What’s better than having a large pizza with all your favorite toppings delivered to your front door?

How about a side order of cash, saving you a trip to the ATM or bank branch?

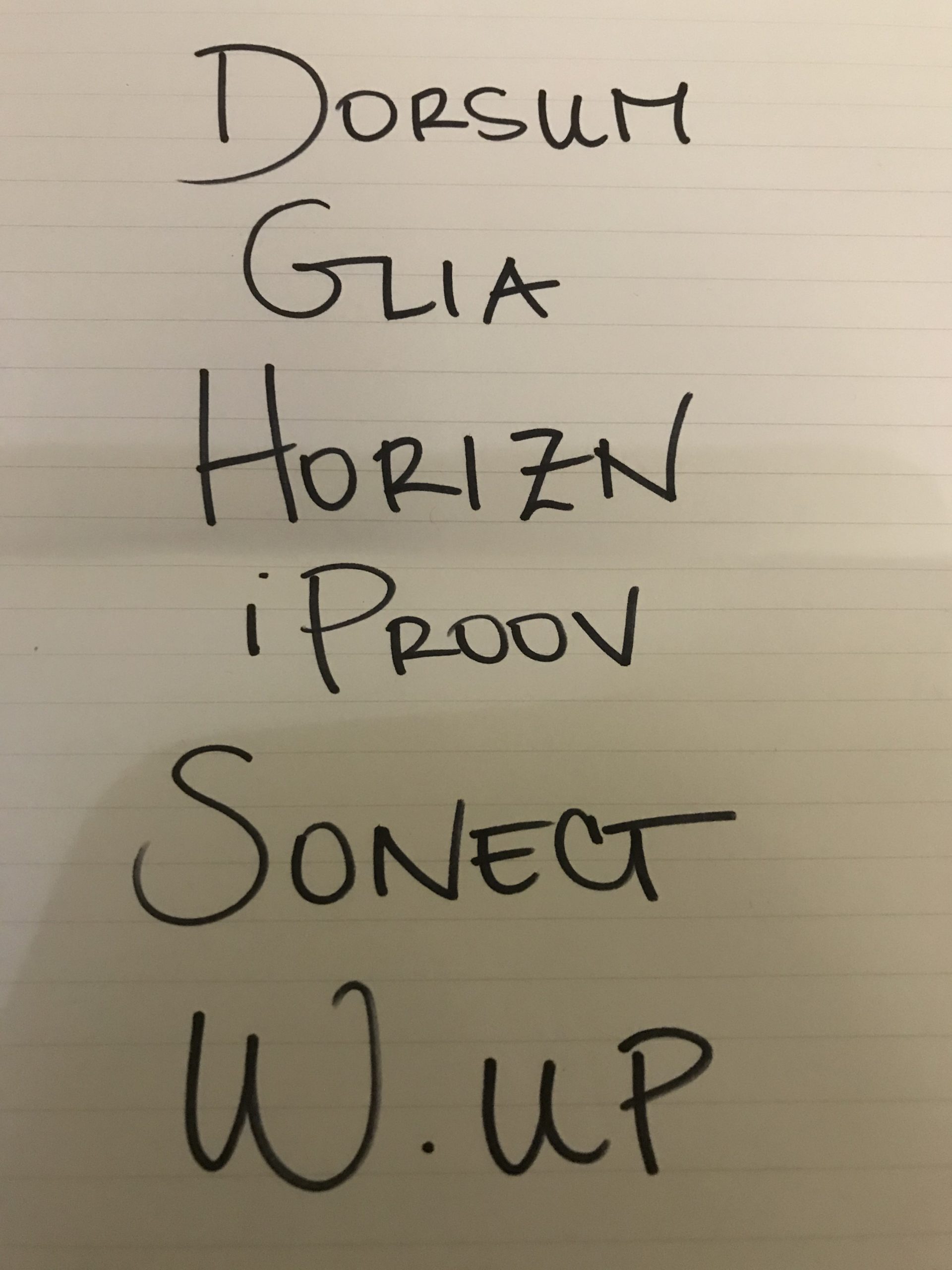

Sonect, which won Best of Show in its Finovate debut at FinovateEurope in Berlin earlier this month, leverages what it calls a social network for cash to help people get the cash they need wherever they are. Based in Zurich, Switzerland and founded in 2016 by CEO Sandipan Chakraborty, the company enables merchants ranging from cafes and coffee shops to pharmacies and bodegas to benefit from the additional customer traffic of Sonect customers.

At the same time, banks can extend their ATM networks with Sonect, avoiding the expense of purchasing and maintaining additional cash distribution hardware.

The solution works simply for the user. After downloading the Sonect iOS or Android app, the user creates a Sonect account. They then select their preferred shop or merchant and the amount of cash they wish to withdraw. The merchant will scan the barcode in the user’s Sonect app, and the funds will automatically be deducted from your account as soon as the transaction is confirmed. The user then receives their cash.

Both banking accounts as well as credit card accounts can be used with Sonect (both Visa and Mastercard are currently accepted.) The solution is free of charge for both users and shops.

Sonect was inspired in part by observing the slow rate of adoption of new technologies like Apple Pay. A self-described “strong believer of (the) death of cash (at) the hand of mobile payments,” Chakraborty nevertheless saw an opportunity to help bridge the gap between the custom and convenience of cash and the opportunities of digital alternatives that have yet to be fully embraced by banks, consumers, and merchants. It’s also worth noting that Switzerland is a country where cash is still very much king; the Swiss National Bank reports that 70% of all transactions in the country are still in cash.

Chakraborty credits enabling technologies like blockchain and open banking APIs for making Sonect possible. An IT Project/Program Delivery Manager with Credit Suisse for more than 12 years, he likens Sonect to a platform similar to Uber and Airbnb that is able to create a vast, service network – in transportation, accommodations, or, in Sonect’s case, for cash withdrawal – without having to bear the burden of building and maintaining a vast physical infrastructure to go along with it.

Currently available only in Switzerland, there are more than 2,500 shops partnered with Sonect. That said, Chakraborty noted, “We are in a phase where we are expanding within Europe,” adding that because of the company’s Best of Show award, he believes “the word (about Sonect) will spread quicker than we anticipated,” Chakraborty also said that the company has been in conversations with banks “across Europe, across the continent” about potential partnerships.

Sonect has raised more than $8.7 million (CHF 8.5 million) in funding from investors including SixThirty and Loomis AB. The company has 25 employees in its offices in Zurich; Vilnius, Lithuania; and Mexico City, Mexico.