Making sure the beneficiaries of any rewards or loyalty campaign are truly qualified is key to ensuring the program works as planned. To this end, General Motors has called on digital identity platform, ID.me to provide ID verification for its GM Military Discount Program.

This week’s partnership takes ID.me back to its roots in many ways. In a statement, ID.me co-founder and CEO Blake Hall said, “I founded ID.me after observing a veteran display his DD-214 separation paperwork, which listed all of his sensitive personal information, just to prove his military service to an organization. There had to be a better way.” Since then, ID.me says it has provided verification services for more than half the active duty military community and “millions of veterans” using the same Troop ID feature the company is bringing to GM’s Military Discount Program.

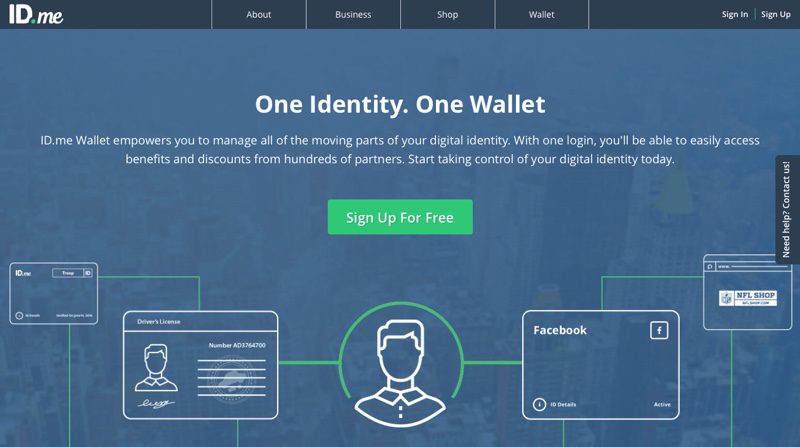

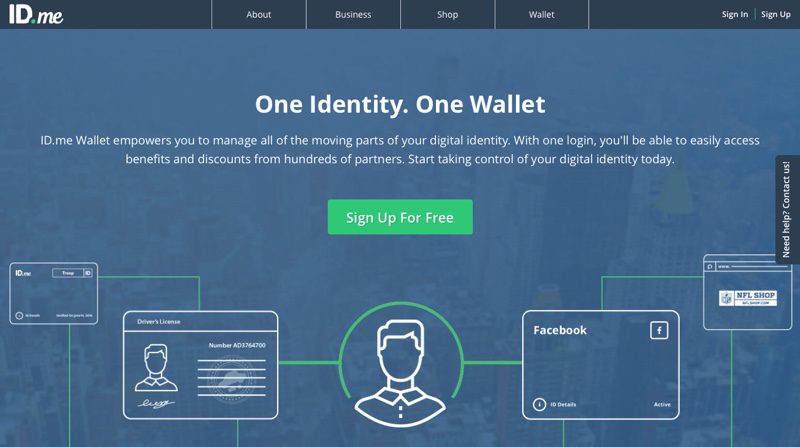

ID.me CEO and co-founder Blake Hall demonstrating ID.me Identity Gateway at FinovateSpring 2017.

The discount program is available to eligible service members purchasing new Chevrolet, Buick, or GMC vehicles. Those on active duty, as well as reservists and National Guard members are eligible, as are veterans within one year of their discharge date, and retirees of the U.S. Air Force, Army, Coast Guard, Marine Corps, and Navy – as well as their sponsored spouses.

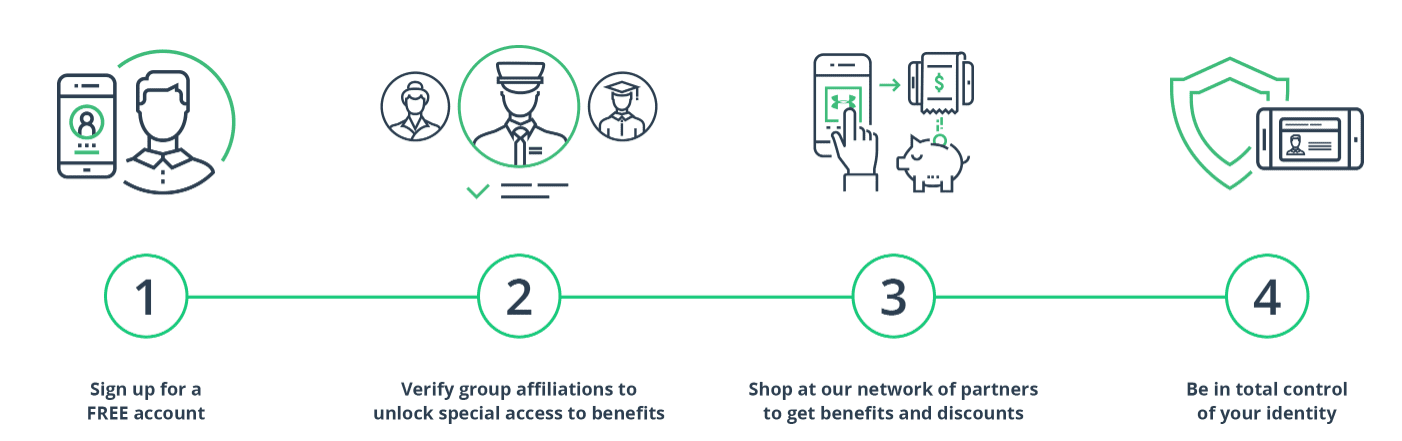

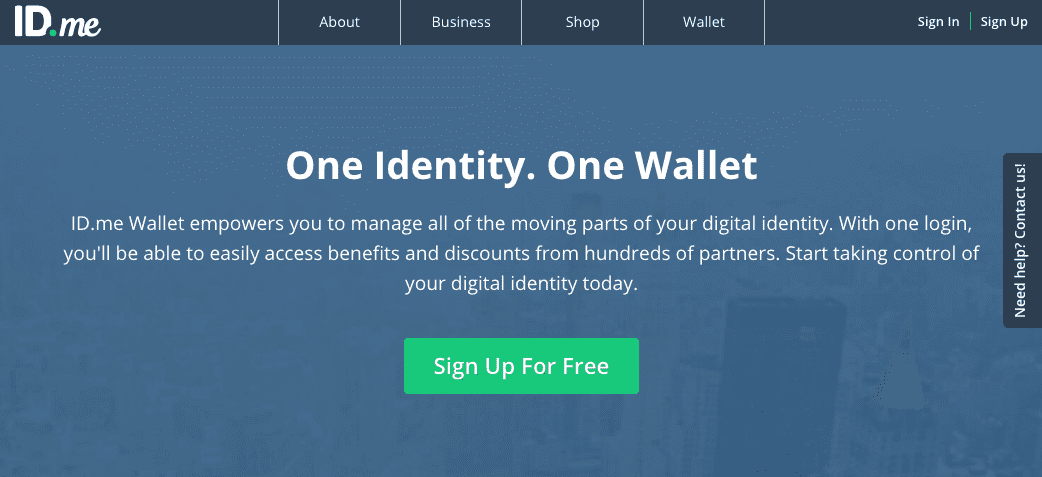

Founded in 2010 and headquartered in McLean, Virginia, ID.me demonstrated its Identity Gateway at FinovateSpring 2017. The company’s technology provides affiliation verification and online identity authentication that helps fight fraud and identity theft. In October, the company announced a partnership with fellow Finovate alum ThreatMetrix to provide ID verification for government and commercial digital services. And in September, ID.me announced support for FIDO U2F (Universal Second Factor) security keys. Former Moneygram International executive Julie Filion joined the company as Chief Marketing Officer in August, and in May, ID.me won the Trailblazer Award at the 1st Annual K(NO)W Nodes Awards Show.

ID.me has raised more than $45 million in funding, including a $19 million Series B led by FTV Capital in March of this year. The company’s platform has more than 200 partners including federal agencies, state governments, veterans groups, and e-commerce retailers. Blake Hall himself is a veteran of the U.S. Army, receiving a pair of bronze stars for his service in Iraq.