This week’s edition of Finovate Global looks at recent fintech news and headlines from Malaysia.

Agentic Commerce: Mastercard Completes Pilot Project

One of the biggest stories in payments in 2026 is the rise of agentic commerce. This week, Mastercard announced that it had completed an AI-powered commerce pilot project in partnership with Kuala Lumpur-based CIMB Group Holdings Berhad (CIMB), Malayan Banking Berhad (Maybank), and RHB Banking Group (RHB). The project involved using Mastercard Agent Pay to show how AI can help consumers complete common tasks such as coordinating transportation. Specifically, as part of the pilot, an AI agent booked a ride from Kuala Lumpur International Airport to KL Sentral via hoppa, an international mobility provider. The transaction was facilitated by CardInfoLink’s AI agent connected to hoppa’s taxi and airport limousine service.

“This milestone underscores how AI can simplify everyday interactions without compromising customer control,” CIMB Bank Berhad and CIMB Malaysia CEO Gurdip Singh Sidhu said. “It reflects our vision of banking that is intuitive and seamlessly woven into life. Our collaboration with Mastercard enables us to deliver secure and responsible AI-powered experiences to our customers.”

The transaction leveraged tokenized credentials that were authenticated with Mastercard Payment Passkeys to ensure strong customer verification and data protection. This pilot project was designed to confirm the feasibility of agentic transactions in Malaysia. Commercial deployment of the technology will be introduced in phases with Mastercard working with issuing banks and partners to educate consumers on agentic commerce and the safe use of AI-powered payments.

“Mastercard’s first live agentic transaction in Malaysia demonstrates how AI can engage in commerce responsibly,” Mastercard Country Manager Malaysia, Beena Pothen said. “With Agent Pay, we’re embedding trust, authentication, and transparency directly into AI-driven payments. In collaboration with CIMB, Maybank, and RHB, we’re meeting the highest standards of tokenization, enhancing security and consumer protection.”

This week’s news is the latest example of Mastercard’s involvement in bringing agentic commerce to the Asia Pacific region. It follows authenticated agentic transactions completed previously in Australia, New Zealand, and India.

Embedded Finance: Boost Bank Unveils Insurance Offering

Customers of Malaysia’s Boost Bank can now access insurance plans directly from their banking app. Courtesy of a partnership with Great Eastern General Insurance Malaysia, Boost Bank will offer three protection plans for travel (TravelProtect), personal accidents (CoreProtect PA), and daily commutes (CommuteProtect).

Priced at RM15 ($3.30) annually, TravelProtect offers coverage of up to RM250,000 ($55,000). CoreProtect PA provides personal accident coverage, including accidental death and permanent disablement benefits, of up to RM50,000 ($11,000). CommuteProtect specifically covers personal accidents of up to RM25,000 ($5,500) during daily commutes. Both CoreProtect and CommuteProtect will be available for RM25 ($5.50) a year. The average monthly income in Malaysia is between RM3,000 ($660) and RM4,000 ($880).

Purchasing any of the three plans will unlock the new Protect Jar feature under the Special Jars section of the Boost Bank app. The Protect Jar offers 3.3% per year in daily compounding interest. Customers who make deposits into the Protect Jar will get a complimentary TravelProtect Lite PA plan. The plan provides coverage for personal accidents and travel disruptions such as flight delays.

Headquartered in Kuala Lumpur, Boost Bank began operations in January 2024 as Malaysia’s first fully digital bank. A joint venture between Axiata’s Boost and RHB Banking Group, and licensed by Bank Negara Malaysia, Boost Bank offers digital banking services, including lending, savings, and e-wallet solutions.

Compliance: Regulating Islamic Fintech and a Look at the Malaysian Model

There are countries in the Asia-Pacific that have higher Muslim populations than Malaysia. Indonesia, for example, has the largest Muslim population in the world with more than 230 million Muslims (87% of its population). Bangladesh has about 150 million Muslims who represent approximately 91% of its population.

By comparison, Malaysia’s 20 million Muslims might seem small. Yet Muslims do represent the majority of the country’s population at 63%. This creates a significant opportunity to provide financial services, specifically Islamic and shariah-compliant financial services, to customers throughout the country.

We discussed the challenges and opportunities in Islamic finance in a Finovate Global interview a little over a year ago. A recent essay in Salaam Gateway took a more focused look at innovation and Islamic finance, highlighting the approach taken by Malaysia’s Bank Negara Malaysia (BNM), which oversees and establishes standards for Islamic banking and Shariah-compliance for financial institutions, and Securities Commission Malaysia (SC), which regulates capital markets, digital asset exchanges, and peer-to-peer (P2P) lending platforms.

The article discusses not only the internal operations of BNM and SC—and the institutions’ partnerships with entities such as the Islamic Development Bank—but also notes that Malaysia’s Shariah governing system has positively influenced regulators and policy advisors in Muslim-majority markets in Southeast Asia. Indonesia was highlighted specifically for its recent efforts to expand its fintech regulatory sandbox, and pursue stronger coordination between financial regulators and those committees and boards providing Shariah certification.

Here is our look at fintech innovation around the world.

Central and Eastern Europe

- Lithuanian P2P lending platform Finbee secured an investment of €5 million from venture builder Tesonet.

- Estonian fintech group lute Group to establish its first fully digital bank in Ukraine.

- Latvia unveiled a new specialized credit institution license to empower new financial service providers and fintechs.

Middle East and Northern Africa

- Dubai-based Network International announced that it was powering card tokenization for Apple smartphones for select banks in Egypt.

- Payment orchestration platform MoneyHash partnered with Iraq-based fintech startup Wayl.

- IBS Intelligence looked at the rise of Qatar as a Islamic fintech hub.

Central and Southern Asia

- Mongol iD, Mongolia’s largest payment infrastructure firm, has joined RTGS.global’s liquidity network.

- FinHarbor completed the core deployment of a hybrid neobank platform for Asterium, a fintech project based in Uzbekistan.

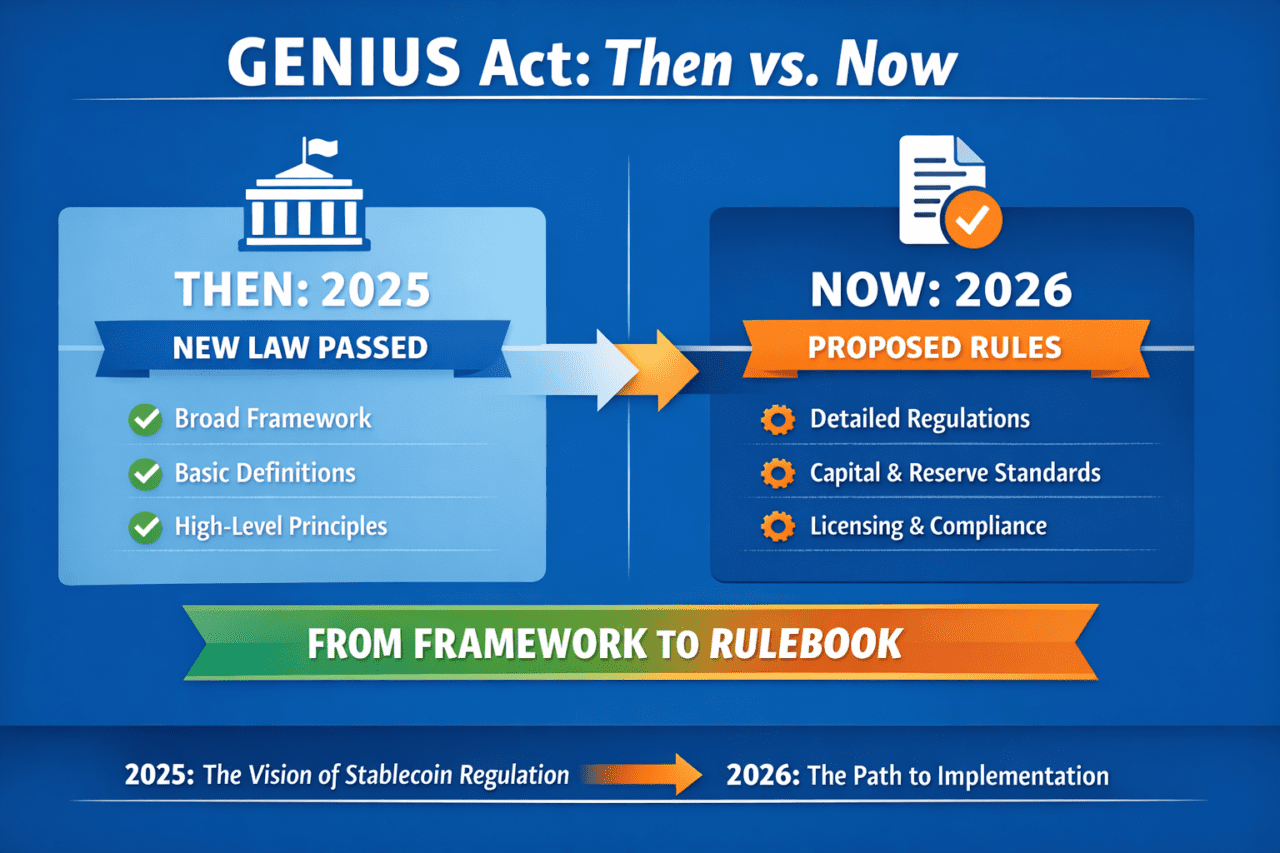

- India’s Pine Labs announced plans to launch stablecoin payments outside of the country.

Latin America and the Caribbean

- Latin American neobank Ualá raised $195 million at a valuation of $3.2 billion.

- Mexican fintech Bravo secured $235 million in financing for its debt settlement and credit solution.

- Uruguay-based cross-border payment platform dLocal partnered with stablecoin offramp solution provivder Stable Sea.

Asia-Pacific

- China announced that it will provide state banks with $44 billion to support technology investments.

- Malaysian financial institution Boost Bank partnered with Great Eastern General Insurance Malaysia to offer three protection plans via its app.

- Southeast fintech platform Fiuu issued a report highlighting recent developments in the Philippine fintech industry.

Sub-Saharan Africa

- Kenya’s Capital Markets Authority (CMA) announced plans to bring robo-advisors and digital investment platforms into its licensing framework.

- Western Union and Sasai Fintech partner to launch a new international money transfer mobile app for consumers in South Africa.

- Ghana-based digital lender Fido Ghana raised $5.5 million in debt financing.

Photo by Mohd Jon Ramlan on Unsplash