- BILL is expanding beyond payments by launching new procurement tools that unify accounts payable, receivable, expense management, forecasting, and payments into one centralized platform for small businesses.

- The new release offers features like advanced approval routing, invoice matching, and bulk payments.

- With the launch, BILL positions itself as a financial command center for SMBs, offering a holistic alternative to point solutions like Ramp by delivering integrated, customizable, and scalable cash flow management.

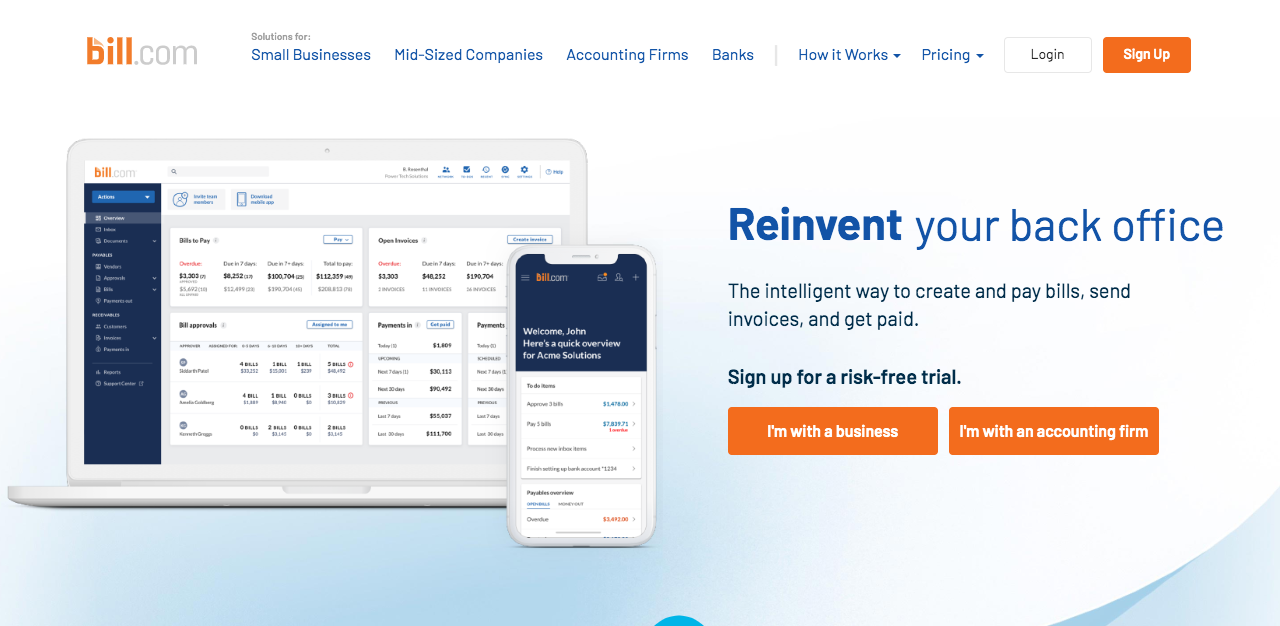

Small business financial software provider BILL unveiled new procurement capabilities this week. The California-based company is releasing new tools to help businesses and accountants take control of their cash flow. Adding this well-rounded set of procurement capabilities signals BILL’s intent to move beyond payments into a broader role as a small business financial command center.

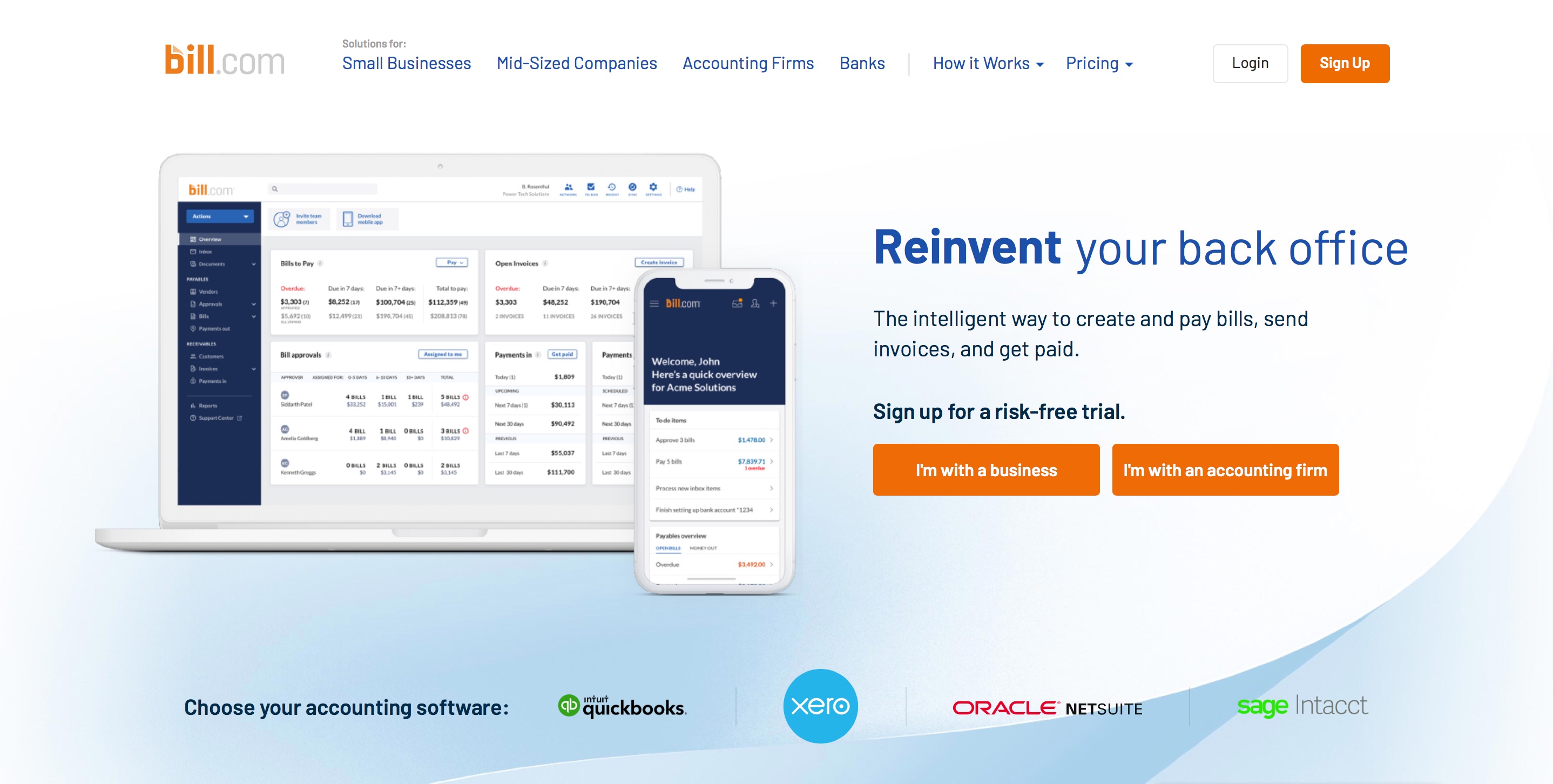

BILL is enhancing its platform with new procure-to-pay capabilities, and bringing accounts payable, accounts receivable, payment cards, expense management, insights, and forecasting in a single solution. The additional procurement tools will enable businesses to efficiently manage, approve, and track purchase orders with greater accuracy. Features like advanced approval routing and automated invoice matching will help reduce fraud risk and payment errors, while streamlining workflows to minimize manual effort and increase operational efficiency.

While other platforms, such as Ramp, focus on specific elements of small business financial operations, BILL differentiates itself with a holistic approach that combines procurement, payments, and forecasting in one platform. Consolidating all of a business’ needs into one platform not only streamlines operations but also reduces the need for third-party add-ons and disjointed data reconciliation between systems.

“Our expansion into procurement reinforces how BILL is driving innovation and setting new standards for helping businesses and accountants to manage and control their cash flow, eliminate ‘busy work’, and make strategic decisions that drive long-term growth and success,” said BILL Founder and CEO René Lacerte.

The three new capabilities BILL is releasing include BILL Multi-Entity, which enables businesses and accounting firms to manage payments across multiple organizations from a single, centralized platform; the BILL API Platform, which allows businesses and accountants to tailor financial workflows to meet their own needs; and a bulk payments option that will save businesses time and money by paying thousands of bills at a time.

The new capabilities will allow, for example, a multi-location accounting firm to route purchase approvals through custom rules for each entity while managing all payments from a single dashboard. This reduces manual tracking, improves compliance, and frees up teams to focus on higher-value tasks.

“In an uncertain environment, control and visibility of cash flow is not only key to efficiency—it’s one of the most powerful levers a business has to be more resilient. Legacy spreadsheets and disparate tools are costing American businesses time, money and opportunity, and BILL is the only technology partner delivering more control, more value and more innovation SMBs need and deserve,” added Lacerte.

Founded in 2006, BILL helps 460,000 businesses automate their financial operations and has processed $266 billion in payments volume. The company, which trades on the New York Stock Exchange under the ticker BILL, went public in 2019 and has a market capitalization of $4.55 billion.