A collaboration announced late last week between a pair of Finovate alums will give small businesses new options when it comes to digital receipt and expense management.

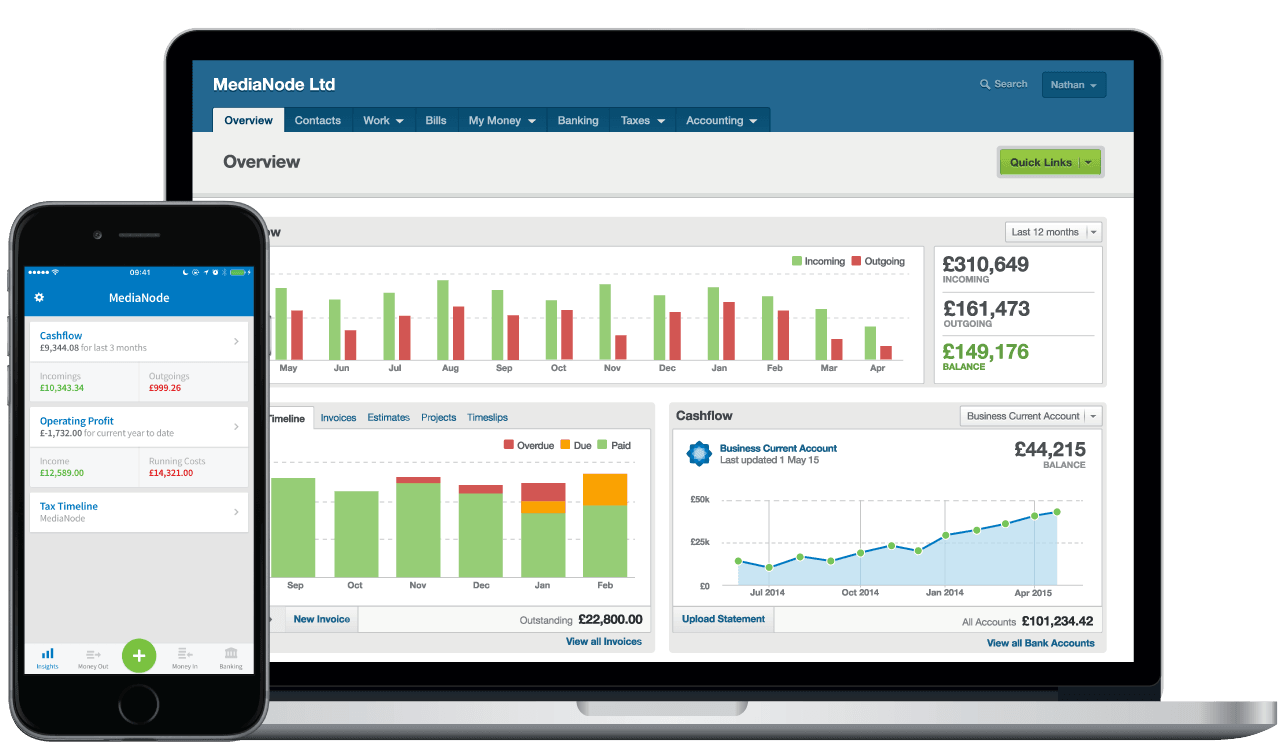

Toronto, Ontario, Canada’s Sensibill, which won Best of Show for its FinovateFall demo of its digital receipt insights solution, has partnered with FreeAgent. The U.K.-based cloud accounting software company will combine Sensibill’s technology within its own new Auto Extract feature to help SMEs transition from manual expense management and receipt tracking to a modern, automated process.

“By joining forces with FreeAgent, we’re eliminating the time and money businesses have traditionally spent manually entering data into clunky and cumbersome spreadsheets and systems,” Sensibill Chief Technology Officer Danny Piangerelli said. “Instead, we’re delivering item-level details that enable faster, better expense management.”

Sensibill’s customer data platform blends ethically sourced, enriched SKU-level data with real-time, actionable insights to help FIs achieve personalization at scale. Integrated into FreeAgent’s Auto Extract technology, the technology enables businesses to capture, organize, and categorize their receipts digitally and accurately link them with corresponding bank transactions.

“Automation is at the center of our business,” FreeAgent co-founder and CEO Roan Lavery said, “which is why partnering with Sensibill was a natural choice.” Lavery added the collaboration will help increase satisfaction and engagement among customers while relieving SMEs and their accounting team from the “administrative hassles,” costs, and inaccuracies that plague most manual, expense management processes.

Founded in 2007 and making its Finovate debut in Europe in 2013, FreeAgent was acquired by NatWest five years later for $73 million (£53 million). The company currently has more than 110,000 small businesses, freelancers, and contractors in the U.K. using its technology for a variety of key business tasks – from invoice and expense management to project management and sales tax calculation.

With more than 60 million users across 150+ financial institutions in Canada, the U.S. and the U.K., Sensibill was founded in 2013 and has raised more than $50 million in equity capital. Founded by current CEO Corey Gross, the company has forged partnerships this year with fellow fintech CAARY, as well as with Maryland-based SkyPoint Federal Credit Union ($182 million in assets) and AbbyBank, a full-service community bank based in Wisconsin with assets of $616 million.

Photo by Karolina Grabowska from Pexels

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”

Germany

Germany Ireland

Ireland The Netherlands

The Netherlands

United Kingdom

United Kingdom