- Tradeshift is partnering with HSBC to develop embedded finance solutions.

- As part of the partnership, HSBC is contributing $35 million to Tradeshift’s $70 million funding round announced today.

- There is limited information about the details of the new joint venture between the two parties, but the announcement said more information will be unveiled ahead of the planned launch slated for early 2024.

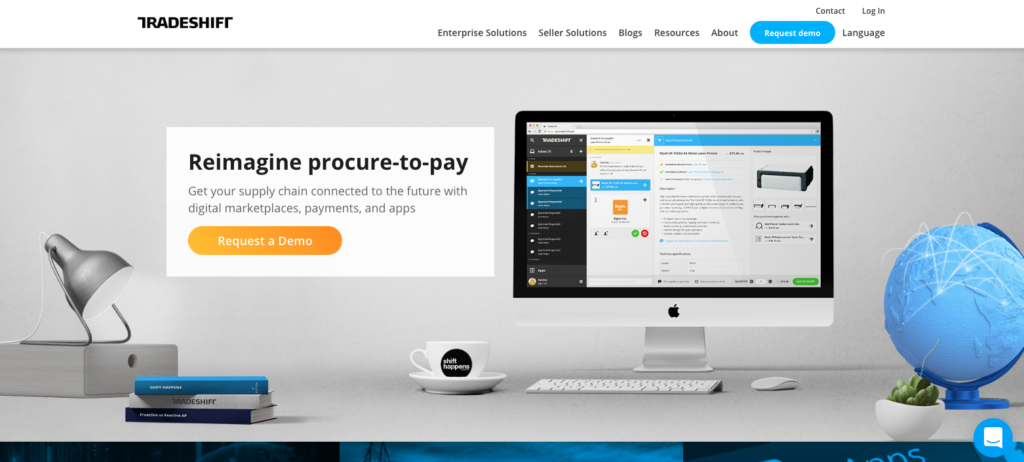

Supply chain procurements and payments company Tradeshift is teaming up with HSBC to launch a new business. The jointly-owned business endeavor will focus on developing embedded finance solutions and financial services applications.

As part of the partnership, HSBC is investing $35 million in Tradeshift as part of a round that is expected to close at around $70 million. Existing investors AYTK Limited, LUN Partners Group, Fuel Venture Capital, Doha Venture Capital LLC, Notion Capital, IDC Ventures and The Private Shares Fund contributed to the round.

The round will add to the more than $1.1 billion in funding Tradeshift has amassed since it was founded in 2009.

Details about the new joint venture between Tradeshift and HSBC are sparse. The announcement states that the two will “deploy a range of digital solutions across Tradeshift and other platforms” that will include embedded finance tools for trade, e-commerce, and marketplaces. The new business will enable Tradeshift to globally scale its business commerce network that currently sits at one million users.

Tradeshift expects that the HSBC brand will “bring instant credibility and broad appeal” to the new financial solutions. HSBC currently facilitates more than $800 billion in trade each year.

“The world’s biggest trade bank and the world’s largest trade network are joining forces,” said Tradeshift CEO and Co-founder Christian Lanng. “Our deepening partnership with HSBC delivers a strong foundation from which to scale and accelerate our vision of a trade network that creates economic opportunity for businesses everywhere.”

The two will announce more details about the joint venture ahead of its launch, which is expected in early 2024.

“We are very excited to partner with Tradeshift to help businesses and their suppliers trade more smoothly using world-class technology and solutions that the joint venture will deliver,” said HSBC CEO of Global Commercial Banking Barry O’Byrne.