Call it them the Finovate Fifth.

Nearly 20 of the companies highlighted in Planet Compliance’s new RegTech Top 100 Power list – and five of the top ten – are Finovate and/or FinDEVr alums. To measure “power”, Planet Compliance used an algorithm that measured a company’s activity in the media, as well as online and in social media including Facebook, LinkedIn, Twitter, and Wikipedia.

Interestingly, Planet Compliance says it has added a “secret ingredient” to the ranking system. It is also worth noting that their definition of RegTech is broad enough to include not just ID verification/authentications specialists, but biometric security innovators, as well.

So let’s take a look at how Finovate/FinDEVr alums stacked up.

- Founded 1993. Headquartered in Geneva, Switzerland. Market capitalization of $5.63 billion.

Pictured: Aaron Phethean, Marketplace Director for Temenos B2B Financial Services Marketplace, during his FinDEVr Silicon Valley presentation.

- Founded in 2011. Headquartered in Vancouver, British Columbia, Canada. Raised $23 million in funding.

- Founded in 2011. Headquartered in Zurich, Switzerland. Raised $4.5 million in funding.

- Founded in 2012. Headquartered in New York, New York. Raised $18 million in funding.

- Founded in 2009. Headquartered in San Mateo, California. Raised $26 million in funding.

- Founded in 2008. Headquartered in Menlo Park, California. Raised $106 million in funding.

(18) NetGuardians SA (FA16)

- Founded in 2007. Headquartered in Vaud, Switzerland. Raised $5.5 million in funding.

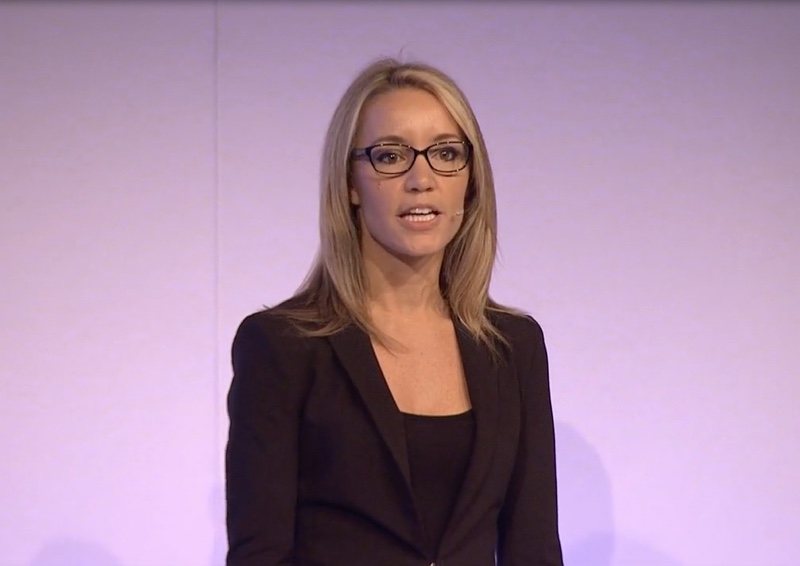

Pictured: Mine Fornerod, Net Guardians Digital Marketing Manager, demonstrating FraudGuardian at FinovateAsia 2016.

- Founded in 2011. Headquartered in Tel Aviv, Israel. Raised $11.6 million in funding.

(34) Investglass (FA16)

- Founded in 2014. Headquartered in Plan-les-ouates, Geneva, Switzerland. Raised $100,000 in funding.

- Founded in 1985. Headquartered in San Diego, California. Market capitalization of $218 million.

Pictured: Sarah Clark (General Manager, Identity, Mitek) demonstrating Mobile Verify at FinovateEurope 2017.

- Founded in 2012. Headquartered in Wilmington, North Carolina. Raised $64.7 million in funding.

- Founded in 2008. Headquartered in Toronto, Ontario, Canada. Raised $89 million in funding.

(48) Rippleshot (FF14)

- Founded in 2012. Headquartered in Chicago, Illinois. Raised $4.6 million in funding.

- Founded in 2014. Headquartered in San Jose, California. Raised $6 million in funding.

(66) BehavioSec (FF15, FD15)

- Founded in 2007. Headquartered in Stockholm, Sweden. Raised $8.2 million in funding.

Pictured: Olov Renberg, BehavioSec COO, demonstrating BehavioSec On Demand at FinovateFall 2015.

(76) DemystData (FA12)

- Founded in 2010. Headquartered in Singapore. Raised $12 million in funding.

- Founded in 2009. Headquartered in Dublin, Ireland. Raised $80 million in funding.

- Founded in 2013. Headquartered in Cork, Ireland. Acquired by TransUnion.

(96) Global Debt Registry (FF14)

- Founded in 2005. Headquartered in Wilmington, Delaware. Raised $7 million in funding.

Stay tuned for more coverage of RegTech and other growing industries within fintech as we begin previewing the presenters of FinovateSpring 2017. Finovate returns to San Jose on April 26 and 27 for our annual spring conference. Visit our registration page today to save your spot.