- Crédit Agricole Next Bank has launched a new lead management platform and CRM courtesy of a partnership with InvestGlass.

- The new offering will help the bank deal with new customer growth and increasing linguistic diversity among its clients and employees.

- Switzerland-based InvestGlass most recently demoed its sales and compliance automation technology at FinovateEurope in February.

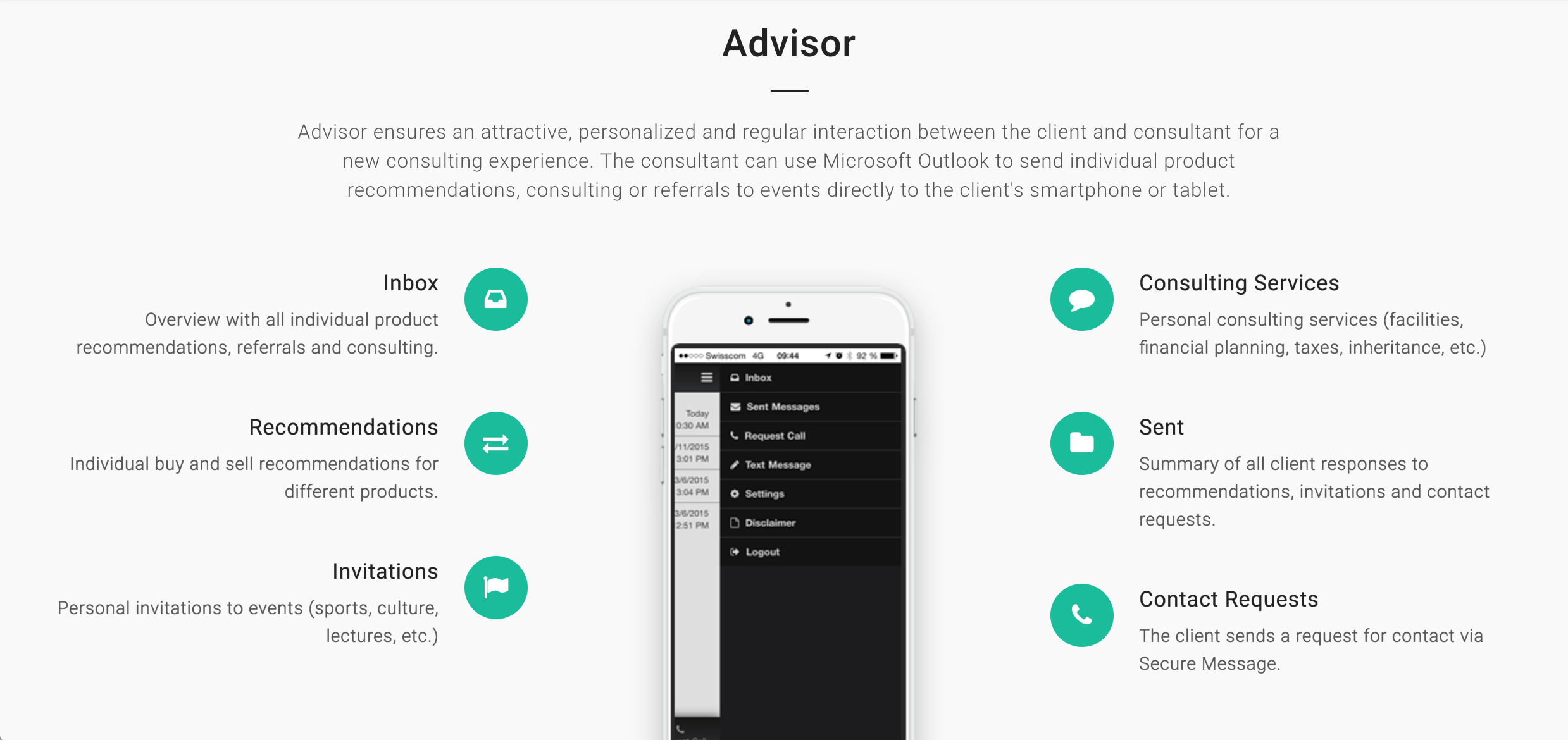

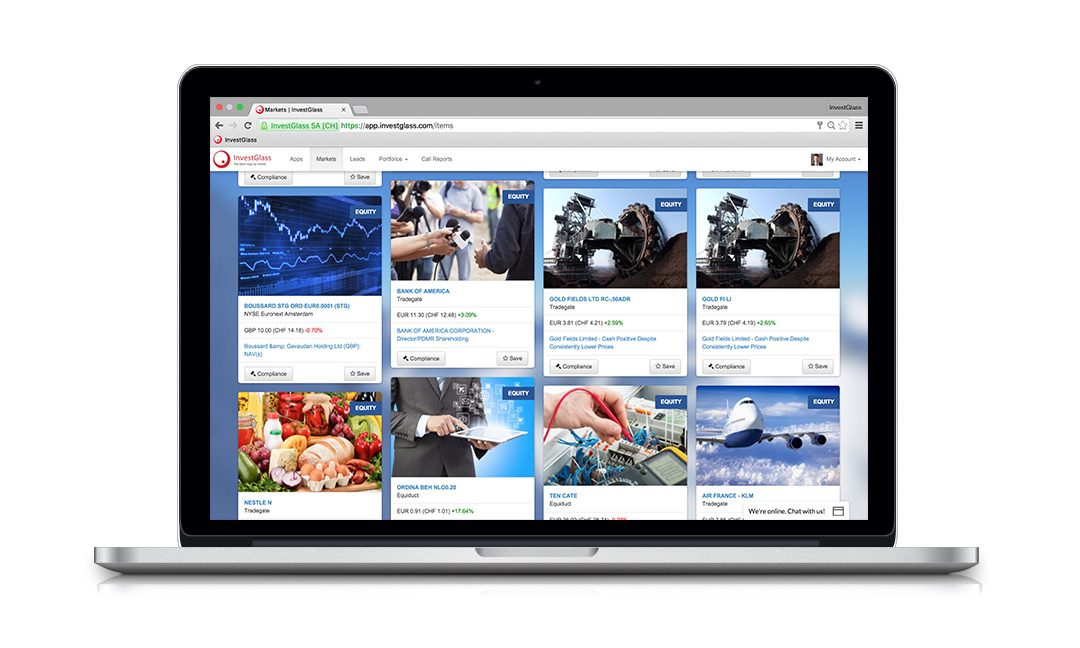

Courtesy of a partnership with sales and compliance automation solution provider InvestGlass, Crédit Agricole Next Bank has launched its new lead management platform and CRM. The offering, unveiled this spring, will help the institution enhance the customer experience as well as automate internal processes for employees.

“The deployment of InvestGlass within Crédit Agricole Next Bank represents more than just a technical improvement,” Crédit Agricole Next Bank Deputy Director of Development Maxime Charton said. “It’s a cultural transformation that allows the bank to continue innovating and improving its digital journeys for the benefit of its clients.”

One of the key ways that Crédit Agricole Next Bank will leverage its new technology is to help the firm deal with the linguistic diversity that characterizes both its customers and staff. With more than four languages to contend with, the institution will benefit from InvestGlass’s flexibility and automation capabilities, which will enable Crédit Agricole Next Bank to provide personalized experiences even as its clientele grows.

Additionally, InvestGlass will help the institution fulfill its goal of digitalizing the lead management process, with appointment scheduling, prospect flow automation, and mailing tools integrated into the platform. This will make it easier for Crédit Agricole Next Bank to monitor and manage its communications more effectively across multiple channels.

“InvestGlass allows us to optimize our operational efficiency while significantly improving our clients’ experience,” Crédit Agricole Next Bank Director of Online Agency Stephane Graeffly said.

Headquartered in Geneva, Switzerland, InvestGlass made its Finovate debut at FinovateEurope in 2016 and returned to the Finovate stage most recently for FinovateEurope earlier this year. At the conference, the company demonstrated its automation solution for sales and compliance that helps banks, brokers, government agencies, and crypto companies become more productive with a non-U.S. CRM option.

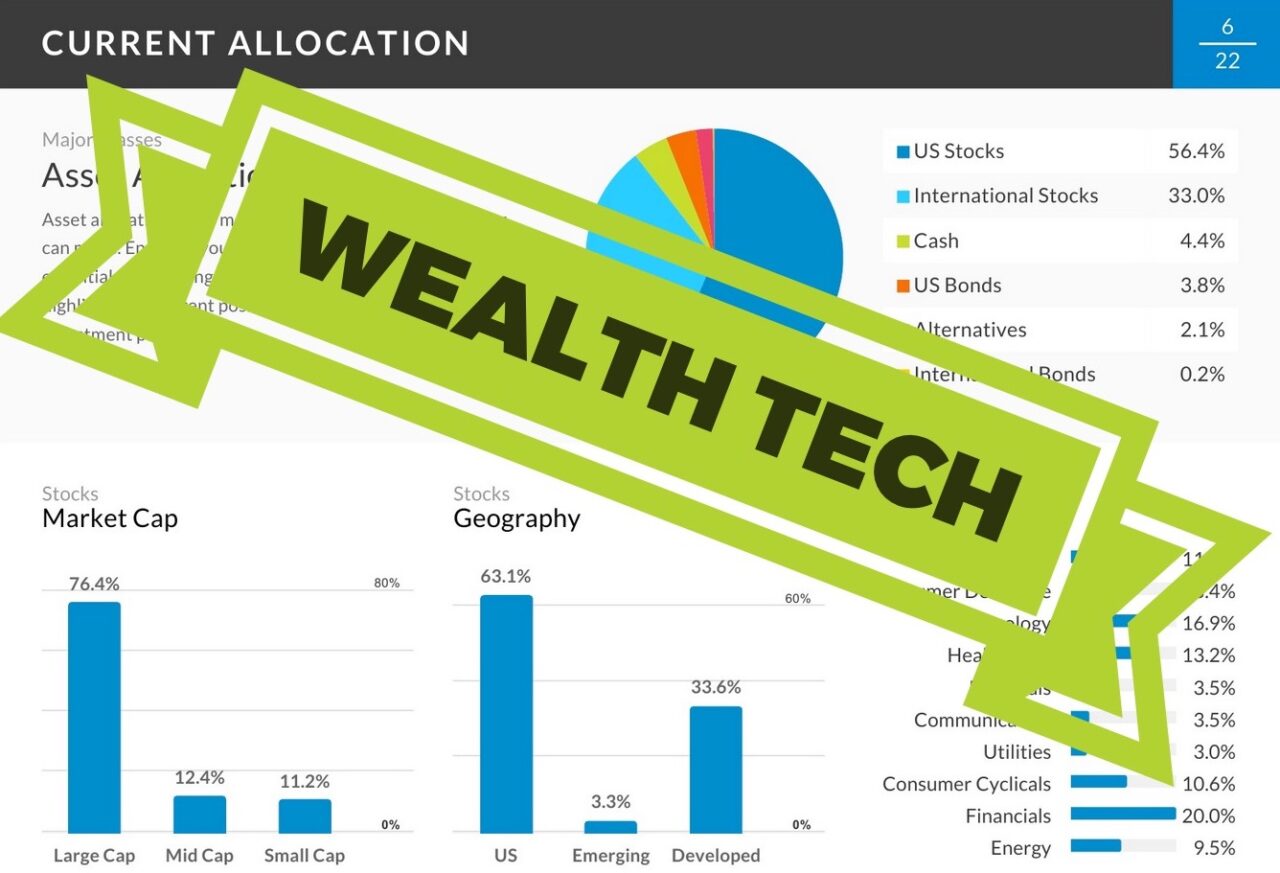

InvestGlass’s partnership announcement comes a month after the company unveiled a pair of new AI solutions, Copilot and Mistral, to help businesses convert unstructured data into conversational knowledge and actionable insights. Copilot is the cloud-based option that allows companies to use their OpenAI API key. Mistral is InvestGlass’s local server/on-premise offering.

InvestGlass was founded in 2014. Alexandre Gaillard is CEO.

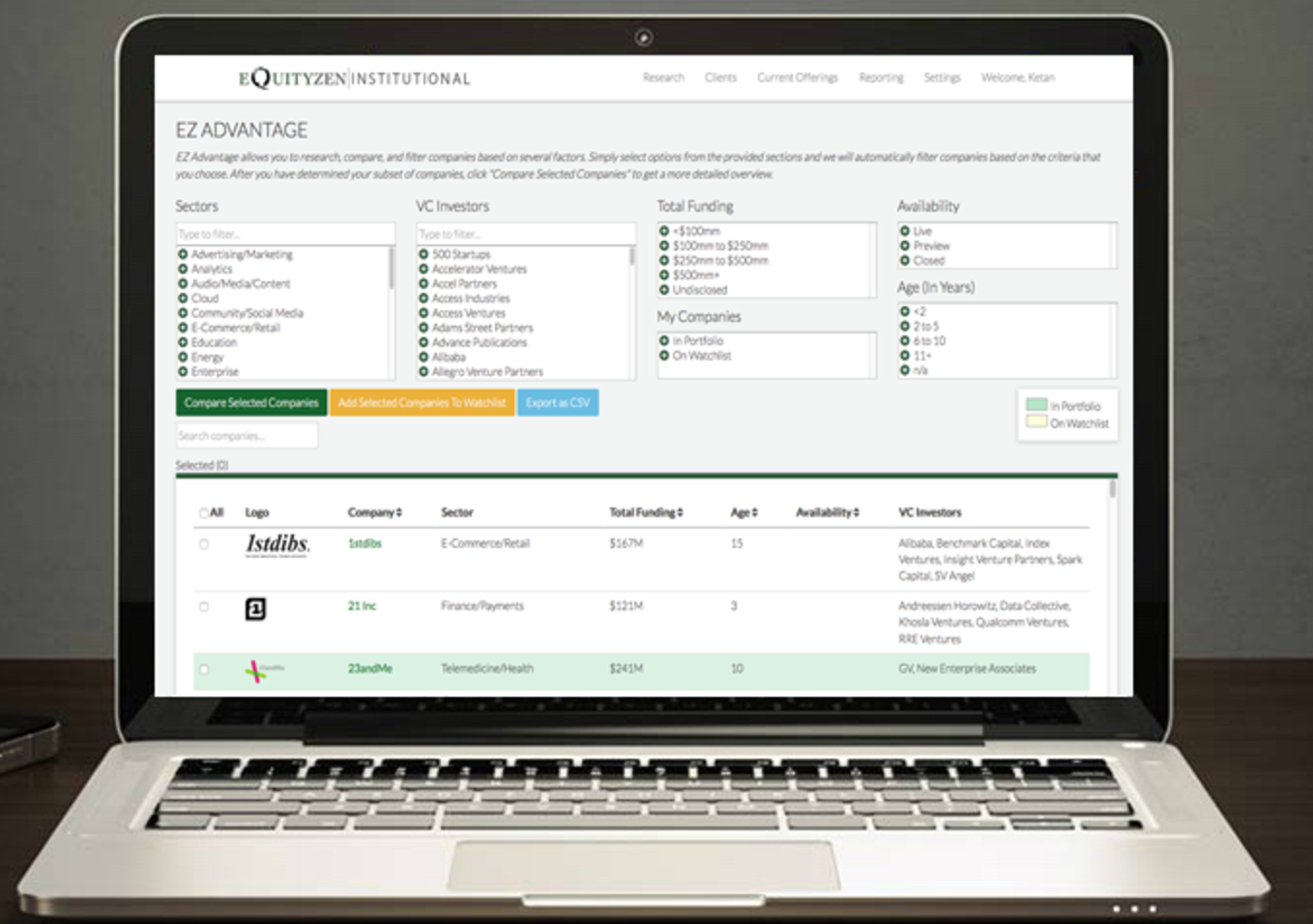

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

CEO Alexandre Gaillard Presenting with CTO Sébastien Thevenaz at FinovateEurope 2016 in London.

CEO Alexandre Gaillard Presenting with CTO Sébastien Thevenaz at FinovateEurope 2016 in London. In an interview with the company’s CEO, Alexandre Gaillard, we discussed the value that InvestGlass brings advisers. Gaillard is a French citizen and speaks English, French, and Mandarin. He is passionate about behavioral finance and has worked as a banker, adviser, and was once head of equity sales.

In an interview with the company’s CEO, Alexandre Gaillard, we discussed the value that InvestGlass brings advisers. Gaillard is a French citizen and speaks English, French, and Mandarin. He is passionate about behavioral finance and has worked as a banker, adviser, and was once head of equity sales.

Presenter

Presenter