There are two words that help summarize 2020: unpredictability and volatility. It turns out that both of these attributes are bad for a lot of things and that’s especially true for underwriting consumer loans.

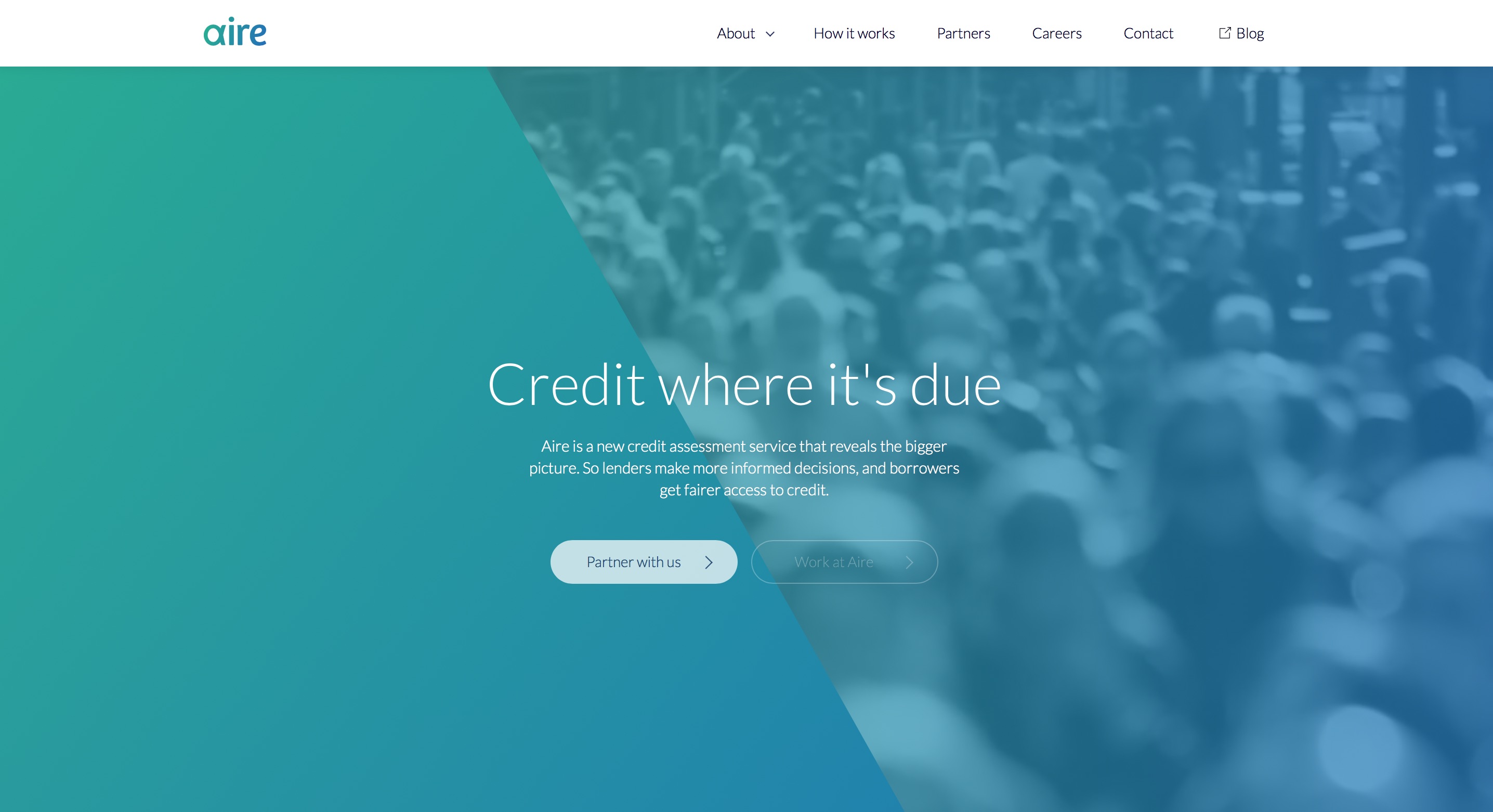

Recognizing this issue, U.K.-based credit assessment services company Aire launched Pulse, a product to help lenders calculate risk in the post-COVID borrowing landscape.

“Lenders have always played catch up when understanding how existing customers perform on commitments elsewhere, and this challenge is exacerbated by the major CRAs’ Emergency Payment Freeze,” said Aire CEO and Founder Aneesh Varma. “In a rapidly changing economic situation, lenders need new tools that can understand the context of the consumer to help them detect emerging risks. Pulse is a quick, convenient and FCA-regulated way for lenders to spot financial change as it happens, providing lenders with a truly holistic view, gathered from the most up-to-date data source available to them: the consumer themselves.”

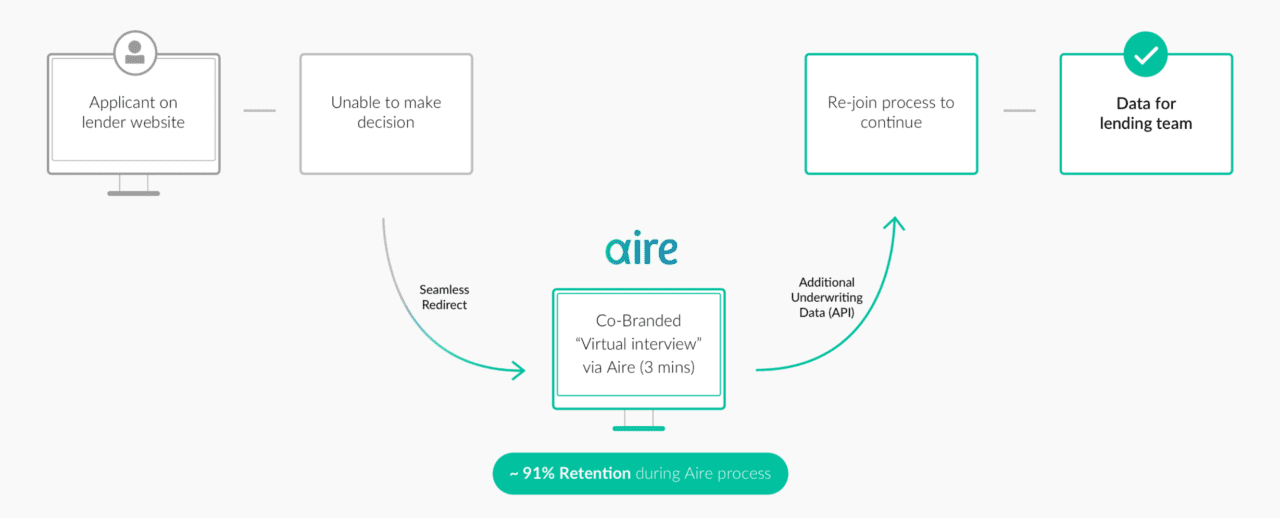

At its core, Pulse is a scalable communications tool. It enables lenders to collect current information from customers about their changing financial circumstances while maintaining fair and FCA-compliant account handling. The tool enables lenders to reach out to their existing borrowers via SMS and email to conduct an Interactive Virtual Interview (IVI) to gather information regarding disposable income levels and risk of financial difficulty.

It takes consumers an average of three-to-five minutes to complete the IVI, which asks for information such as employment status, current working hours, income level, household bills and expenses, and levels of savings. In order to ensure the information is correct, Aire cross-checks it against its own database of consumer information. After the assessment, Aire sends the lender insight into the consumer’s financial difficulty, affordability, and engagement.

Because of its proactive approach, Pulse offers lenders information about a consumer’s changing financial situation much faster than the traditional method of waiting for historical information from CRAs who identify changes in customer circumstances.

The underwriting and credit scoring space has always been an area of disruption for fintechs. Given that the new reality across the globe has multiple impacts on the economy and unemployment, we can expect to see more existing companies adapt their services to not only help underwriters understand and assess risk but also help consumers access cashflow when they really need it.

Aire was founded in 2014 and has since raised $24 million. Aneesh Varma is CEO.

Photo by Blake Wheeler on Unsplash