Intelligent Virtual Assistance (IVA) company Interactions recently announced a new partnership with Next Caller, a phone fraud detection and authentication firm, with a goal of boosting Interactions’ fraud protection.

“At Interactions, security is a top priority,” said Mary McKenna, director of product management at Interactions. “Customer service interactions generate massive amounts of data that are often sensitive, so being able to provide our clients with state of the art security is a must. With this enhanced security offering, we strengthen our commitment to protect our clients and their customers from security threats.”

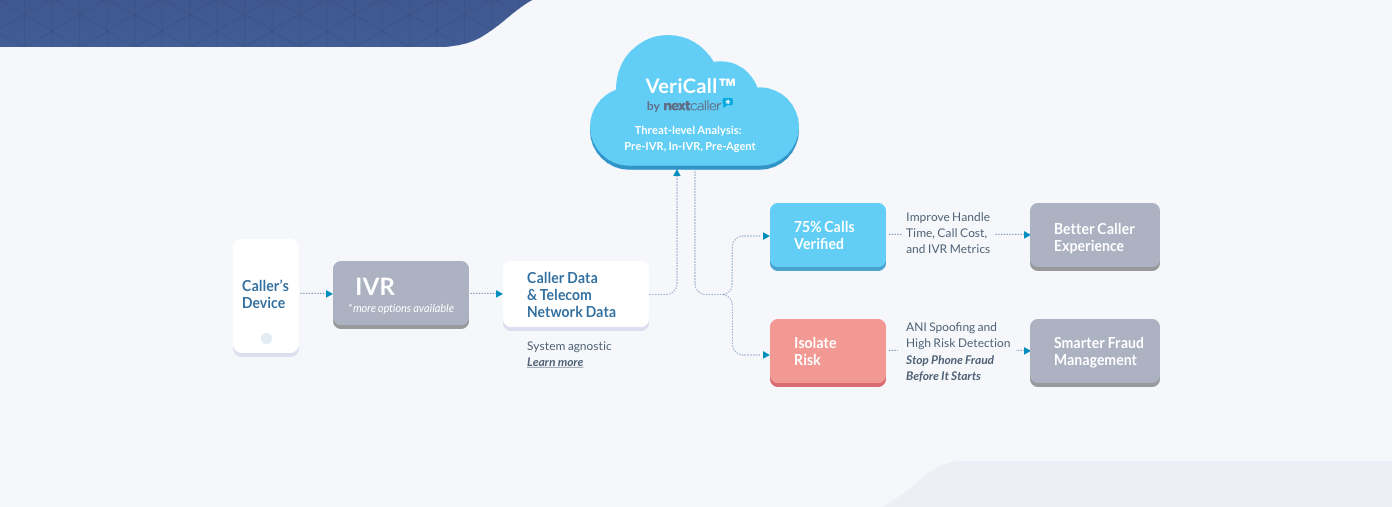

Under the agreement, Interactions will expand security services for its IVA enterprise clients by leveraging Next Caller’s VeriCall tool, which will add a layer of security to prevent fraudulent phone calls. VeriCall will help IVA assess the threat level of an incoming call using the caller’s automatic number identification (ANI) and network information. The resulting risk score will route high risk calls to either further screening questions or to a live agent, and will direct low-risk calls via a more frictionless user experience.

“Our partnership with Interactions will provide sophisticated real-time call verification and authentication technology to their customers,” said Ian Roncoroni, co-founder and CEO of Next Caller. “Fraud is a growing problem for businesses today, and can be especially damaging to companies that have to deal with large amounts of customer data. One small mishap can provide a fraudster with enough personal information to steal a customer’s identity.”

Interactions will use Next Caller’s technology alongside its current security offerings, including Voice Biometrics, which creates a personalized voice print for customers; ANI Blacklists, which cross-checks a caller’s ANI against existing databases of blacklisted numbers; and Voiceprint Blacklists, which uses the caller’s voiceprint to search an existing database of fraudster voiceprints.

Massachusetts-based Interactions leverages AI and voice-recognition technology to help big brands offer a more friendly, automated customer experience. The company most recently presented its IVA at FinovateFall 2018. Founded in 2004, Interactions facilitates 1 billion customer interactions per year across six different channels for large brands including Hyatt, Humana, LifeLock, and Mountain America Credit Union.