Bangladesh-based fintech Nagad teamed up with Huawei Technologies.

- The Reserve Bank of India approved cross-border payment licenses for BillDesk, Amazon Pay, and Adyen.

- Texas-based migration fintech Vesti announced an expansion to Bangladesh, India, and Pakistan.

Latin America and the Caribbean

- Caribbean-based PROVEN Bank partnered with Ireland’s Fenergo to enhance its transaction monitoring and AML operations.

- Mexican fintech platform for the underbanked and microbusinesses Aviva raised $5.5 million in funding.

- Ripple teamed up with the National Federation of Associations of Central Bank Servers (Fenasbac) to promote fintech innovation in Brazil.

Asia-Pacific

- ADVANCE.AI launched its KYB business intelligence service to enhance its operations in Singapore and Malaysia.

- Financial solutions firm Opn announced a strategic partnership with BigPay as part of its expansion in Thailand.

- Australian lender ANZ acquired Suncorp’s banking business.

Sub-Saharan Africa

- Flutterwave secured a Payment Service Provider license from the Bank of Ghana.

- Techpoint Africa looked at MTN Nigeria’s fintech revenue growth in the first half of the year.

- Tanzanian fintech Nala raised $40 million in Series A funding.

Central and Eastern Europe

- Poland’s Comarch announced a strategic partnership with DSK Bank.

- Bank of Russia pledged to launch a digital ruble by July 2025.

- Leanpay, a buy now pay later and POS lending platform based in Slovenia, raised EUR 10 million in Series B funding.

Inc. 5,000 Europe

Inc. 5,000 Europe

CREALOGIX

CREALOGIX Dorsum

Dorsum ebankIT

ebankIT

Horizn

Horizn ICAR

ICAR ITSector

ITSector Mitek

Mitek

Swaper

Swaper Trustly

Trustly Wealthify

Wealthify Xignite

Xignite

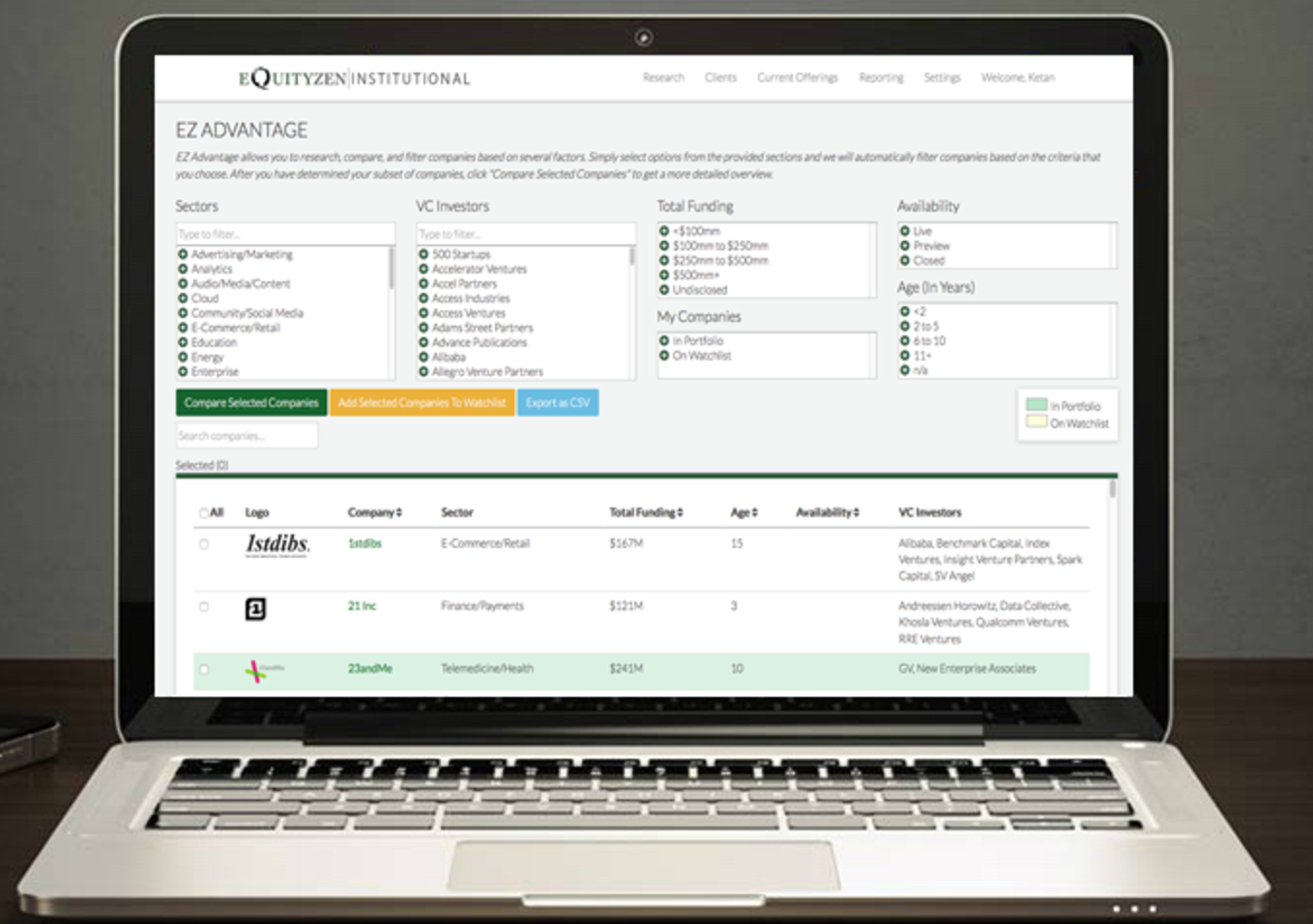

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

Presenters

Presenters Paulina Powązka, Senior Business Solutions Consultant

Paulina Powązka, Senior Business Solutions Consultant