Last week we took a look at what the alums of FinovateSpring 2015 have been up to in the year since they demoed on the Finovate stage. Today, we’re focusing on the funding.

All $326 million of it.

Of the 72 companies that demoed at FinovateSpring 2015 in San Jose last year, 21 of them had raised capital within a year. Kabbage’s raise of $135 million certainly stands out. But the $25 million investment picked up by itBit in May of last year, as well as the $15 million raised by Trulioo and the $12 million raised by Moven were also major contributors to a strong fundraising performance from the Class of FinovateSpring 2015. And this doesn’t even include companies such as Yodlee, which was acquired by Envestnet for $660 million, or Aurora Financial Systems, bought by fellow Finovate alum, Finicity, for an undisclosed sum.

March 2016

- StockViews Raises $355k in Seed Funding, Adds Fidelity’s Balk as Chairman – video

- Emailage Receives Strategic Investment from Wipro – video

January 2016

- LoanNow Secures $50 Million Credit Facility ($6 million equity) – video

- CUneXus Raises $1 Million, Signs Partnership with Edmunds.com – video

Dec 2015

- [M&A] Ciright One Purchases Stratos Card – video

- Trulioo Raises $15 Million with Help from American Express Ventures – video

- Onovative Raises $1.2 Million in New Funding – video

- Trizic Raises $2 Million to Help Advisers Compete with Algorithms – video

October 2015

- Kabbage’s Fresh $135 Million to Help Grow Karrot Consumer Lending Platform – video

- Moven Rounds Up $12 Million in Funding for International Expansion – video

September 2015

- [M&A] Finicity Acquires Aurora Financial Systems – video, video

- Cloud Lending Solutions Raises $8 Million in Series A – video

August 2015

July 2015

- A Dash of Good Karma: Karmic Labs Raises $5 Million – video

- New Investment for Dealstruck Boosts Lending Capital to More than $100 Million (raised $10 million in new funding) – video

- Malauzai Raises $11 Million in Venture Funding – video

June 2015

- Prairie CloudWare Announces New Round of Investment – video

- Currency Cloud Cooks Up $18 Million in New Funding Round – video

May 2015

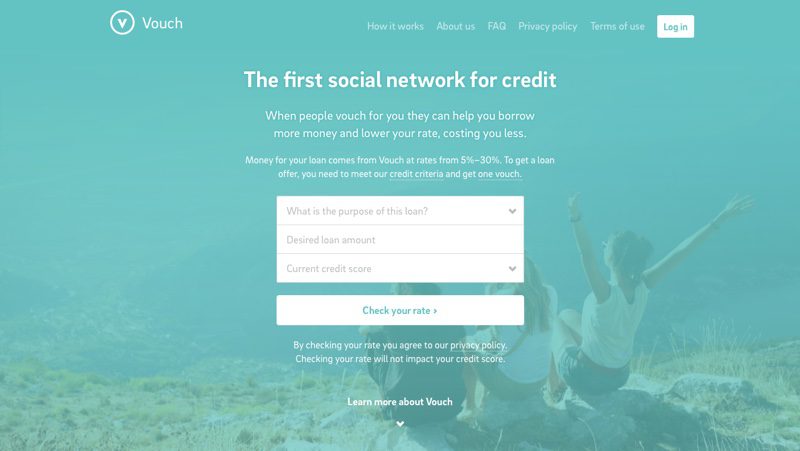

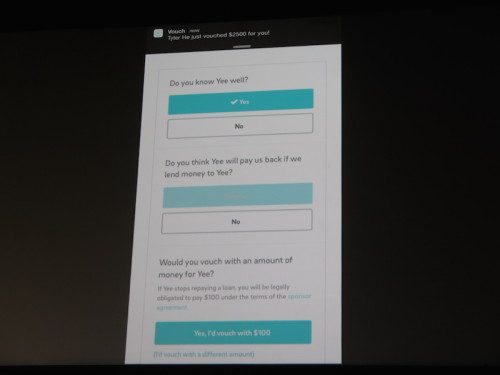

- Friction is Good: Social Network for Credit Innovator Vouch Raises $6 Million – video

- itBit Raises $25 Million, Earns New York State Trust Charter Ahead of Finovate Debut – video

- Get Your Kicks: DriveWealth Earns Investment from Route 66 Ventures – video

- LendKey Adds $8 Million in Venture Debt; Reaches $800 Million in Loans – video

- Credit Sesame Raises $16 Million in New Funding – video

- Trizic Raises $3 Million in Seed Funding from Operative Capital – video

——-

FinovateSpring 2016 is less than a month away. Pick up your tickets today and save your spot at our upcoming spring conference in San Jose, California.

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked.

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked. Outski’s

Outski’s

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.