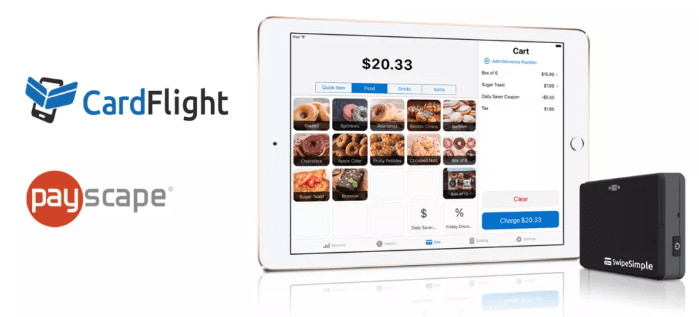

Payment tech company CardFlight formed a partnership this week that will help boost its client base. The New York-based company has formed a distribution partnership with small business software provider and payment technology company Payscape.

Aimed at serving small-to-medium-sized businesses, Payscape will offer CardFlight’s SwipeSimple payment acceptance technology and business management tools to its clients as a part of its Payscape Mobile product offering. Payscape Mobile is a holistic product offering that provides merchants advanced payment acceptance technology, leading security, and management tools.

A handful of new capabilities will be available to Payscape Mobile users via SwipeSimple. Additions include mobile point of sale and Bluetooth LE credit card readers that are EMV and magstripe compatible, customer subscription and installment plan technology, address verification for card not present payments, and an analytics, inventory, and business tools dashboard for merchants.

“At Payscape, our goal is to help businesses grow by equipping them with superior products and services,” Said Adam Bloomston, CEO and co-founder of Payscape. “We’re happy to partner with CardFlight because their product aligns with our goal and allows us to provide the best solutions to our customers and give them everyday advantages in managing their businesses and accepting payments.”

Payscape is the latest of CardFlight’s reseller clients, which together have distributed CardFlight technology to more than 45,000 merchants across the U.S. Other resellers include TSYS, Worldpay, and First Data.

Founded in 2013, CardFlight serves 10 of the top 30 merchant acquirers in the U.S., reaching tens of thousands of merchants across all 50 states. The company debuted its technology at FinovateSpring 2013, showing off the first iteration of its API/SDK. Last month, CardFlight launched SwipeSimple Customers to help merchants build customer databases and manage card data. Earlier this year, the company added paper receipt printing capabilities and enhanced its security.