It’s that time of the year once again: KPMG and H2 Ventures have teamed up to introduce their Leading Global Fintech Innovators roster, the Fintech 100 for 2017. The judges for this year’s Fintech 100 included more than 20 professionals from KPMG and other organizations with expertise in IT, data analytics, capital markets, financial services, and more.

This year 11 Finovate/FinDEVr alums made the Leading 50, with another 12 alums making the Emerging 50. New entrants to the KPMG/H2 Ventures roster include SoFi and Revolut among the Leading 50. All 12 the alums on the Emerging 50 are making their first appearance. See the full list.

Some of the highlights from the 2017 Fintech 100 include the observation that five of the roster’s top 10 companies are from China, as are the top three companies on the list: Ant Financial, ZhongAn, and Qudian (Qufenqi). The U.S. has a pair of companies in the top five: Oscar and Avant, and Europe and the U.K. each have one company in the top ten: Kreditech and Atom Bank, respectively.

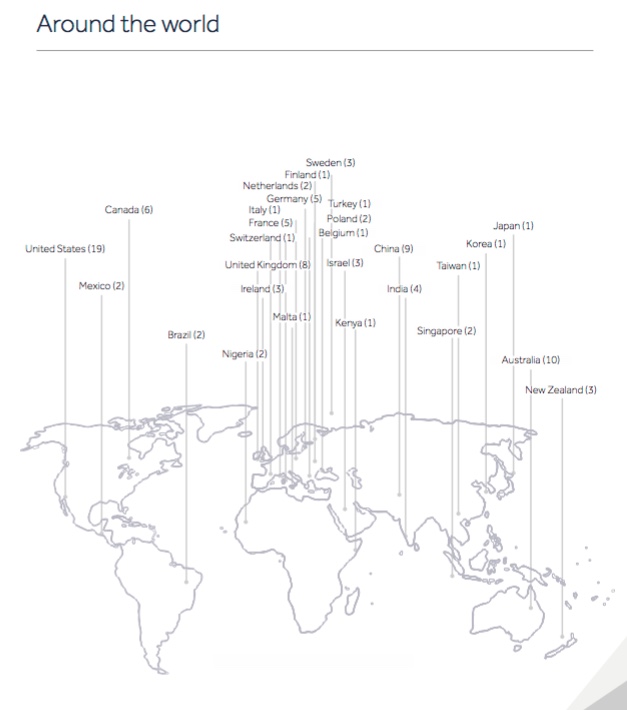

Speaking of Asia, the Asia-Pacific region has 30 fintech companies in the top 100. The United States has 19 companies – the most from any single country – and the U.K. and EMEA areas have 41 companies in the list. The U.K. and EMEA region are also responsible for the highest number of companies on KPMG/H2 Ventures’ Emerging 50 list with 26.

With regard to sectors within fintech, the Fintech 100 breaks down as follows:

- 32 lending companies

- 21 payments companies

- 14 transaction and capital markets companies

- 12 insurance/insurtech companies

- 7 wealth management/wealthtech companies

- 6 cybersecurity/regtech companies

- 4 blockchain/digital currency companies

- 3 data and analytics companies

Alums from the Leading 50

- #7 Kreditech (FS2014) | Hamburg, Germany | Founded in 2012

- #10 Kabbage (FS2015) | Atlanta, Georgia | Founded in 2009

- #11 SoFi (FDNY2017) | San Francisco, California | Founded in 2011

- #12 Nubank (FDNY2016) | Sao Paolo, Brazil | Founded in 2013

- #14 Klarna (FS2012) | Stockholm, Sweden | Founded in 2005

- #16 Xero (FS2011) | Wellington, New Zealand | Founded in 2006

- #18 SecureKey Technologies (FF2012) | Toronto, Ontario, Canada | Founded in 2008

- #22 Revolut (FE2015) | London, U.K. | Founded in 2013

- #28 OnDeck (FS2012) | New York, New York | Founded in 2007

- #40 Coinbase (FS2014) | San Francisco, California | Founded in 2012

- #46 Lending Club (FS2009) | Sunnyvale, California | Founded in 2006

Alums from the Emerging Stars

- AdviceRobo (FE2016) | London, U.K. | Founded in 2013

- AutoGravity (FF2016) | Irvine, California | Founded in 2015

- Kensho (FE2014) | Cambridge, Massachusetts | Founded in 2013

- Leveris (FE2017) | Dublin, Ireland | Founded in 2014

- Moneytree (FA2016) | Shibuya-ku, Tokyo, Japan | Founded in 2012

- Sensibill (FF2017) | Toronto, Ontario, Canada | Founded in 2013

- Stash (FF2017) | New York, New York | Founded in 2015

- ThetaRay (FF2015) | Israel & USA | Founded in 2013

- Token (FE2017) | San Francisco, California | Founded in 2015

- Trusona (FF2016) | Scottsdale, Arizona | Founded in 2015

- VATBox (FE2015) | Herzilliya, Israel | Founded in 2012

- Wave (FF2017) | Toronto, Ontario, Canada | Founded in 2010