Austin, Texas-based F1 Payments will leverage technology from Agreement Express to enhance its merchant underwriting and onboarding processes. Agreement Express’ client onboarding software platform, which the company demonstrated at FinovateFall 2016, will enable F1 Payments to automatically underwrite merchants in under 15 minutes, and offer them a seamless, digital alternative to the traditional onboarding experience. F1 will also benefit from Agreement Express’ enterprise-level APIs and integrations for secure connections to acquirers and proprietary systems.

F1 Payments President Chad Anselmo connected his company’s mission to accelerate the process for all participants in the business payments ecosystem with the decision to partner with Agreement Express. “Adding Agreement Express to our tech stack allows us to provide a unique, seamless and secure underwriting and onboarding experience for our clients and partners,” he said, “all of which results in increased levels of merchant acquisition and brand loyalty.”

“It was evident from our first conversations that F1 was hyper-focused on providing partners and customers a seamless, secure and efficient experience during the underwriting and onboarding process,” Agreement Express Senior Account Executive Brandon Yttri said. He praised the company’s “customer-centric approach to partnership” and called F1’s decision to select Agreement Express’ platform as “a concrete demonstration of (F1’s) dedication to providing relevant and innovative resources that fuel growth for clients and partners.”

A registered ISO of Fifth Third Bank in Cincinnati, Ohio, F1 Payments offers merchant processing, chargeback management, consulting, and other financial services. Founded in 2017, the firm leverages a diverse payments technology ecosystem to increase business velocity and provide frictionless connections for its clients and partners.

Headquartered in British Columbia, Vancouver, Canada, Agreement Express’ partnership news comes just a month after the company reported that it was working with payments-as-a-service provider Zift to improve merchant underwriting and onboarding at the Spanish Fork, Utah-based firm. This spring, Agreement Express announced a collaboration with Paya Services that made the company’s check and ACH offerings available via the Agreement Express Unified Application.

Agreement Express began the year with a major C-suite onboarding of its own, appointing former Zywave CEO and founder Dave O’Brien as its new Chief Executive Officer. Mike Gardner, who founded the company in 2001 and had served as CEO, will transition into the role of Chief Strategy Officer, as well as continue to serve on the company’s board of directors.

CEO Mike Gardner and Account Exec Andrew Grocholski demoed Agreement Express at FinovateFall 2016

CEO Mike Gardner and Account Exec Andrew Grocholski demoed Agreement Express at FinovateFall 2016 After his presentation at FinovateFall, we conducted an interview with Mike Gardner, Agreement Express CEO, to gather more information about the company and its future plans.

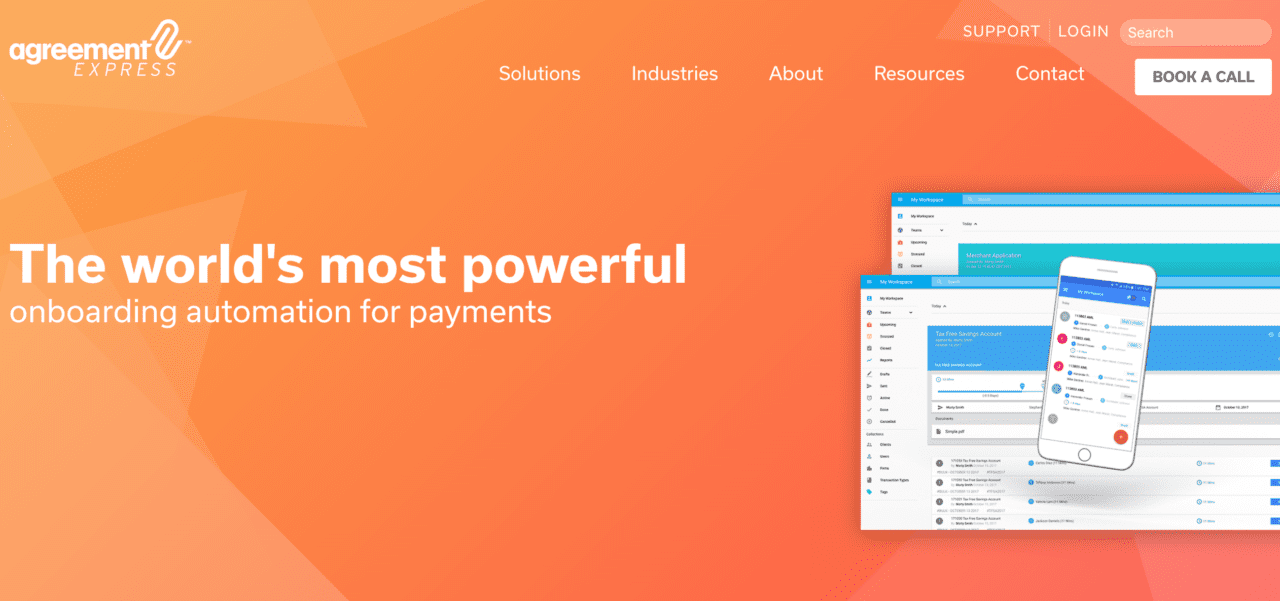

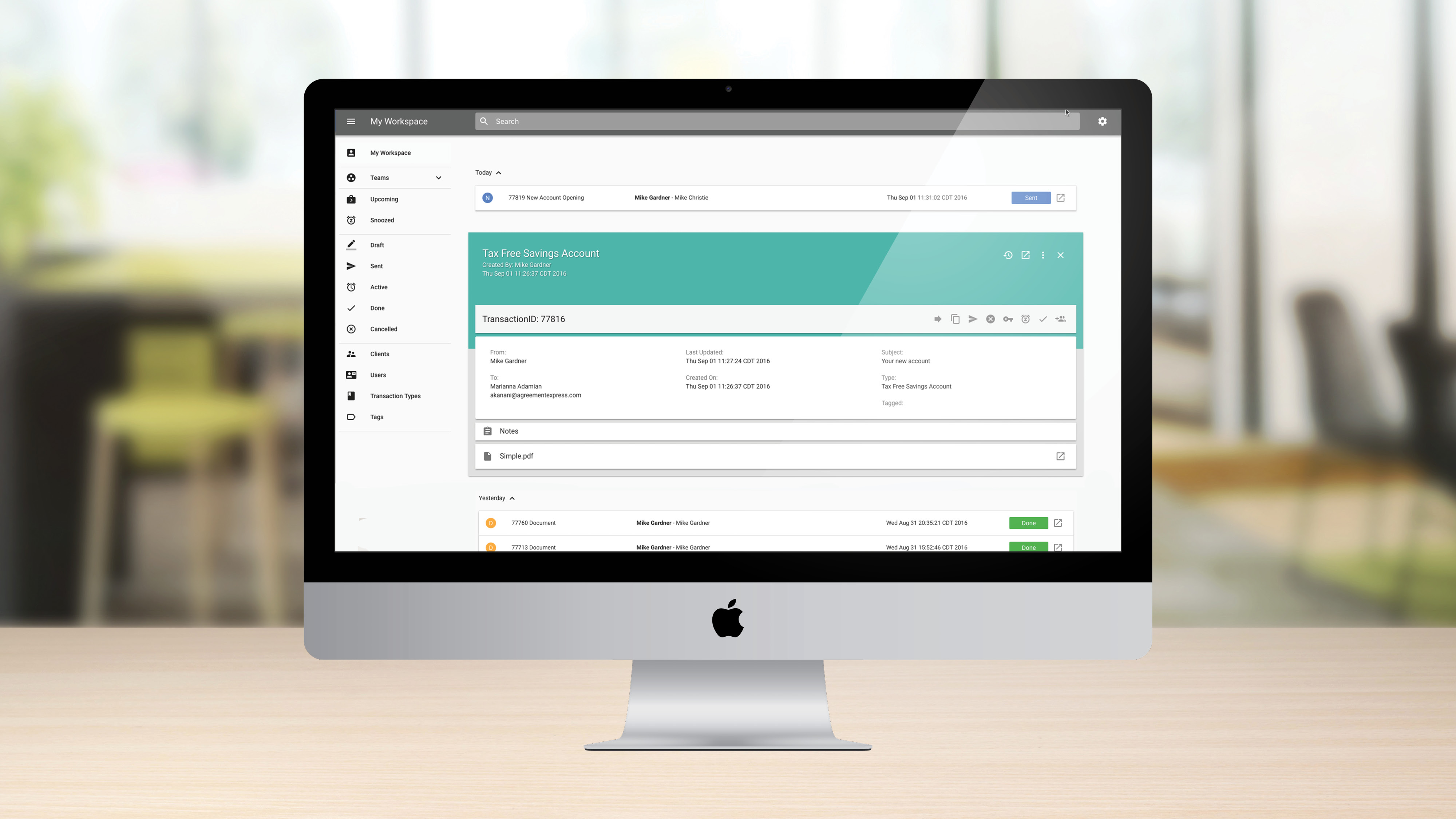

After his presentation at FinovateFall, we conducted an interview with Mike Gardner, Agreement Express CEO, to gather more information about the company and its future plans. Agreement Express document management screen

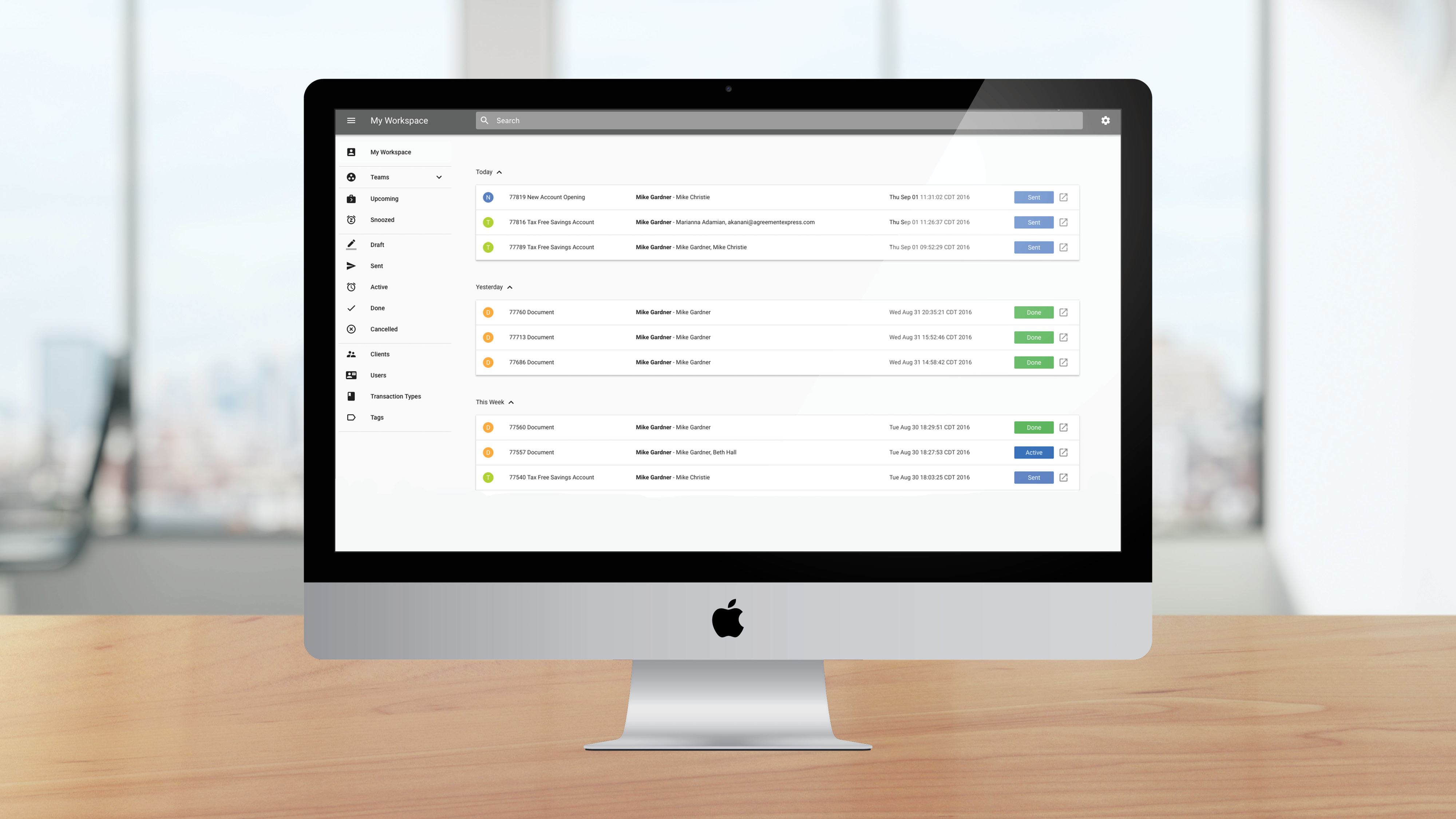

Agreement Express document management screen Agreement Express adviser workspace

Agreement Express adviser workspace

Presenters

Presenters Andrew Grocholski, Account Executive

Andrew Grocholski, Account Executive