- Sezzle is expanding its Payment Streaks loyalty program to Canada.

- The program uses a gamified approach to reward shoppers for on-time payments.

- The program is not available in Quebec.

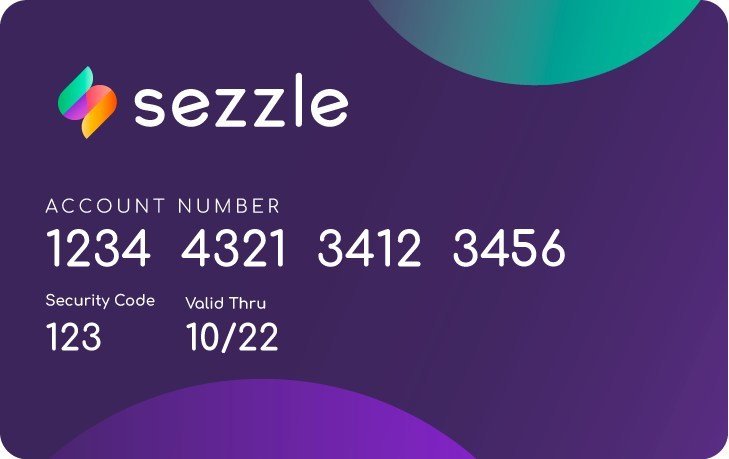

Just in time for Canada day (which is July 1, for those who may not celebrate), buy now, pay later (BNPL) technology provider Sezzle announced it is expanding its Payment Streaks loyalty program to users in Canada, with the exception of shoppers in Quebec.

Sezzle launched Payment Streaks in May of this year to reward consumers for consistent and timely payments. Through the gamified approach, when users consistently make their payments on time over the course of 90 days, they qualify to advance through to the next loyalty tier. The loyalty tiers offer a range of benefits to users, including entries in monthly giveaways and bonuses for friend referrals.

“Launching Payment Streaks for our Canadian users is a game-changer in promoting financial responsibility and customer satisfaction,” said Sezzle Canada GM Patrick Chan. “By turning on-time payments into a rewarding journey, we’re empowering users to manage their finances wisely while enjoying exclusive perks.”

Failed or rescheduled payments, or payments associated with refunded or canceled orders, do not qualify for streaks. Long-term financing payments and payments charged back by banks are also excluded from streaks. In the case of a failed payment, however, Sezzle allows users that resolve the issue within the same day to stay in their existing loyalty tier.

“By gamifying timely payments, we’re not only encouraging smart spending habits but also creating a more engaged community of shoppers. For merchants, this means stronger customer loyalty and trust, ultimately driving growth and success.” said Chan. “As we introduce Payment Streaks to Canadian users, we are reinforcing our commitment to shaping a future where financial empowerment is accessible to all.”

As one of the original BNPL players, Sezzle was founded in 2016. The company went public on the Australian Stock exchange in 2019 and shortly thereafter benefitted from the BNPL growth of 2020. Sezzle listed on the Nasdaq in August of 2023 and has a current market capitalization of $464 million.

Photo by Hermes Rivera on Unsplash