We’re two weeks into featuring all 70+ presenting companies that will demo their new technology at FinovateSpring next month in San Jose, and there’s still a lot of information to take in.

We’re two weeks into featuring all 70+ presenting companies that will demo their new technology at FinovateSpring next month in San Jose, and there’s still a lot of information to take in.

Today, we’re taking a closer look at:

On 12/13 May, we’ll host a crowd of fintech experts, banking execs, investors, and press at San Jose’s City National Civic. Pick up your ticket here to claim a ticket of your own.

If you missed them, be sure to check out the fourteen companies we featured last week:

- Sneak Peek Part 1: Alpha Payments Cloud, CUneXus, DRAFT, FundAmerica, SayPay, StockViews, and TrueAccord

- Sneak Peer Part 2: Bento for Business, DoubleNet Pay, Karmic Labs, SizeUp, Stratos, TickerTags, and Trulioo

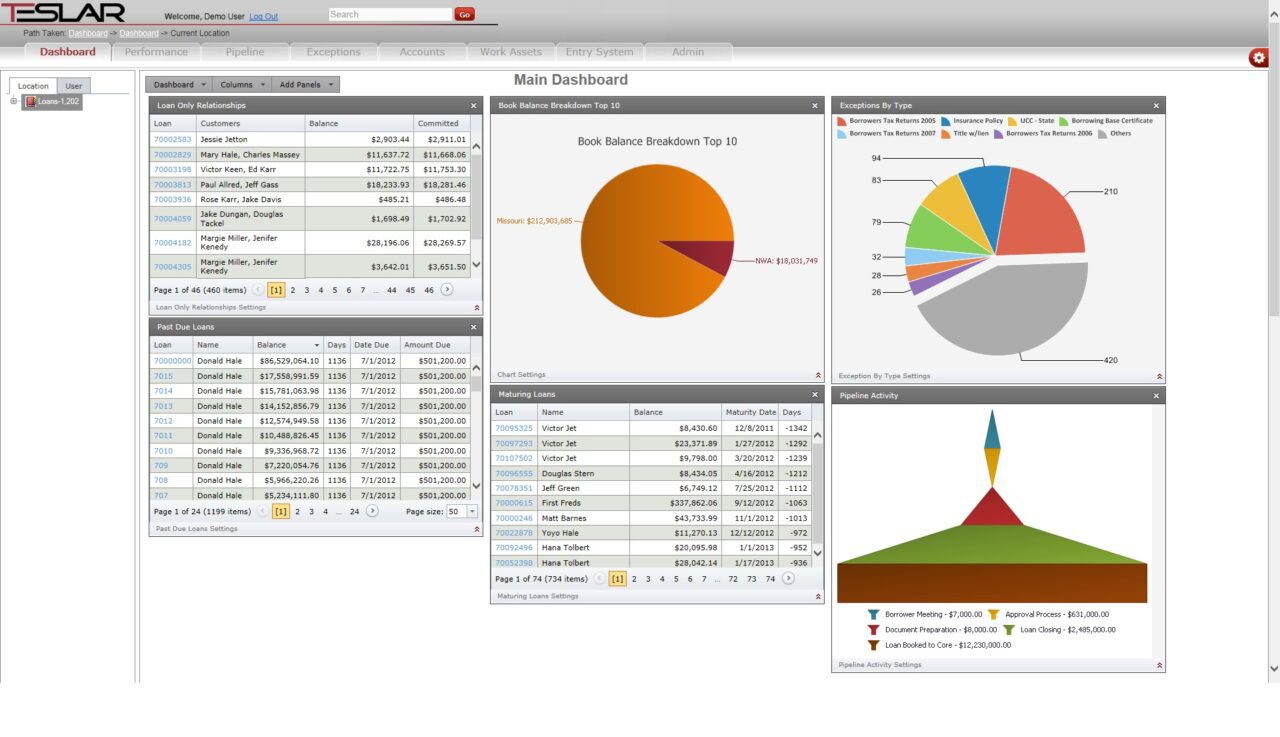

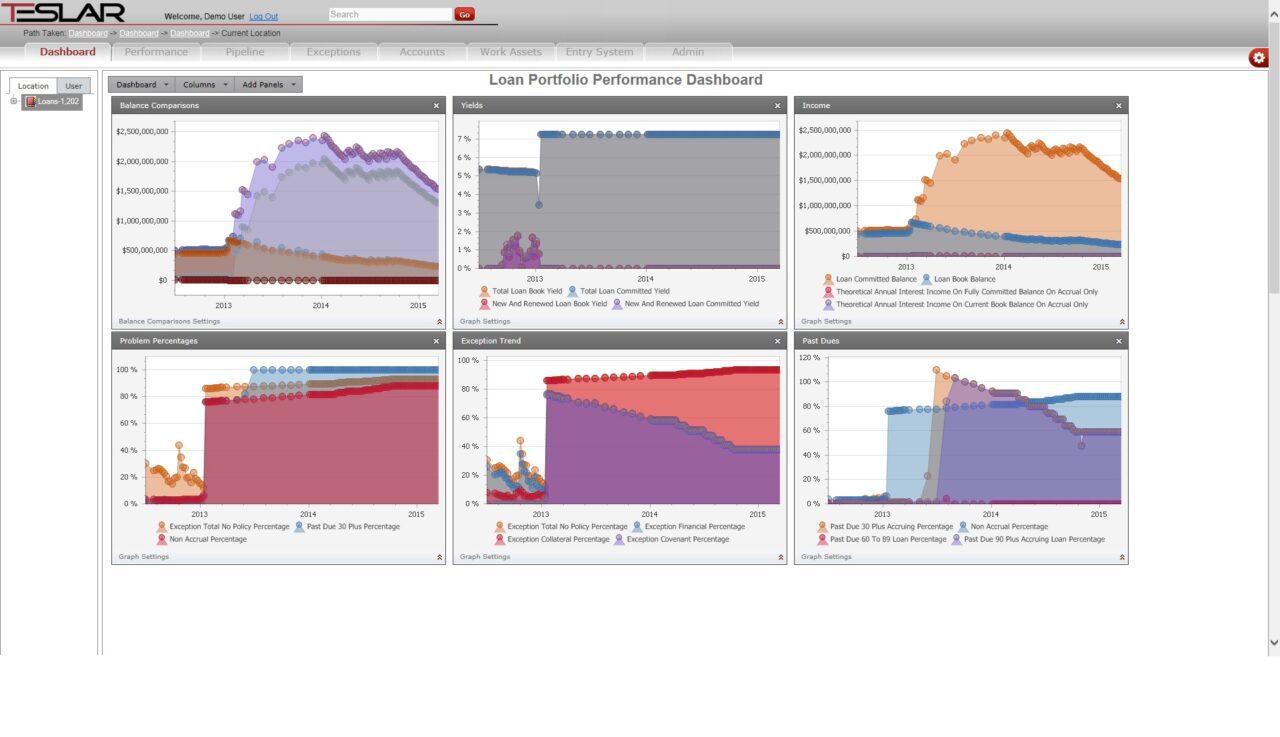

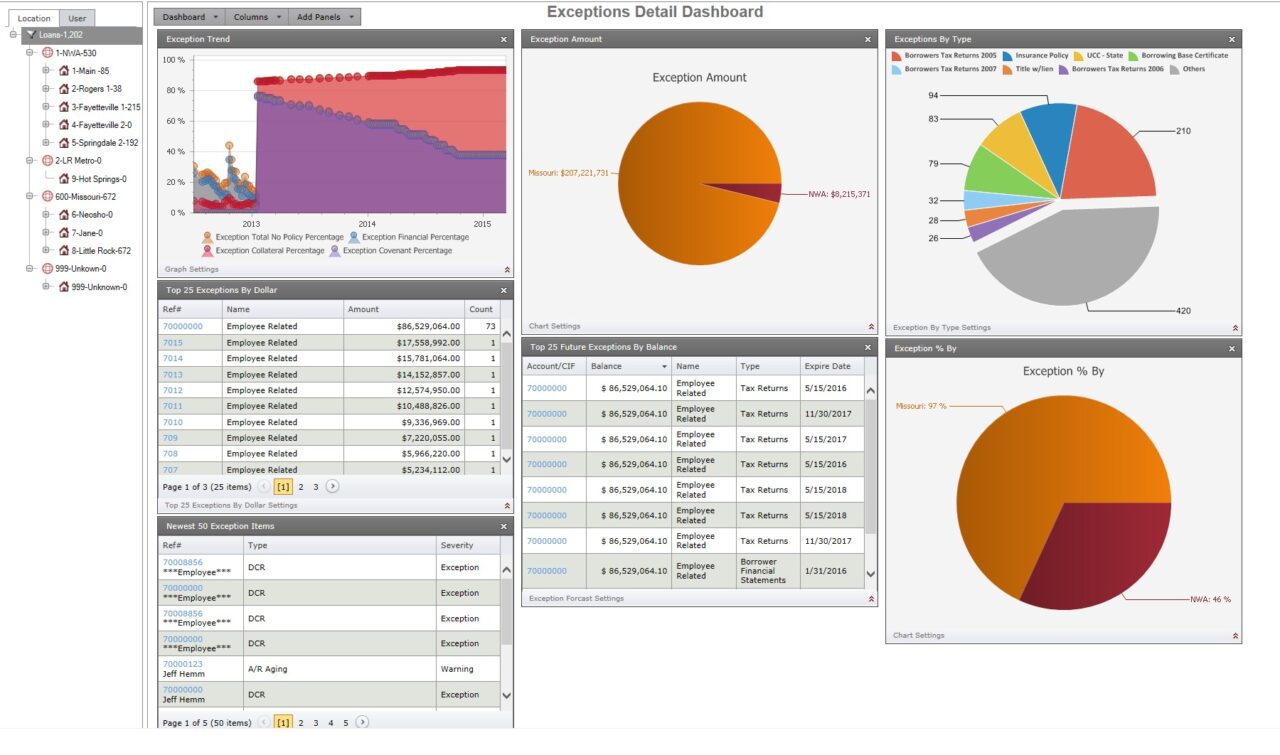

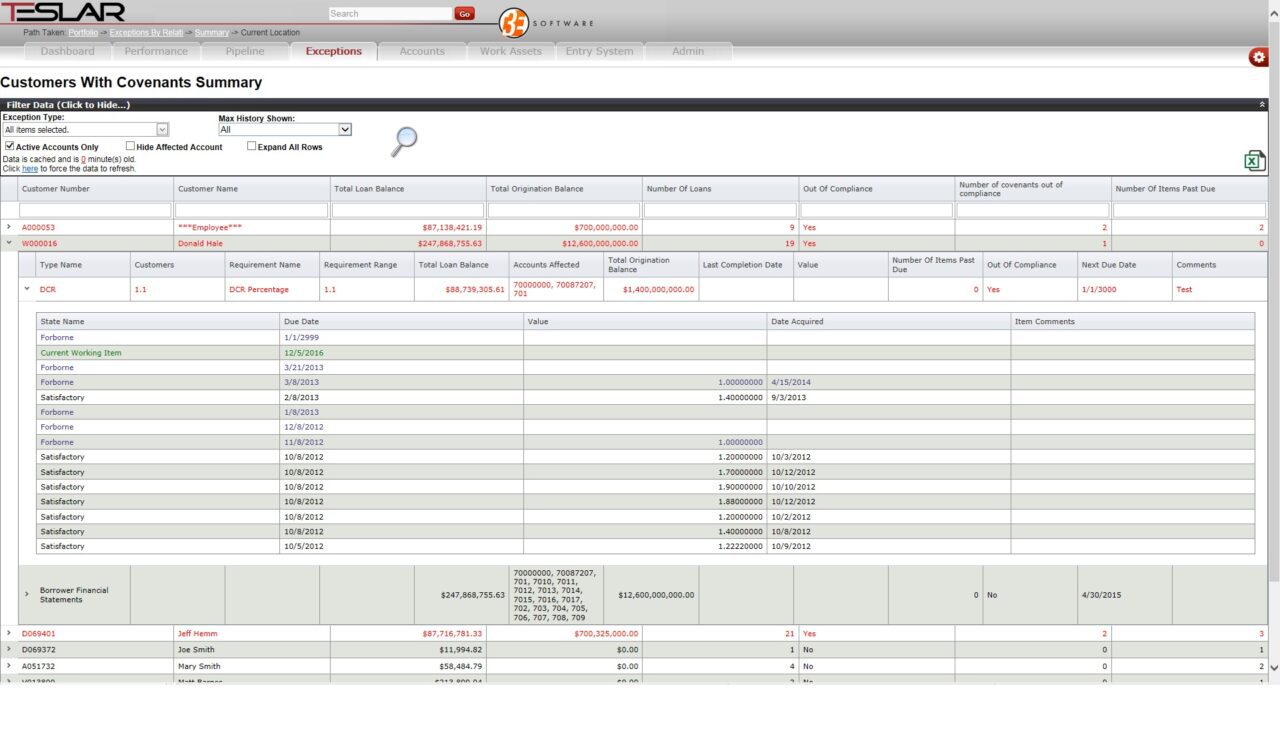

3E Software: Ever dream of a solution where lending staff can access and interact with all the data they need from any source? That’s Teslar.

Features:

- Data from all systems: core, credit card, factoring, etc.

- Empowers your lending staff

- So easy even a lender can use it

Why it’s great

One word: Empowerment. With Teslar, your lending staff can be empowered to get things done now, not when another resource can get to it.

Presenter

Presenter

Joe Ehrhardt, President, CEO

For 16 years, Ehrhardt has worked in or for financial institutions. With his common-sense approach and technology know-how, he is driven to change how banks of all sizes work and operate.

LinkedIn

Corezoid.com is the first cloud operating system that can implement and support any kind of algorithm and business process.

Corezoid.com is the first cloud operating system that can implement and support any kind of algorithm and business process.

Features:

- Rapid integration into any type of business process

- Low-cost, flexible system

- Faster with fewer developers

Why it’s great

While you read this text, 32,000 small corezoids have easily handled the work of huge online banks and implemented about a million logical operations.

Presenters

- Maria Gurina, deputy head of ecommerce

- Egor Avetisov, creative director

- Kristina Chaykovskaya, head of ecommerce

Malauzai Software is a mobile-only, virtual banking experience that makes banking fun, effortless and completely branchless. See it on Apple Watch too!

Malauzai Software is a mobile-only, virtual banking experience that makes banking fun, effortless and completely branchless. See it on Apple Watch too!

Why it’s great

A cool, mobile-only virtual banking experience that delivers effortless, branchless banking, powered by advanced technology.

Presenters

Presenters

Robb Gaynor, Founder, Chief Product Officer

Gaynor heads up the product development and marketing of the organization, focused on ensuring the company has solutions at the cutting-edge of mobile innovation. He has more than 25 years of experience.

LinkedIn

Danny Piangerelli, Founder, Chief Product Officer

Danny Piangerelli, Founder, Chief Product Officer

Piangerelli leads the technology team and is responsible for all aspects of Malauzai’s technology infrastructure. He has more than 15 years of engineering and enterprise-class technology experience.

LinkedIn

PayActiv changes the status quo and gives employees a noncredit alternative to predatory short-term lending products with security, dignity and savings.

PayActiv changes the status quo and gives employees a noncredit alternative to predatory short-term lending products with security, dignity and savings.

Features:

- Bridges the timing gap between earning and spending

- Eliminates the stress of overdraft and predatory fees

- Provides intelligent and preemptive cash-flow management

Why it’s great

PayActiv puts more money in the hands of every employee right now. They do it by making business’s payroll in real-time.

PayActiv puts more money in the hands of every employee right now. They do it by making business’s payroll in real-time.

Presenters

Safwan Shah, CEO, Founder

Technologist, payments expert, and entrepreneur, Shah is an innovator with a purpose.

LinkedIn

Kacky Fuller, Vice President Business Development

Kacky Fuller, Vice President Business Development

Fuller is PayActiv’s sales leader with 10 years’ experience in payroll and prepaid products.

LinkedIn

PsychSignal’s big-data processing-engines generate sentiment-analysis plus artificial intelligence to calculate stock-cycle shifts for Quant Funds, Hedge Funds and Traders.

PsychSignal’s big-data processing-engines generate sentiment-analysis plus artificial intelligence to calculate stock-cycle shifts for Quant Funds, Hedge Funds and Traders.

Features:

- Big-data processing detects mood shifts ahead of trade-direction shifts

- Unusual sentiment activity triggers direct, actionable alerts

- Fully automated system

Why it’s great

The next generation Squawk-Box is here.

Presenters

Presenters

James Crane-Baker, CEO

Crane-Baker is the former head trader of Broadway Trading, the pioneer of direct-access electronic trading; he is the founder and chief executive officer of PsychSignal.

LinkedIn

Bjorn Simundson, CMO

Bjorn Simundson, CMO

Simundson is a serial entrepreneur, inventor, angel investor, and he serves as chief marketing officer for PsychSignal.

LinkedIn

Someone With Group offers a compassionate way for hospitals to reduce bad debt by providing patients a secure platform to reach out to friends and family for financial support.

Someone With Group offers a compassionate way for hospitals to reduce bad debt by providing patients a secure platform to reach out to friends and family for financial support.

Features:

- Fraud resistant

- Restricted spending

- Branded for the hospital

Why it’s great

Someone With Group is taking the crowdfunding concept to the next level with a fraud-resistant platform that helps both hospitals and patients.

Presenters

Paula Jagemann-Bane, CEO

Paula Jagemann-Bane, CEO

Jagemann-Bane is a successful entrepreneur who thinks big, then delivers. Dynamic and engaging, she is poised to solve the hospital bad-debt problem—with compassion.

LinkedIn

Matt Pomrink, President, COO

Pomrink is detail-oriented without losing sight of the big picture; he has shepherded the  Someone With Group concept to a robust solution.

Someone With Group concept to a robust solution.

LinkedIn

Trizic offers a cloud-based software platform, Accelerator, comprised of a consumer-facing web experience and an adviser-facing console, enabling financial firms to offer investment advice digitally.

Trizic offers a cloud-based software platform, Accelerator, comprised of a consumer-facing web experience and an adviser-facing console, enabling financial firms to offer investment advice digitally.

Features:

- Automates complex portfolio management, rebalancing and reporting functions

- Accommodates ETFs, mutual funds, equities

- Enables firms to compete with robo-advisers and grow their business

Why it’s great

Trizic Accelerator is the most comprehensive, end-to-end institutional-class digital advice-platform for financial firms, helping them to delight clients and to grow and scale their businesses.

Presenters

Brad Matthews, CEO, Founder

Brad Matthews, CEO, Founder

Matthews, the CEO and founder of Trizic, has deep investment-management expertise, honed at J.P. Morgan, Citi, Barclays and Bear Stearns.

LinkedIn

Stay tuned for part four of our series this Thursday.

Summary of Customers with Covenants (above)

Summary of Customers with Covenants (above)

We’re two weeks into featuring all 70+ presenting companies that will demo their new technology at

We’re two weeks into featuring all 70+ presenting companies that will demo their new technology at

PayActiv

PayActiv

Trizic

Trizic