As 2024 works its way toward halftime, we’re seeing an uptick in partnership and collaboration activity from crypto to regtech. Check back all week long for updates on the latest in fintech news.

Payments

Payment orchestration platform Gr4vy extends its partnership with open banking payments company Trustly.

Tyro Payments teams up with StoreConnect to enable integrated payments for a Salesforce-based POS solution.

Intelligent verified payouts solutions provider Verituity closes $18.8 million funding round.

MENA and Africa-based consumer fintech Pyypl to issue prepaid Visa cards from its UAE headquarters as part of a new partnership with Visa.

Clair partners with Check to seamlessly offer on-demand pay.

Tribe Payments appoints Andrew Hocking as CEO.

Frost Bank taps Finzly to provide FedNow and RTP instant payments to its business clients and consumers.

Digital banking

Mahalo Banking introduces its latest partner: Industrial Credit Union.

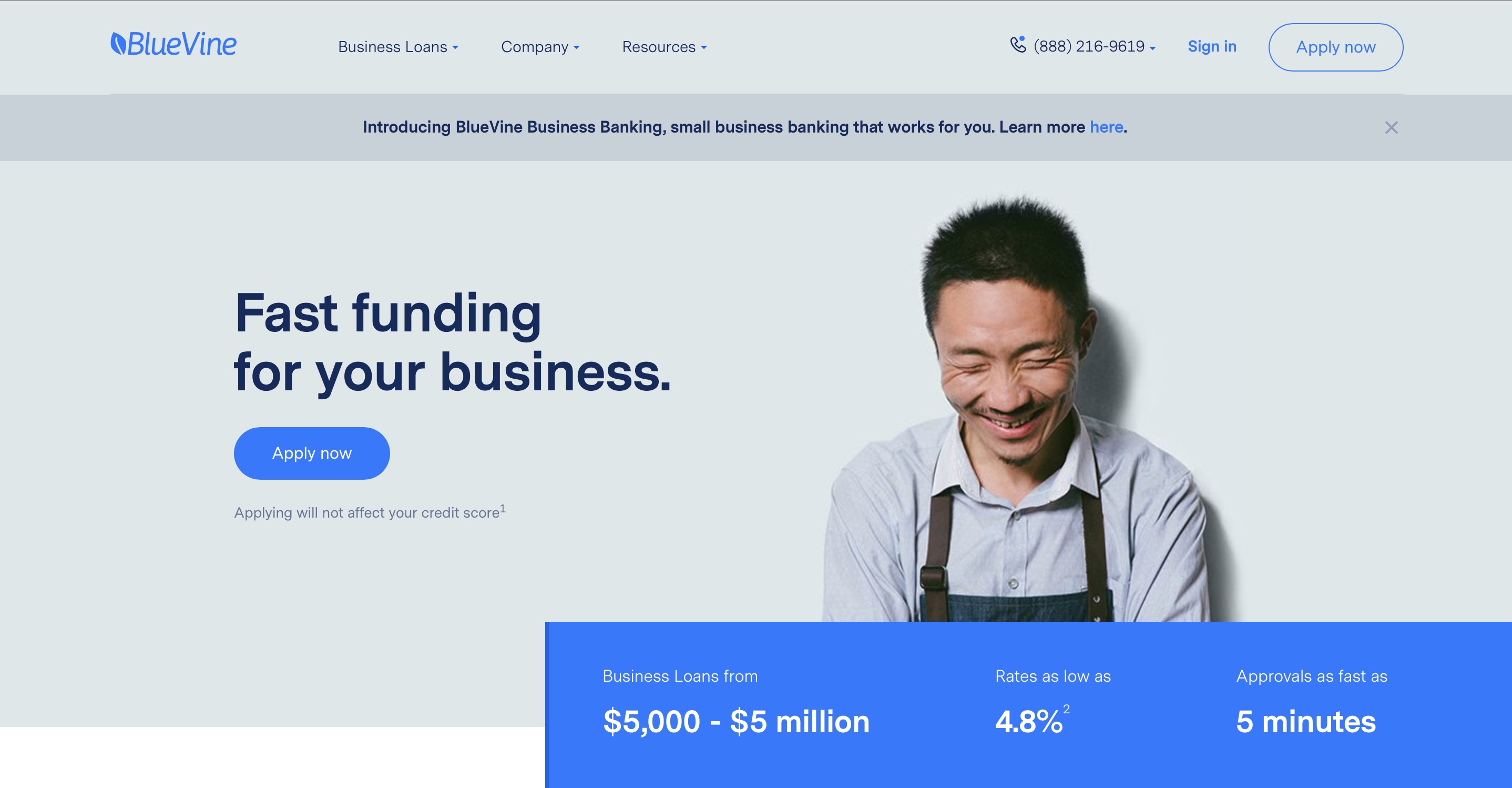

Bluevine teams up with Mastercard to launch its new Small Business Cashback Mastercard.

Bank Midwest partners with Finastra to launch its new digital bank, OnePlace.bank.

Tuum expands its partnership with Amazon Web Services (AWS) to deliver its next generation core banking platform through the AWS Marketplace.

Quail Creek Bank chooses Jack Henry to stay competitive and enhance customer experience.

MoneyLion appoints Jon Kaplan as Chief Revenue Officer.

Avidia Bank partners with Q2 and Personetics to modernize its digital banking experience and strengthen engagement.

Eltropy announces key enhancements to unified conversations platform.

Fraud and Identity management

Risk-decisioning software provider Provenir launches onboarding fraud solution.

Email address intelligence firm AtData forges strategic partnership with unified identity platform Dodgeball.

DataVisor enhances multi-tenancy capabilities for scalable, secure, and flexible fraud and AML solutions.

E-Commerce

Klarna divests its Klarna Checkout (KCO) division for $520 million.

Regtech

E-document management platform A-Cube API announces collaboration with Salt Edge to facilitate compliant document digitization.

DeFi

Decentralized finance (DeFi) platform 1inch partners with Web3 security provider Blockaid.

Embedded finance

Cotribute, an embedded fintech platform serving credit unions, partners with APCU and Center Parc Credit Union to launch an automated digital account opening solution.

Embedded finance platform for technology purchases Gynger raises $20 million in a Series A round led by PayPal Ventures.

Banking-as-a-Service

Payments and financial solutions provider Finzly partners with Frost Bank to bring FedNow and RTP Instant Payments to business and retail customers.

Egyptian Banking-as-a-Service startup Connect Money secures $8 million.

Lending

USMI names Enact MI President and CEO Rohit Gupta as Chair of the Board.

Conotoxia makes loan applications and processing available in its mobile app.

Small business finance

Airwallex integrates with Intuit QuickBooks to provide seamless multicurrency reporting.