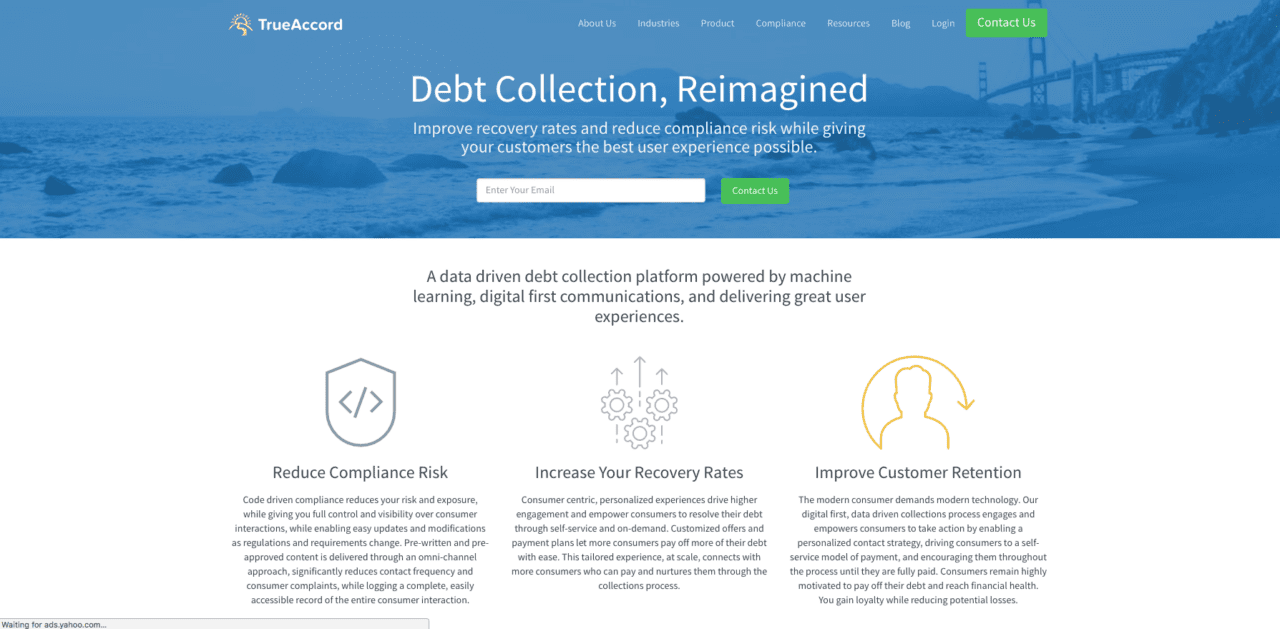

TrueAccord uses machine learning and behavioral analytics to automate the debt-collection process. The result is an all-in-one, debt portfolio management platform with a multichannel, “humanistic” approach to engage the debt-account holder.

At FinovateSpring 2015, the company demoed the white-label version of its platform. TrueAccord says they have seen recovery improvements of 20% or more in the companies using the technology, and individual agent productivity gains of 10x. The goal at Finovate was to introduce the platform to larger institutions that could use the technology under their own brands to better manage debt accounts.

TrueAccord co-founders: CTO Nadav Samet and CEO Ohad Samet demonstrated their white-label, automated debt-recovery platform at FinovateSpring 2015 in San Jose.

Company facts:

- Founded in 2014

- Headquartered in San Francisco, California

- Services more than $60 million in debt from more than 400,000 debtors

- Ohad Samet is co-founder and CEO

The story

Ohad Samet left his job as chief risk officer at Klarna to launch TrueAccord. Inspired in part by his own experience with a debt collector, Samet enlisted his brother, Nadav Samet, a veteran of the Israeli intelligence services and a former Google engineer. Together they began to tackle some of the key problems involved in debt collection:

- Make it easier for lenders to track and manage their debt portfolios. TrueAccord provides institutions with a visually engaging, online dashboard where all debt accounts can be reviewed and monitored.

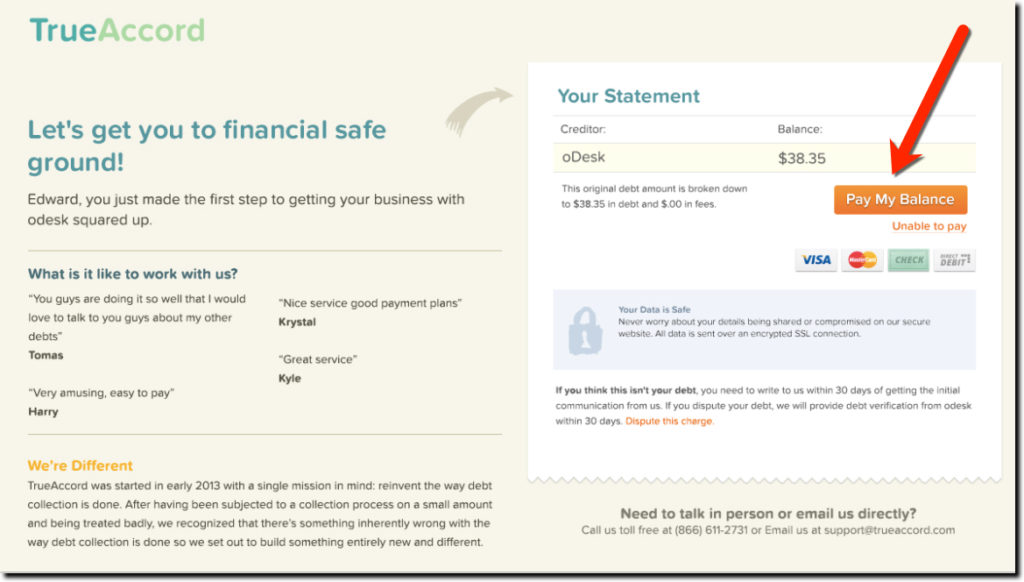

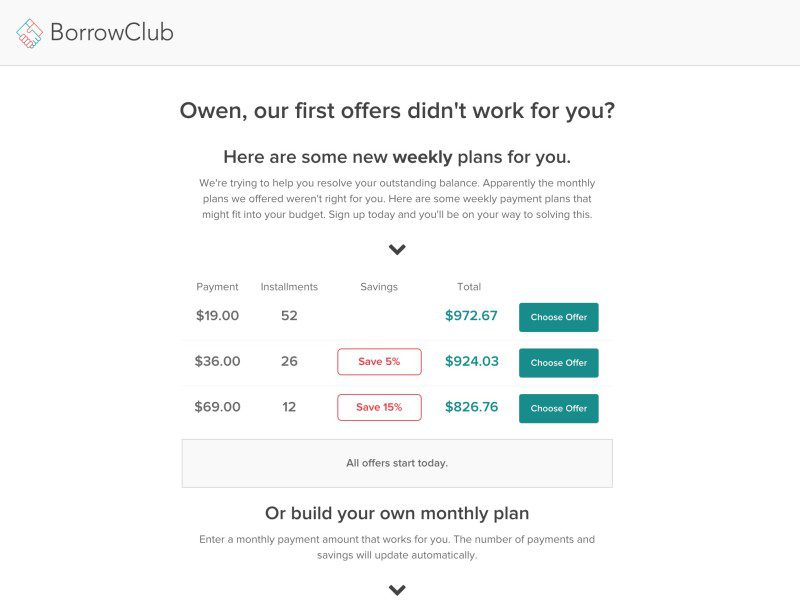

- Automate as much of the process as possible. TrueAccord’s platform provides automated repayment plans that can be accepted as-is by borrowers or modified, and creatively engages with the debtor automatically to suggest alternative plans—even if the debtor abandons the process by closing the window.

- Add the right kind of “human touch.” In building TrueAccord, Samet and his team knew that different debtors would respond differently to requests to repay debt. One debtor may respond better to a lighthearted text with emoticons. Another debtor may be more encouraged to pay off his debt with a more overtly motivational approach. Yet another debtor may just need to “see the math” in order to realize the importance of prioritizing debt repayment.

What’s important is meeting the debtor where he or she is, in the channel of his or her preference, in a voice (or tone or image) that is likely to produce the positive result of turning non- or under-performing loans into performing ones.

How it works

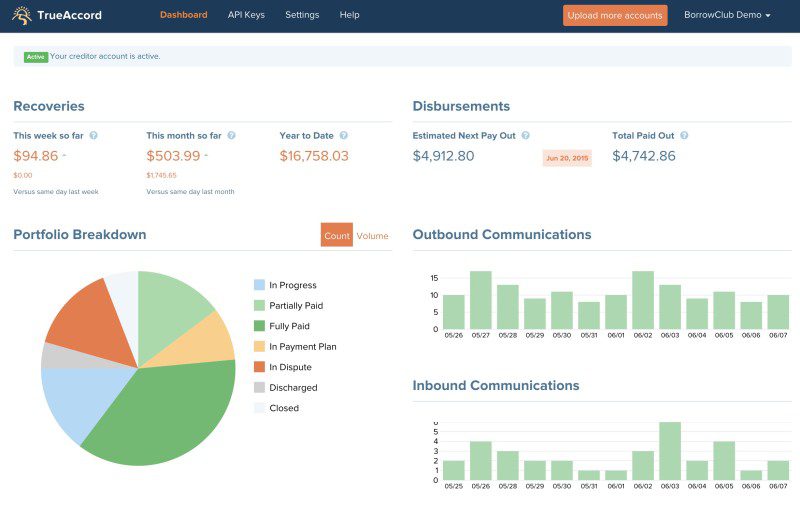

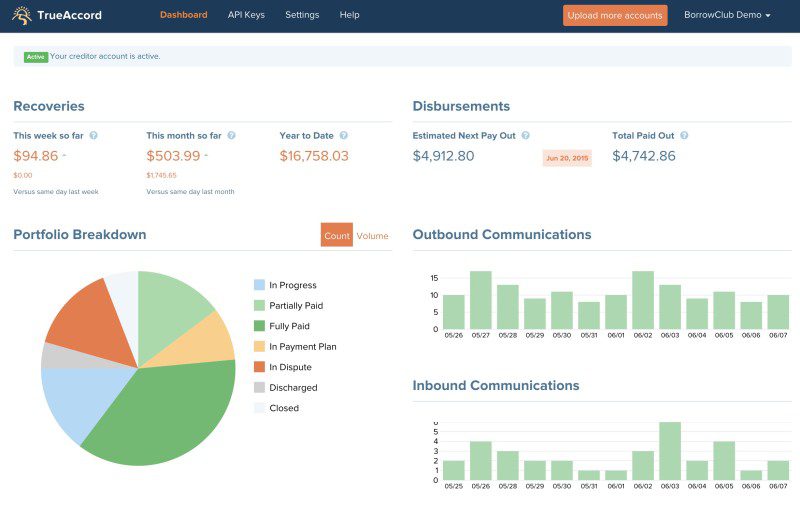

When a company initially logs onto the TrueAccord platform, the first thing to do is add loan accounts, a task easily done either by uploading files via CSV, or by using TrueAccord’s API to set up a two-way integration. Once the loan accounts are uploaded, TrueAccord goes to work classifying the loans and displaying the information graphically in the dashboard (see below).

The dashboard makes it easy to track the kind and quality of loans in the portfolio: working and non-working loans, loans in dispute, loans under a revised payment plan and more. The dashboard also tracks inbound and outbound communication volume; recoveries (with week-to-week and month-to-month comparisons); and disbursements.

Above: TrueAccord’s dashboard gives the lender all the relevant information in an easy-to-digest graphical format.

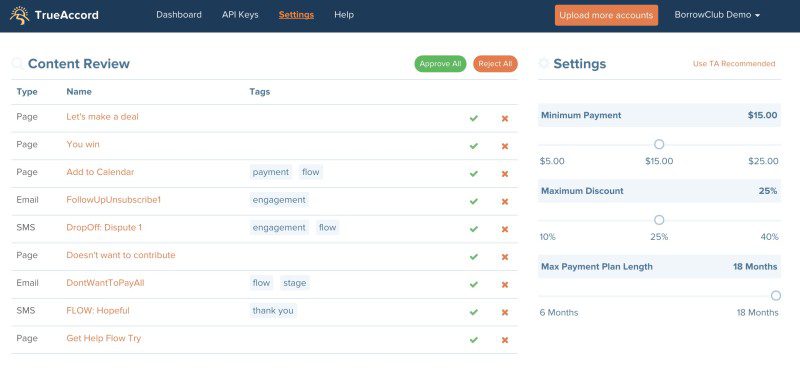

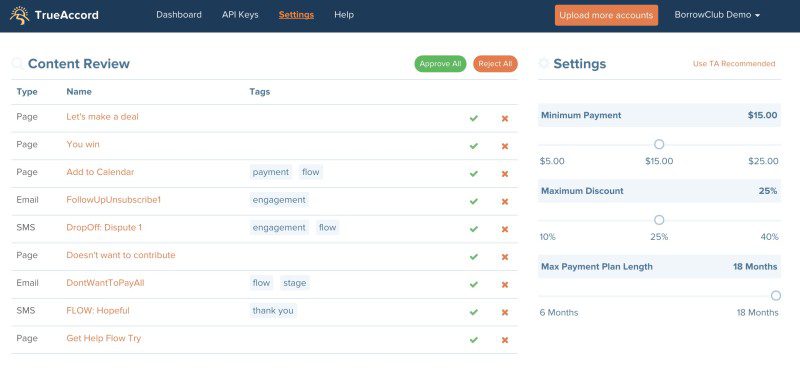

The settings control (below) lets the company establish parameters to guide the automated debt-recovery process. Select minimum payments, maximum discounts to be offered, and maximum payment-plan length, and the system does the rest. Administrators can use the settings tab from the dashboard to see what other features TrueAccord’s engineers are developing. Those features are tested for stability before being offered for use on the platform.

Above: The settings tab in the dashboard gives the lender the opportunity to customize and adjust the parameters of the loan-repayment terms TrueAccord will offer on its behalf.

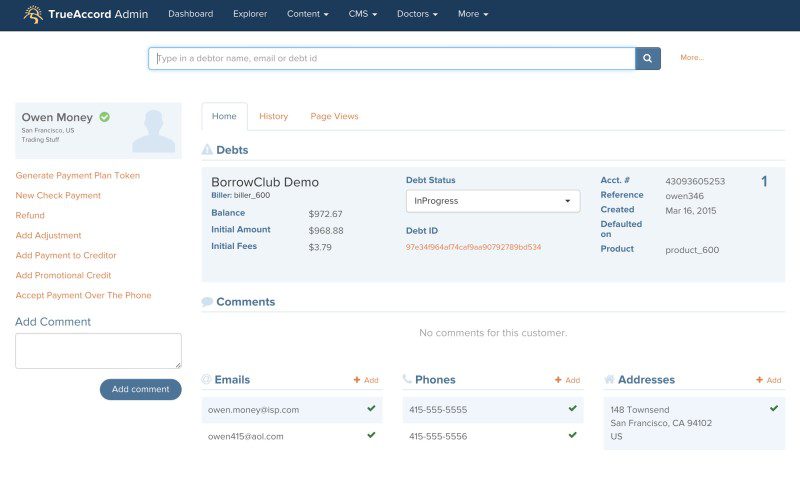

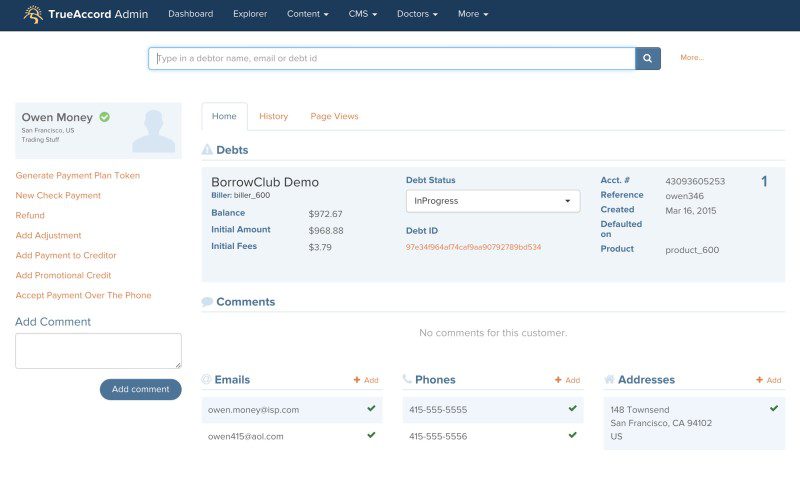

Below is an example of the view of the platform from the perspective of an individual agent reviewing accounts. The account view gives the agent all the information he or she needs in order to see exactly what condition any given loan is in. Here, the agent can see the name, outstanding balance, initial loan amount, and contact information. To the right of the Home tab, the history tab displays all of the contact between the company and the debtor. The time and date when the contact was made is noted, as are the channel (email, voicemail, SMS, etc.), and any other substantive details. Interestingly, the platform also lets the agent know if the contacted debtor has tried to access any of the messages (whether or not the debtor actually returned them), including attempts that are abandoned. TrueAccord also lets the agent know if the debtor has visited the web site and which pages have been viewed.

All of this is geared toward increasing engagement with a debtor who probably is at least a little reluctant to be engaged. By studying which channels and which messages have received the most positive responses, TrueAccord is able to provide better outcomes from debt collectors and debtors.

Above: The TrueAccord platform gives collection agents the details on individual accounts, including a contact history.

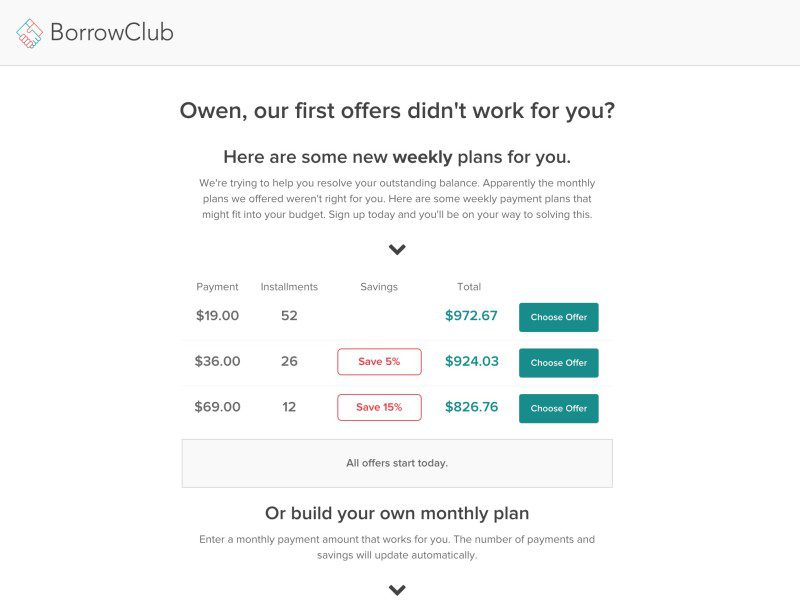

Easily one of the most clever features of TrueAccord from this perspective is the way the technology remains engaged with the debtor, even if the debtor abandons the process. For example, if the debtor closes the tab or window in the middle of a repayment “negotiation,” the platform will send the debtor a text or email with a subject line, such as “Let’s Try Again,” a phrase with a more conciliatory tone (or more “encouraging” or more “motivating,” depending on the debtor’s personal characteristics), and a new repayment-plan offer for the debtor to consider.

Above: TrueAccord automatically recontacts when debtors abandon the process with an email or text offering a repayment plan that may better suit the debtors needs.

The future

Since its Finovate debut in San Jose this spring, TrueAccord has found itself in the headlines. COO Sofya Pogreb was interviewed as part of Huffington Post Business’ Women In Business series earlier this month, and the company was recently highlighted by Fox Business as one of “30 Hot Fintech Startups to Watch” and by Coin Telegraph as one of “6 Rising FinTech Startups.” The company has raised more than $5 million, with its last funding being a $250,000 Series A round completed in October 2014.

TrueAccord’s primary goal now is to encourage more large financial institutions to adopt their technology. And if the company’s desire to add data analysts is any indication, TrueAccord is optimistic about its prospects of getting FIs to put the platform to work. Writing about the company in the fall of 2014 when it included TrueAccord in a list of “Top 10 Tech Companies to Watch,” the editors of American Banker put it simply: “Debt collection is in dire need of an overhaul. TrueAccord is trying to offer an enlightened approach.”

Often we find companies trying to put a “human face” on technology to make it more palatable. In TrueAccord, we have a company knowledgeable enough about the world of debt collection to do the exact opposite.