The week begins with news of investment in insurtech, financial wellness, and risk management. We are also seeing a number of new partnerships in payments and fraud prevention. Check back here all week long at Finovate’s Fintech Rundown for updates on the latest fintech headlines.

Payments

FIS forges strategic partnership with payment network and Buy Now, pay later company Affirm.

Bluefin announces partnership with advanced payment terminal provider Datecs to enhance payment security.

Kivra and Trustly introduce a new generation of Autogiro to make automatic payments easier and more secure.

Trust Bank and TerraPay team up to launch payment solution for Bangladeshi students studying abroad.

StoneX and Fiserv partner to enhance cross-border payment capabilities for financial institutions.

Allied Payment Network signs 84 new financial institutions in 2024, representing an increase of 20% over 2023.

Digital banking

Wells Fargo partners with Q2 to boost collaboration across commercial banking teams.

Alliant Credit Union turns to Backbase to enhance the digital experience for members.

Digital banking solutions provider Apiture and digital solutions company Omnicommander team up to help banks and credit unions better communicate with their customers and members.

Gold Coast Federal Credit Union enlists Tyfone to accelerate digital transformation.

Crypto / Defi

Ripple partners with currency exchange provider Unicâmbio to bring crypto-enabled cross-border payments to Portugal.

Insurtech

Australian digital-first insurance broking firm UpCover secures $19 million in Series A funding.

Via its brand Polly, European digital insurance broker CLARK launches its first fully digital underwriting solution in the UK.

Financial wellness

Malaysia-based Earned Wage Access (EWA) solutions provider Payd raises $400,000 in seed extension funding.

Mortgage and savings software provider finova launches its mobile-first onboarding app.

Risk management

Financial risk management software provider Validus Risk Management locks in $45 million in growth equity funding.

Risk intelligence platform SRA Watchtower acquires Lumio Insight.

Fraud prevention

Financial software and technology company CSI partners with Mitek Systems to launch its proprietary check fraud detection solution for NuPoint customers.

Backbase and Feedzai team up to integrate advanced security capabilities into Backbase’s Engagement Banking Platform.

Regtech and compliance

Sardine AI raises $70 million to make fraud and compliance teams more productive.

Investing / wealth management

Halal investment research platform Musaffa launches new equity crowdfunding round.

Brightwave integrates Quartr’s global database of first-party information from public companies with its document analysis capabilities.

Datalign secures $9 million Seed funding to accelerate AI-powered financial advisory solutions.

Lending and credit

Finastra launches Assist.AI, an AI-powered assistant to enhance the trade finance operations within its Trade Innovation solution.

Eltropy partners with MeridianLink to help advance digital lending for credit unions and community banks.

Mortgagetech and real estate

Agora launches major expansion in Australia.

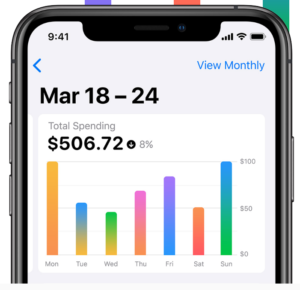

PFM

PFM