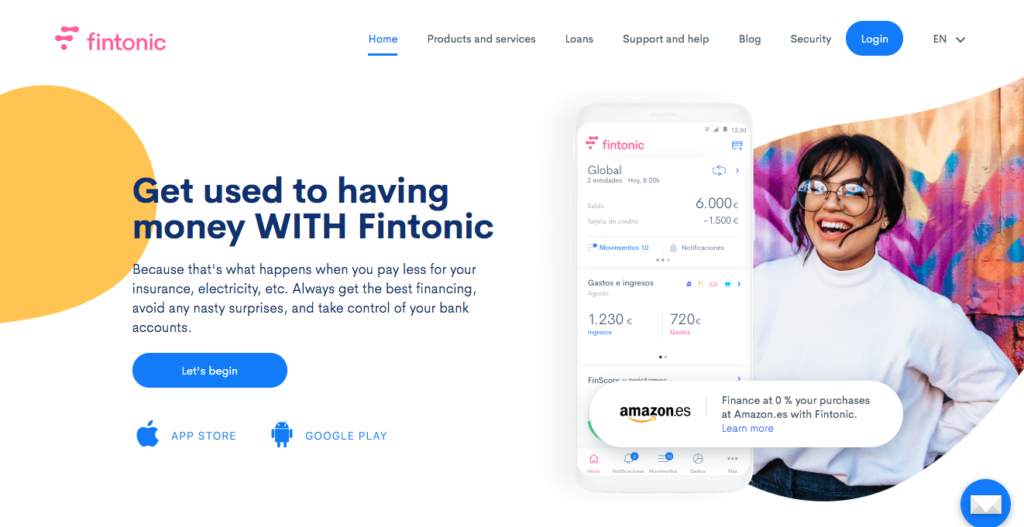

After receiving its banking license from the Bank of Spain last week, personal finance platform Fintonic has become Spain’s newest challenger bank. Having passed all of the certifications, Fintonic is now a payment initiation service provider (PISP) and PSD2 compliant account aggregation service provider (AISP).

“We are very pleased to be pioneers in receiving this license, because it supports our value proposition to always be next to our users helping them with total transparency,” said Lupina Iturriaga, founder and co-CEO of Fintonic.

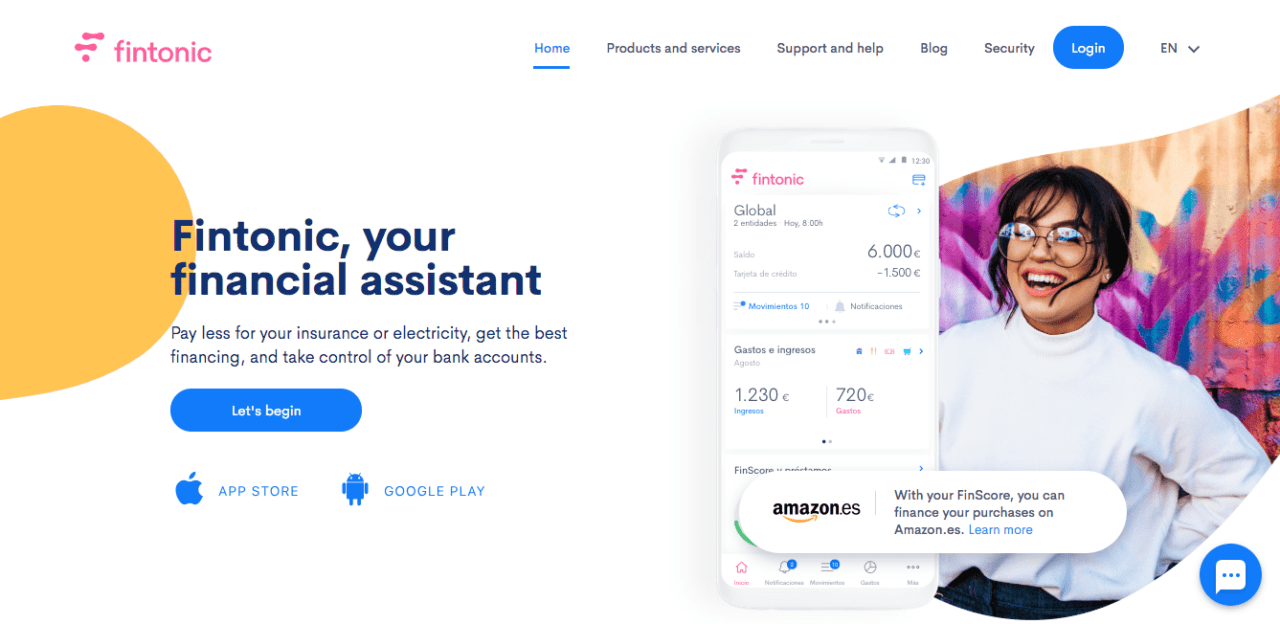

By becoming a PISP and AISP, the company anticipates it will be able to launch products and services that offer its 800,000 users a better way to manage their money. “Our ambition is to offer an ideal financial service with a platform that integrates different entities while maintaining the standards of independence and transparency promoted by Fintonic,” added Iturriaga.

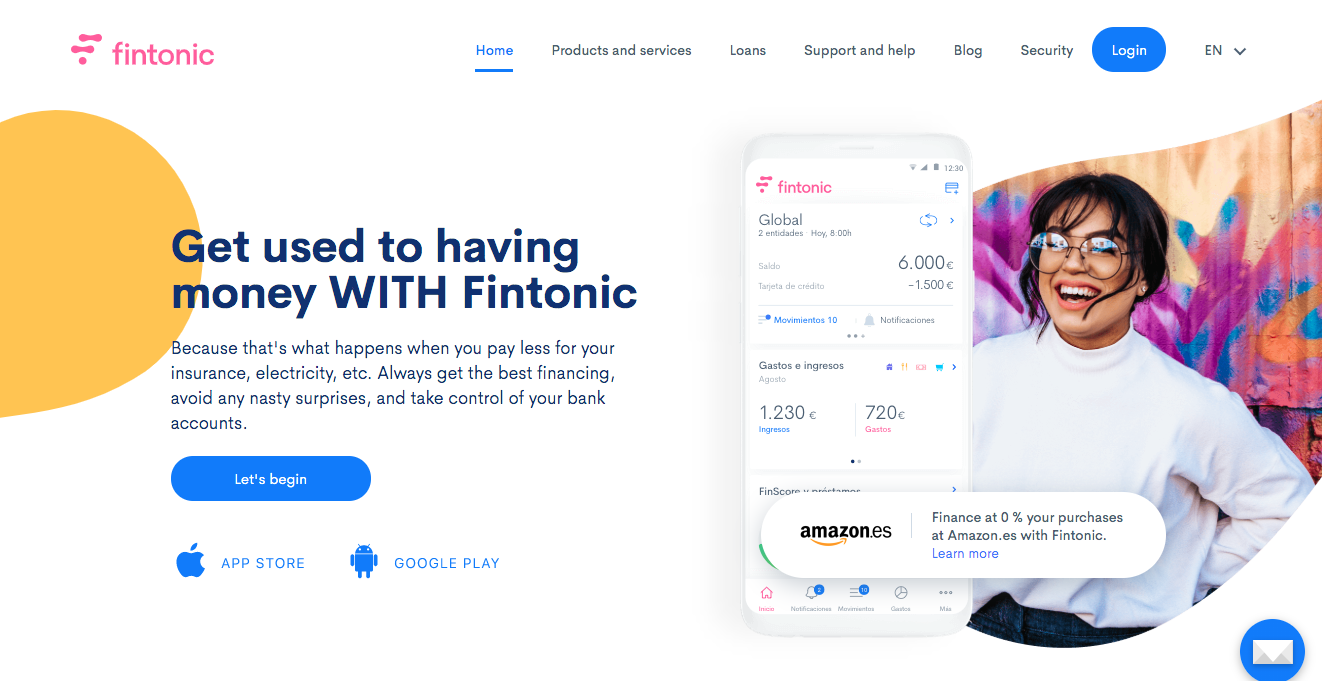

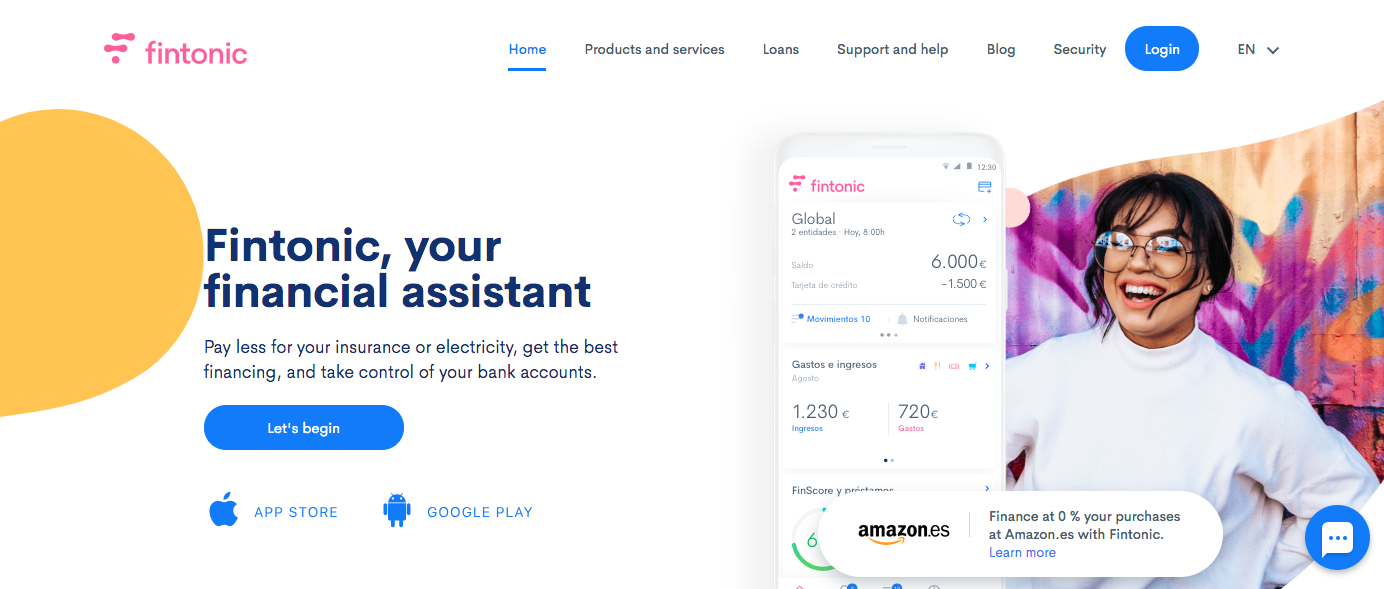

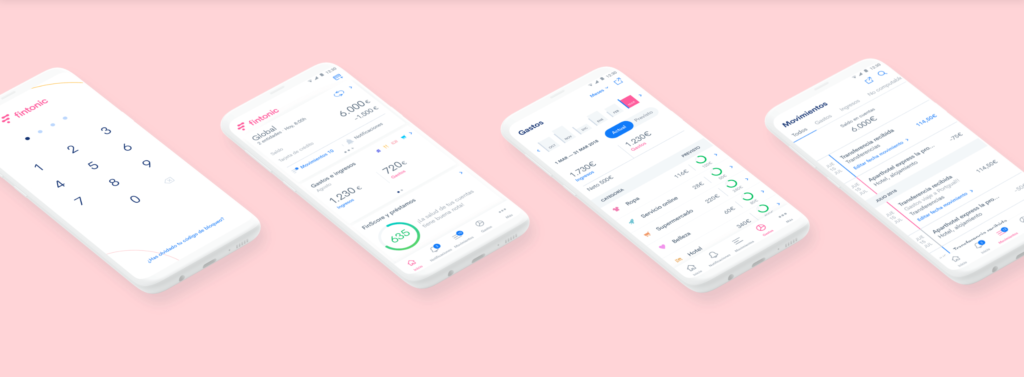

Fintonic’s flagship offerings include financial management tools, insurance, and lending, which allows customers to take out loans of up to $45,000 (€40,000). The company recently revealed other plans in the works– including account-to-account transfers that happen in near-real time. By the end of this year, Fintonic’s goal is to amass one million users.

At FinovateSpring 2016, Fintonic debuted its alerts and inbox system to help users act in a timely manner on their financial needs and recommendations. The company, which recently received a $21.4 million investment, has $51 million in total funding and, earlier this year, was valued at $180 million.