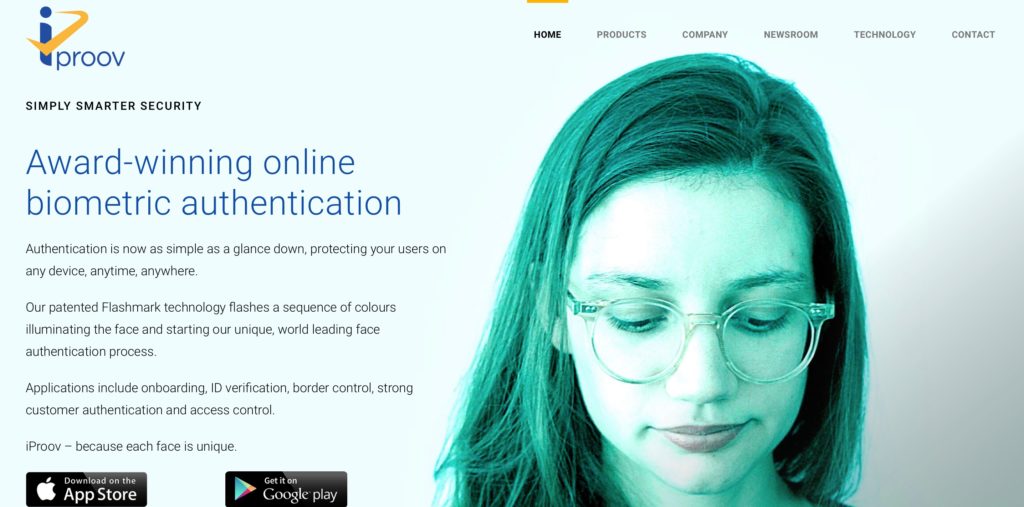

Two of the biggest themes in fintech – digital identity and the rise of fintech in Central and Eastern Europe – meet in the latest announcement from biometric authentication specialist and Finovate Best of Show winner iProov. The company’s facial recognition technology now makes it easier for users of SK ID Solutions’ Smart-ID Service in countries like Estonia, Latvia, and Lithuania to renew their accounts without having to visit a physical bank branch.

“This is a major development for all digital identity providers,” iProov CEO Andrew Bud said. “Estonia has proved, for the first time, that a remote, automated, biometric ID verification service can deliver the highest possible levels of security.”

Recognized as equal to a handwritten signature throughout Europe, Smart-IDs enable users to authenticate themselves and provide permissions online using a smartphone app. iProov’s facial recognition technology adds a three-second scan to compare the image of the user to the image on their presented ID document to help defend against fraud and identity theft.

Smart-ID also leverages NFC-based ReadID document verification technology from InnoValor.

Financial crime risk management innovator Featurespace will be helping Enfuce combat fraud and money laundering courtesy of a newly announced partnership. Enfuce, a financial services firm based in Finland, will use Featurespace’s ARIC Risk Hub to enhance its ability to protect its customers from fraud and financial crime.

“Our clients deserve industry-leading services that allow them to freely and fully concentrate on the success of their core business, without worrying about ever-evolving fraud,” Enfuce co-founder and chair Monika Liikamaa said.

ARIC Risk Hub offers real-time transaction monitoring for fraud and financial crime, enabling institutions to identify and act against anomalous and potentially dangerous behavior as it occurs. The technology also reduces the number of false positives by as much as 70%, keeping anti-fraud processes efficient. Featurespace introduced its fraud-fighting technology to Finovate audiences at FinovateEurope 2016.

Here is a round up of recent news from our Finovate alumni.

- Sezzle unveils new logo along with its first annual report.

- Flybits expands its executive team in New York, Toronto, the U.K., and Dubai.

- ID R&D updates voice biometric solution IDVoice.

- M1 Finance surpasses $1 billion in assets on its platform.

- Armor Bank selects Teslar Software’s automated workflow and portfolio management tools.

- Mastercard partners with myPOS to boost adoption of card payment solutions among European SMEs.

- Black Hills FCU selects nCino’s Bank Operating System.

- Bazaarvoice launches partnership program with Yotpo as the piloting partner.

- Keysafe inks partnership with Salt Edge to access tenants’ bank data without the need to acquire its own PSD2 license.

- Lending Club appoints Annie Armstrong as Chief Risk Officer.

- Assaray Trade and Investment Bank selects Temenos Infinity and Transact to power its digital transformation.

- Long John Silver’s chooses Blackhawk Network for gift card program.

- Trustly and Fly Norwegian team up to let travelers pay directly from their bank accounts.

- Pindrop launches Deep Voice 3, the new version of its voice recognition technology.

- Mastercard CEO Ajay Banga steps down, replaced by Chief Product Officer Michael Miebach.

- Venmo to launch debit card for teens.

- Almost 600 banks select Fiserv’s Turnkey Service for Zelle.

- Finastra to offer ClickSWITCH’s account switching technolkogy to its clients.

- Simmons Bank partners with Jack Henry to leverage its Banno platform to build a digital presence.

- Currencycloud and Currensea team up.

- Yseop and Automation Anywhere join forces to scale intelligent automation.

- Lighter Capital appoints Kevin Fink at CTO and Patricia Elliott as CSO.

- InComm launches Roblox gift cards in France and Germany.

Finovate Alum Features and Profiles

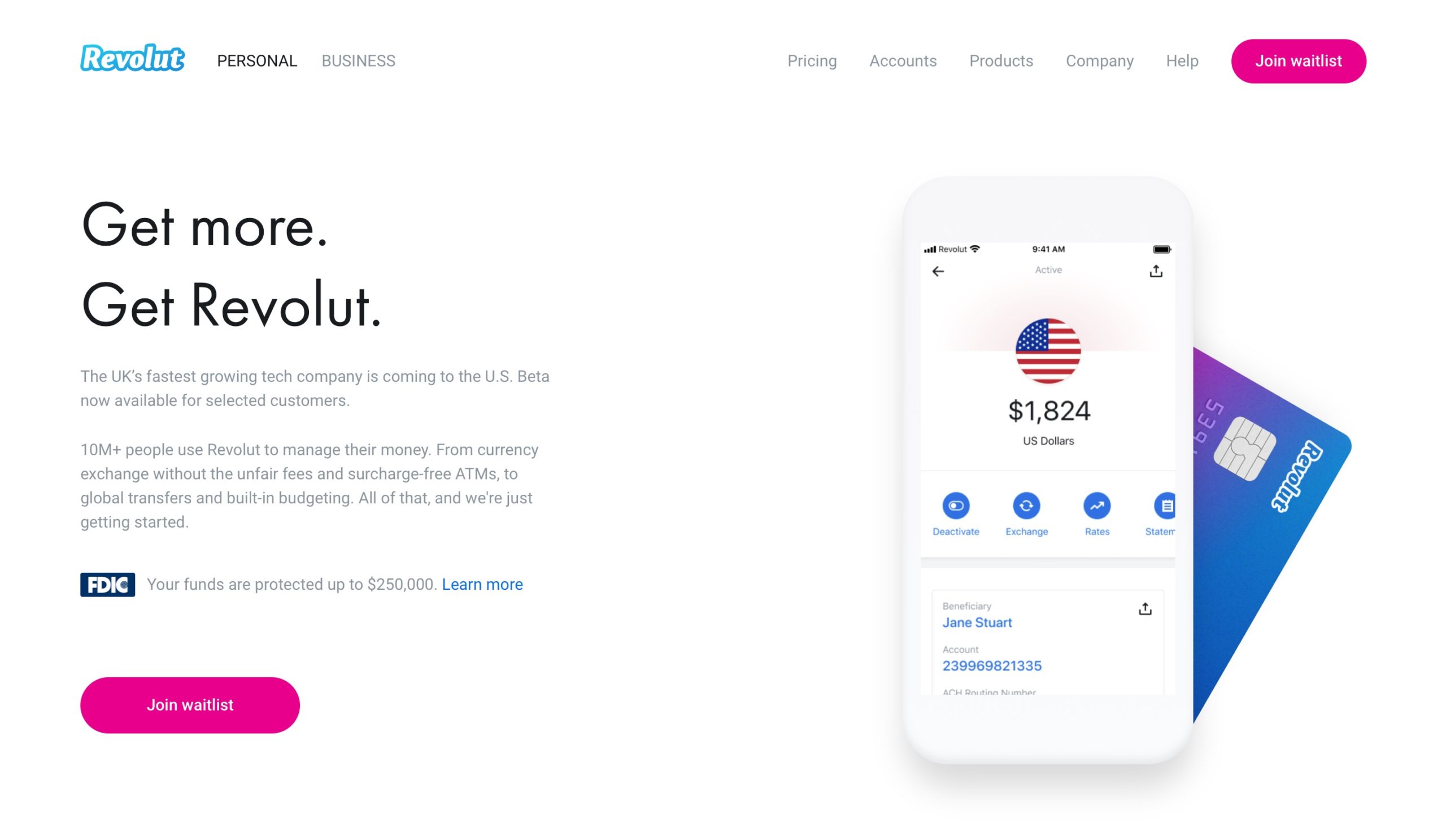

Revolut’s $500 Million Round Boosts Valuation to $5.5 Billion – Global financial platform Revolut has secured its place as the U.K.’s most valuable fintech.

Dealing with Deepfakes in Fintech – The fintech industry is ripe with security firms, such as iProov, that use AI to combat both video and audio deepfakes with anti-spoofing technologies.

Envestnet | Yodlee Acquires Indian Data Aggregator FinBit.io – Envestnet | Yodlee has acquired another asset in its strategy to further grow and develop its data aggregation and analytics business.

Meet Sonect: Cash Network Builder, Finovate Newcomer, Best of Show Winner – What’s better than having a large pizza with all your favorite toppings delivered to your front door? How about a side order of cash, saving you a trip to the ATM or bank branch?

Azimo Taps Ripple for Cross-Border Payments to the Philippines – Fueling these payment transfers is Ripple’s On-Demand Liquidity (ODL) solution that uses XRP to source liquidity and complete money transfers within three seconds.

Lendio Lands $55 Million to Match Small Businesses with Lenders – The investment more than doubles the company’s previous funding, bringing its total to $108.5 million.

SheerID Expands Identity Marketing Platform – The move enables brands to identify and acquire new customers across the globe.