With all of the drama around TikTok these days, you may have forgotten about Snap. Formerly known as Snapchat, the photo messaging app allows users to send and receive ephemeral messages complete with fun filters, animation, and augmented reality.

It appears that Snap may be on the verge of change, as the company reportedly acquired Voca.ai, a smart voice assistant that helps replace customer service agents in call centers. The acquisition, which was first reported by Globes and later picked up by TechCrunch, is estimated to be around $70 million.

While one of the main use cases for Voca.ai’s technology is phone-based debt collection, it can also be used for surveys, customer service, appointment scheduling, and lead qualification. As the name suggests, Voca.ai leverages AI to imitate human representatives’ responses. To create a convincing, human-sounding cadence the technology adds pauses and filler words such as “um.”

Snap may intend to leverage Voca.ai to build out a new voice command feature. According to Globes, “This range of abilities in identifying speech and producing artificial speech have attracted Snapchat, which in June launched a voice command function for users to request filters, which can alter their appearance. For example, the user can ask for their hair to turn pink, and the voice command function ensures that the operation is completed.”

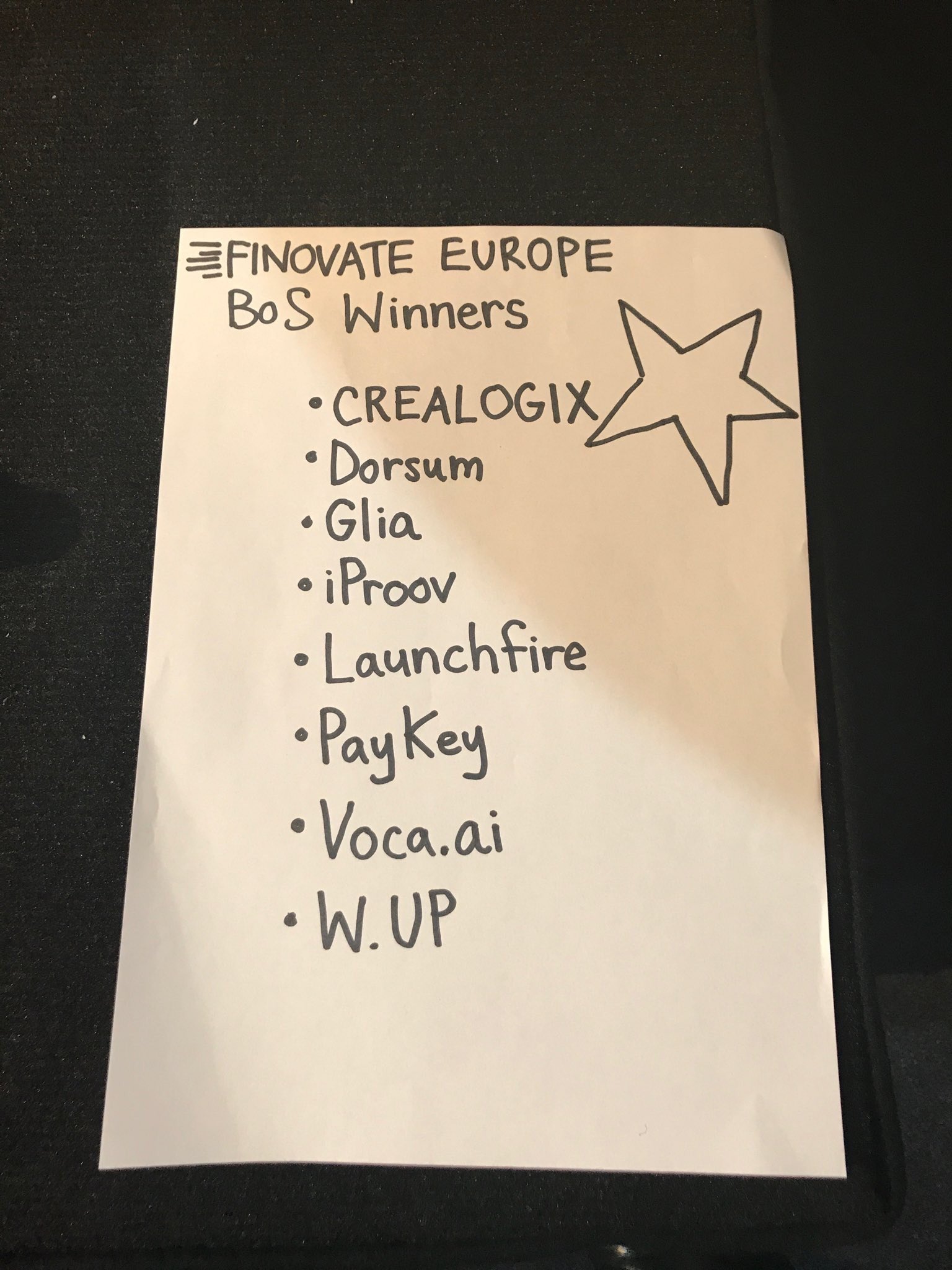

Voca.ai was founded in 2017 and is headquartered in Herzliya, Israel. The company has raised $6 million across two rounds of funding. Voca.ai won a Best of Show award at FinovateSpring last year after company CEO Einav Itamar demonstrated how a bank used the AI voice agent to follow up on a loan inquiry.

Photo by Thought Catalog on Unsplash

Einav Itamar, Co-founder and CEO

Einav Itamar, Co-founder and CEO Ruchman has 20 years of experience in R&D. He is a former director at eXelate, which was acquired by Nielsen.

Ruchman has 20 years of experience in R&D. He is a former director at eXelate, which was acquired by Nielsen.

iProov

iProov PayKey

PayKey

Arival Bank

Arival Bank Avaloq

Avaloq