According to Tolerisk founder and CEO Mark Friedenthal, the newly-announced integration between his company and SS&C’s Black Diamond Wealth Platform will make it easier for advisors to help clients reach their financial goals. The integration will bring sophisticated risk assessment technology to the portfolio management platform, and provide advisors with the ability to more objectively and more comprehensively measure client risk appetites.

“Our focus on providing the best analytical solutions for advisors includes seamless delivery that comes from integrations with leading providers of financial planning, portfolio reporting, portfolio analytics, and CRM technologies,” Friedenthal said.

Specific features of the integration include the ability to post custom notes directly to the Black Diamond Relationship Timeline, as well as client import and mapping functionality to help advisors generate risk assessments and send them to clients quickly and more efficiently. Customers using both systems will be able to leverage additional compatibilities, such as the ability to import client account balances into Tolerisk for faster updating and less manual input.

“Our integration with Tolerisk makes it easy to leverage the power of both tools in a unified way,” Head of Partnerships and Integrations for Black Diamond at SS&Cs Justin Wayne said. “Together, we are empowering advisors to have more meaningful conversations with their clients, which deepens the advisor-investor relationship and provides a competitive advantage.”

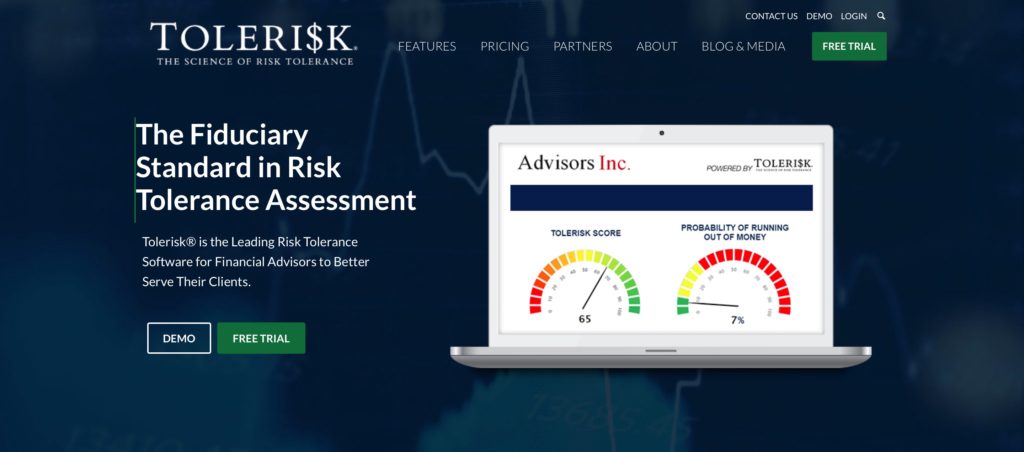

Founded in 2014 and headquartered in New Jersey, Tolerisk demonstrated its Tolerisk 401(k) solution at FinovateFall 2018. The feature leverages Tolerisk’s deep analytics and two-dimensional risk tolerance assessment capabilities to offer customized financial planning advice to customers. The company’s technology not only helps identify a client’s risk profile with its Tolerisk Score feature, it also provides critical Probability of Running Out of Money reports to ensure a client’s withdrawal strategy does not diminish available savings at too rapid a rate.

Tolerisk’s Friedenthal was featured this spring in the New York Times article “When Gambling Seems Like a Good Investment Strategy.” Tolerisk began the year with big partnership news, inking deals with Orion Advisor Tech in February and CircleBlack in January.