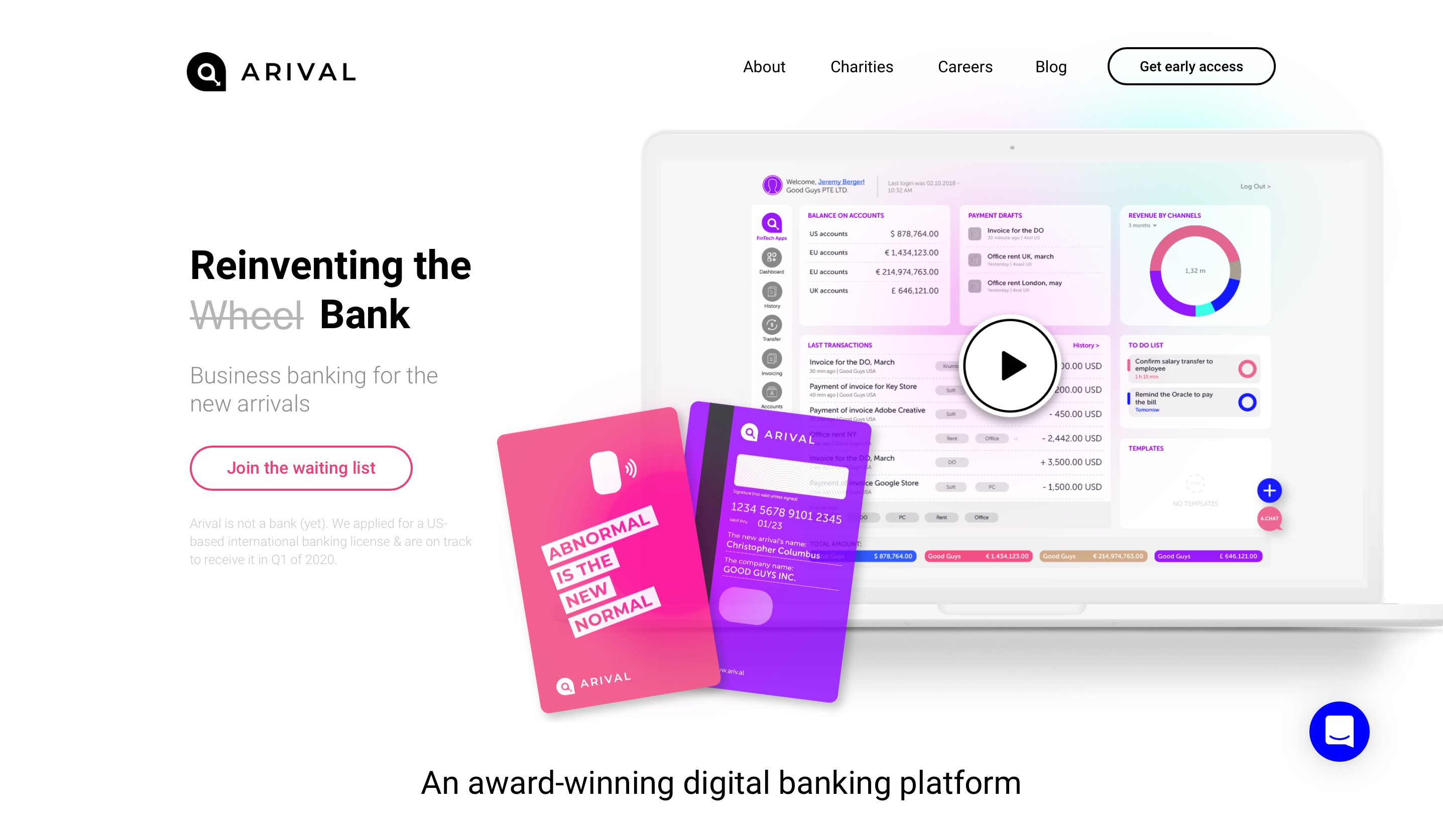

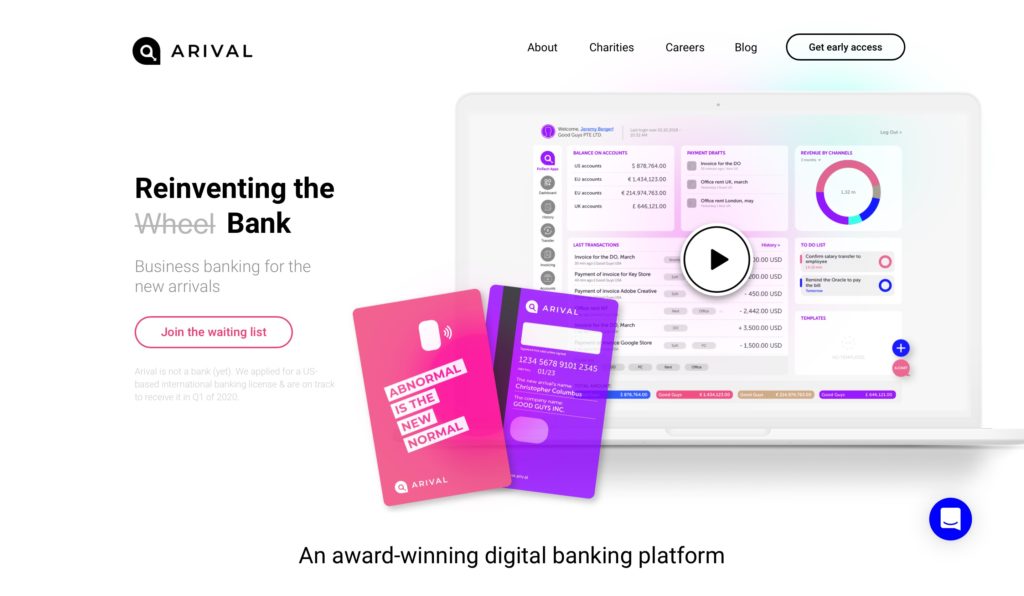

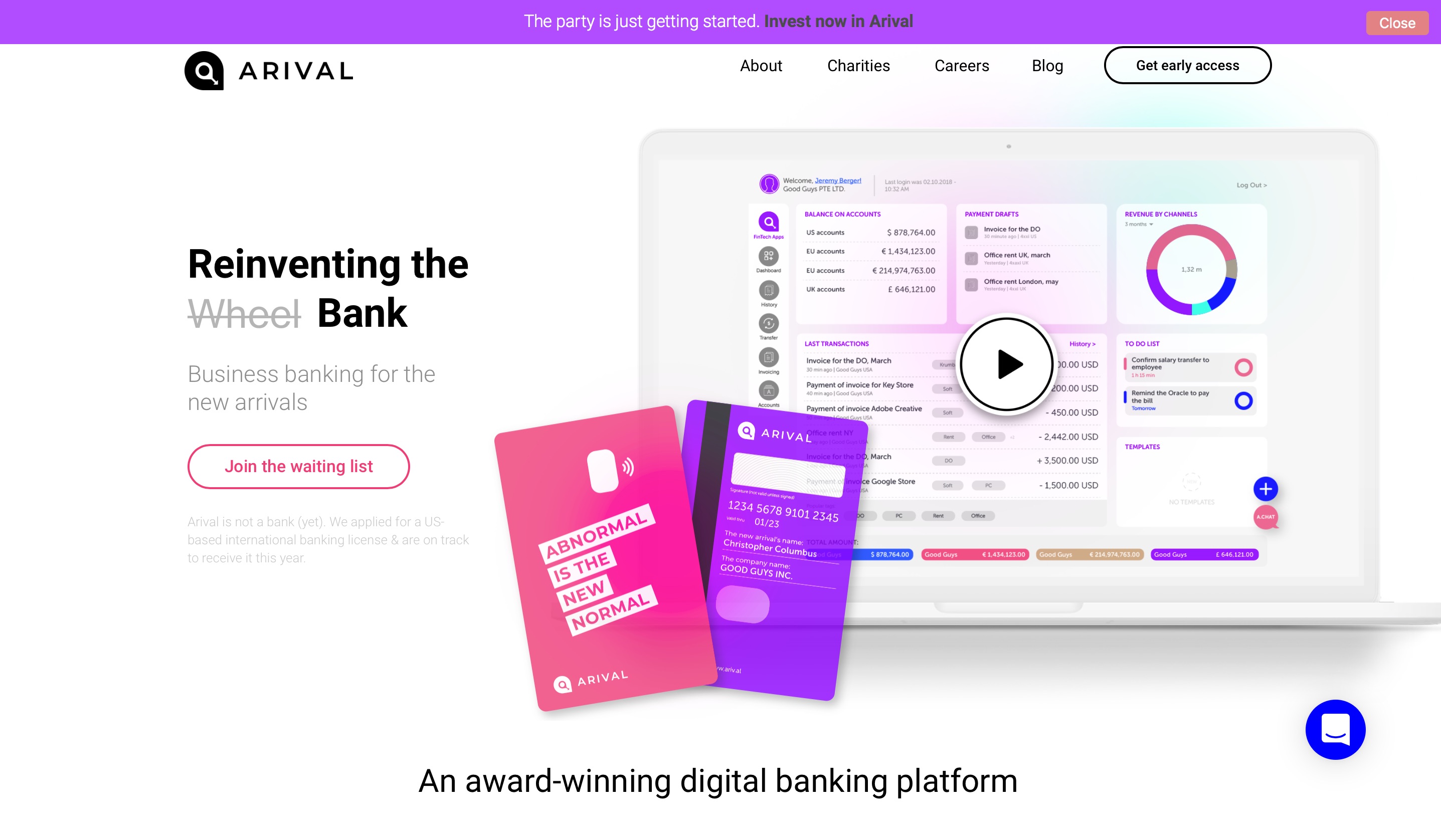

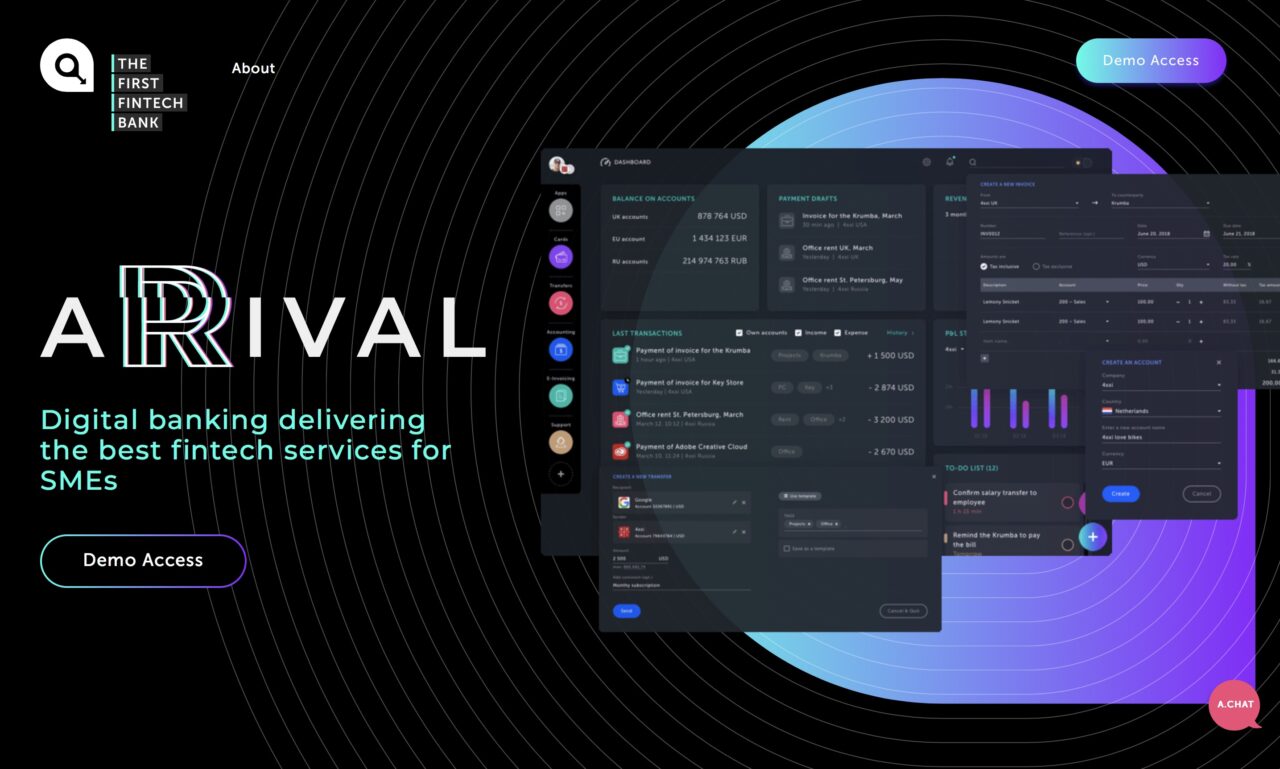

Arival Bank, which won Best of Show in its FinovateAsia debut in 2018, is now a fully licensed and regulated bank. The company was granted its U.S.-based banking license in Puerto Rico and will leverage its “U.S.-based but internationally friendly” license to work with customers around the world. The license generally allows banks to offer full stack fiat banking services, upon receiving the necessary authorization from the local regulator.

Arival Bank’s primary customers are international technology firms. The bank offers these companies USD-based bank accounts, and supports both domestic and international payments for global technology companies. Arival so far has onboarded more than 100 business customers from more than 25 countries, with the biggest demand coming from firms in the U.S., Canada, the U.K., European Union, and Singapore. Arival has experienced 1.7x month-over-month growth and boasts $13 million in assets under management.

“We’re focused on providing bank accounts to customers who have been labeled as ‘abnormal’ or ‘too risky’ by traditional banks,” Arival Bank COO Jeremy Berger explained in a statement. These firms include everything from international tech startups, digital SMEs, and money service businesses, to crypto exchanges and blockchain startups. “We’ve proudly turned this market of misfits into our niche, and we strongly believe the market demand of the ‘abnormal’ will soon outgrow the demand of the traditional banking clientele,” he said.

In terms of traction, Arival Bank recently was invited to FinCEN’s innovation program to showcase its compliance technology to more than 20 top U.S. regulators. FinCEN is the Financial Crimes Enforcement Network, a bureau of the U.S. Department of the Treasury that focuses on defending the financial system against criminal and illicit activity, including money laundering. “We’ve built a compliance-first culture and like to think of ourselves as a cutting-edge compliance firm with a banking license,” Berger said. “That’s really our X factor at the end of the day.”

Additionally, Arival Bank has inked a partnership with Railsbank to launch SGD accounts and local payments as part of its borderless account opening offering. The company noted that it may leverage its relationship with Railsbank to expand its services in regions like Europe and Latin America.

“We’ve achieved significant traction since our launch – in large part thanks to our supportive group of visionary investors from our Seed and Pre-A rounds,” Arival Bank co-founder and CFO Igor Pesin said. “They’ve enabled us to invest heavily into key facets of building a digital bank fit for the 21st century: licensing, technology, infrastructure, compliance, and user experience.”

“We’re starting to gear up for our Series A round as we enter a new phase of growth driven by scaling our footprint internationally,” Pesin added. “Being live operationally is somewhat atypical for a licensed digital bank at their Series A round. In other words, our commitment to infrastructure meets our readiness to scale. And we have the license, product, and team to become the go-to digital bank for a new generation of businesses and entrepreneurs.”

Founded in 2018, Arival has 50 employees and hopes to double its workforce by 2022. The company’s investors to date include SeedInvest, Crowdcube, and Polyvalent Capital. Earlier his year, Arival Bank was nominated by Daily Finance as one of the top Fintech Companies in Singapore.

Photo by Donald Tong from Pexels

Arival Bank

Arival Bank Avaloq

Avaloq

Presenters

Presenters Igor Pesin, Co-Founder and CFO

Igor Pesin, Co-Founder and CFO