Will the new month bring new challenges in fintech? Or will the news cycle take a much-needed vacation as summer approaches? Stay tuned to this week’s news for updates and evolutions throughout the week.

Digital banking

Cloud-native core banking operating system 10x Banking enters collaboration with Deloitte Australia.

Monzo reports first profitable year.

Genesis offers new tools and incentives to financial industry software developers.

Meniga partners with Handelsbanken in Norway to amplify digital banking experience.

Fraud prevention

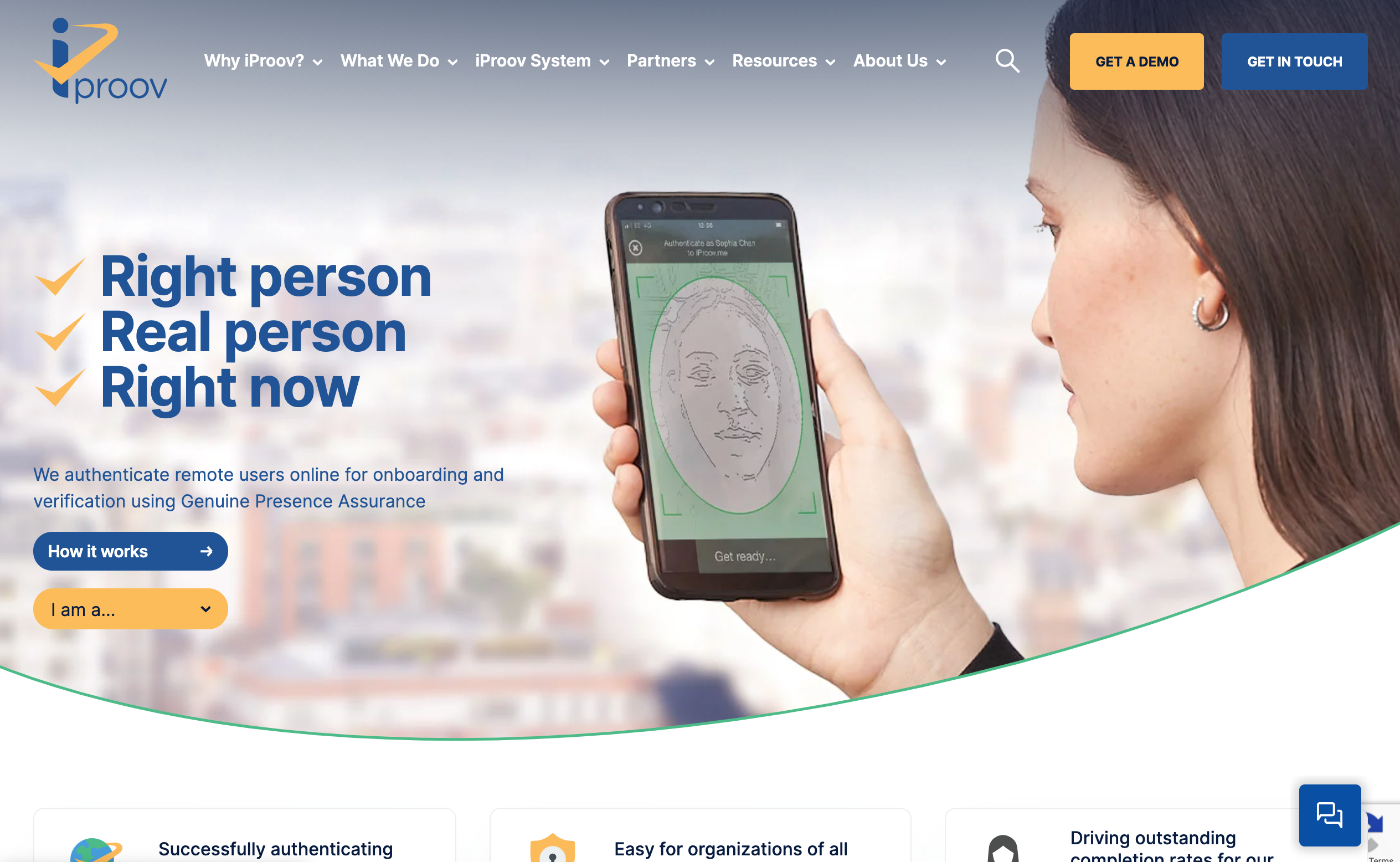

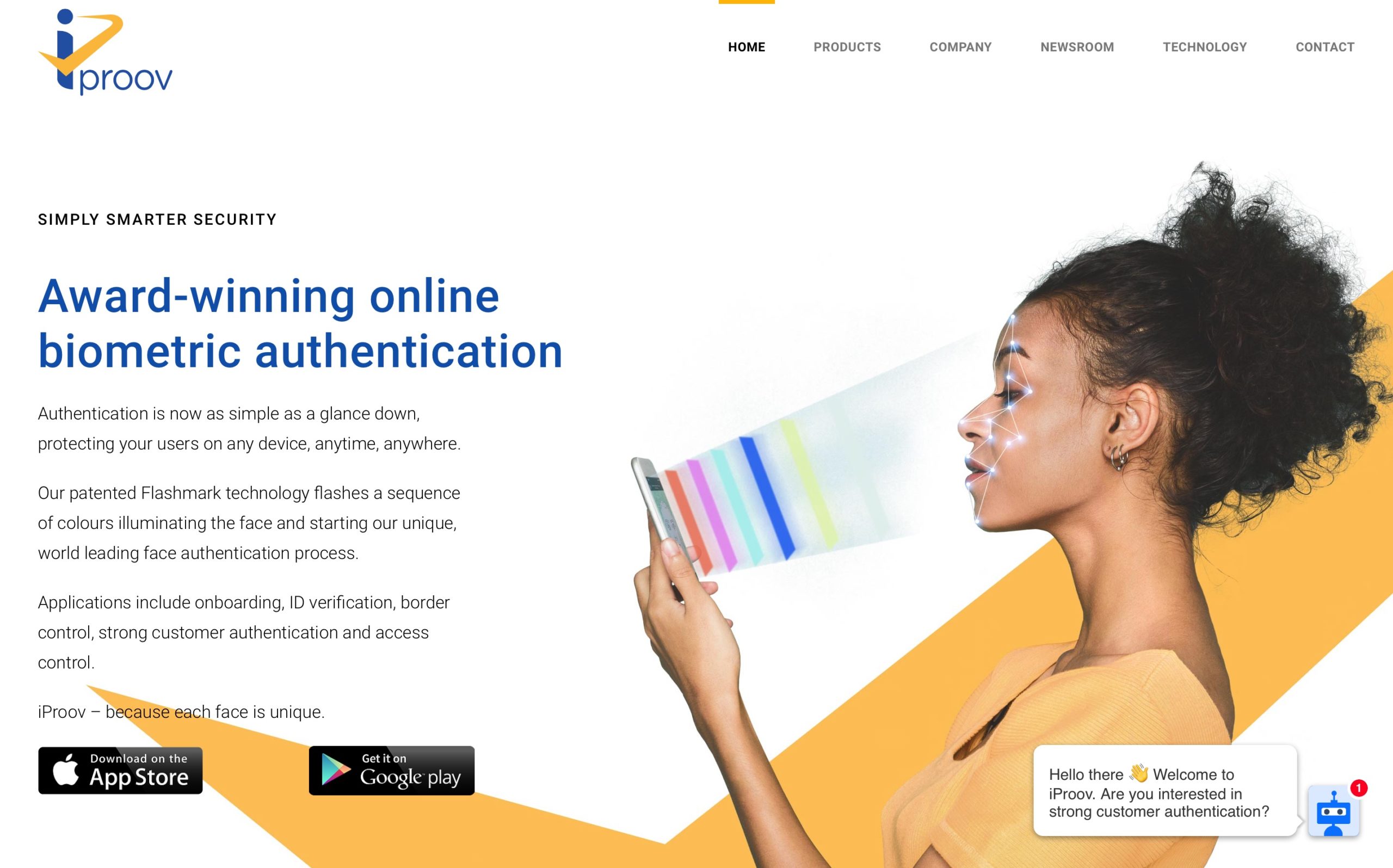

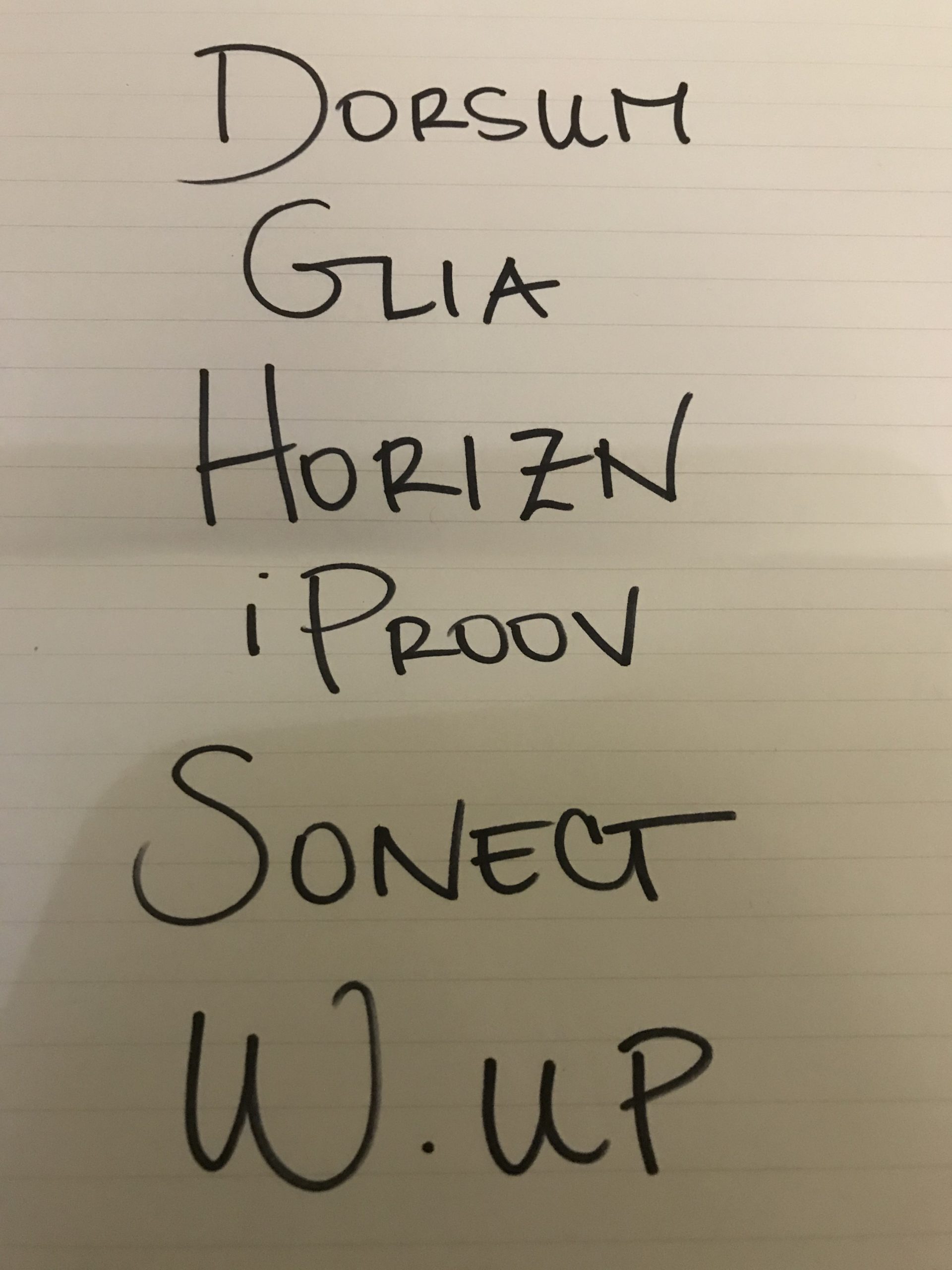

iProov achieves FIDO Alliance certification for facial biometric identity verification.

Fenergo unveils new AI-powered Client Lifecycle Management (CLM) tool to help customers keep pace with evolving regulations.

U.K.-based digital compliance and AML solutions provider SmartSearch launches its International Individual Check solution.

Bunq improves its fraud-detection model’s training speed nearly 100x using NVIDIA AI.

Payments

Payouts orchestration PayQuicker launches its on-demand, earned income access product, Insta-Pay.

Uruguayan cross-border payment platform dLocal partners with cross-border money transfer firm Ria Money Transfer.

Payments leader Jacob Eisen named ICBA Payments President and CEO.

Forward announces $16 million seed round led by Commerce Ventures, Elefund, and Fiserv.

The Bank of London forms strategic partnership with allpay Limited to improve banking and payments in the U.K. Social Housing market.

Vallarta Supermarkets taps Sezzle to offer Buy Now, Pay Later for grocery purchases.

Onbe to power Eisen’s digital solution that issues funds to consumers following account closures.

Temenos and Mastercard join forces to expand cross-border payment capabilities through Mastercard Move.

allpay partners with Enfuce to provide payments for the U.K. public service sector.

NCR Atleos launches U.K. ATM cash deposit service.

REPAY empowers credit unions with enhancements to CU*Answers integration.

Small business finance

Corporate card and spend management provider Torpago raises $10 million in Series B round co-led by Priority Tech Ventures and EJF Ventures.

Commercial lending software provider for U.S. financial institutions, Abrigo, launched its commercial loan origination solution for SME lending.

insightsoftware acquires Fiplana to strengthen Qlik’s extended planning, analysis, and write-back capabilities.

i2c and Affiniti Finance partner to expand financial access for America’s underserved small businesses.

Spend management company Ivalua forges a collaboration with Visa.

Credit Cards

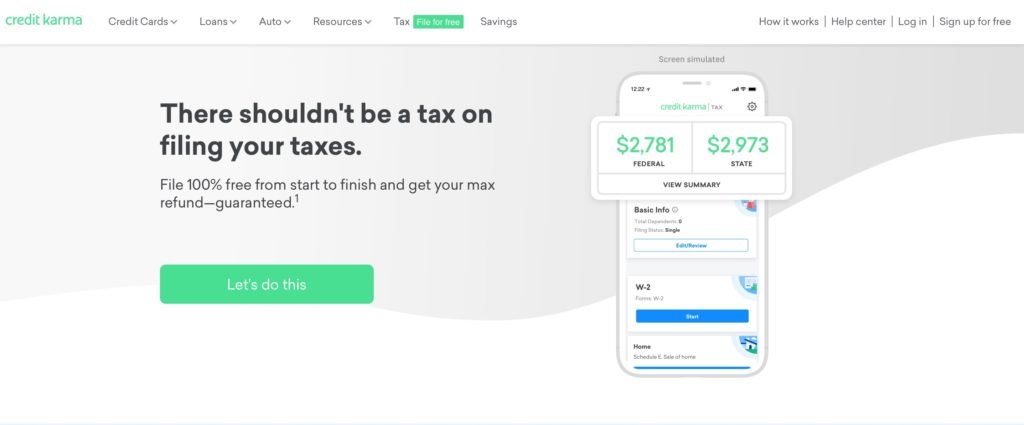

Credit repayment fintech Incredible raises $1 million.

Pinnacle Bank partners with CorServ to implement a modern credit card program for commercial, business, and consumer customers.

Insurtech

Scott Credit Union selects BUNDLE by Insuritas to launch its insurance agency.

Investment and wealth management

Brokerage-as-a-Service innovator DriveWealth forges new partnership with Turkish fintech Papara.

Lending

Plaid unveils Consumer Report, a new solution that brings businesses real-time cash flow data along with credit risk insights through Plaid Check, its consumer reporting agency.

Open banking

Mastercard teams up with Atomic to launch new open banking solutions.

Financial inclusion

Visa teams up with non-profit Plain Numbers to support inclusive financial services for adults in the U.K./