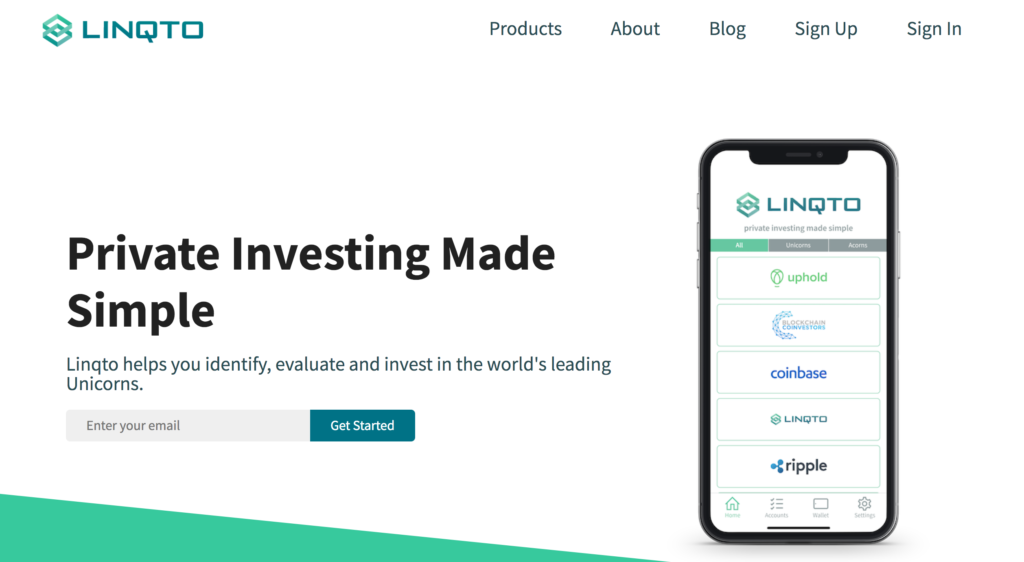

- Linqto has revamped its brand identity and has rolled out new capabilities to enable investors to buy and sell their holdings in real time.

- The new feature comes after a recent bill passed by the House Financial Services Committee revamped the list of accredited investor certifications.

- This marks the company’s second rebrand, after it first pivoted in 2020 to serve individual investors.

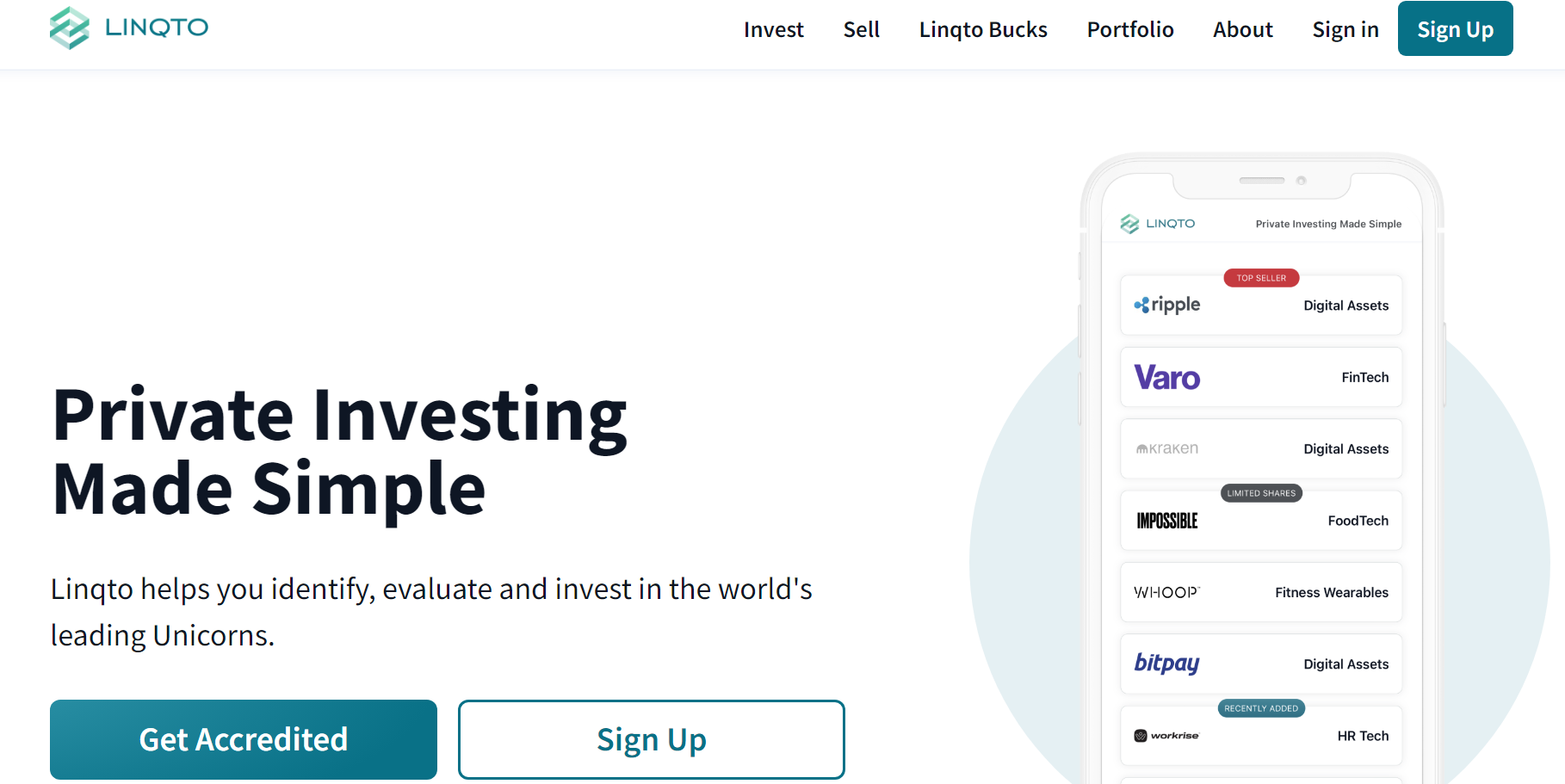

Investment platform Linqto has rolled out a two-fold announcement today. Not only has the California-based company has revamped its brand, but it has also added new capabilities to enable investors to buy and sell their holdings.

At its core, Linqto helps accredited users invest in unicorns before they go public. The platform opens up a ground floor opportunity, with the minimum investment starting at $5,000. The expanded capabilities launched today transforms Linqto into a more holistic platform, allowing users to control and manage their assets in real-time.

“The first generation of Linqto’s platform made private equity investing simple and accessible for accredited investors, and we are now entering a new phase which also makes these investments liquid,” said Linqto Chief Product Officer Patty Brewer. “The expanded platform allows accredited investors to cost-effectively build and manage their own diversified portfolio of private equity investments. Linqto is demystifying the private markets by providing endless opportunities to achieve financial goals.”

Today’s announcement comes after a recent bill passed by the House Financial Services Committee revamped the list of accredited investor certifications. The update further democratizes access to the private market.

“Now we’re doubling down on our core mission of helping accredited investors identify the private companies and industries they’re most interested in and providing real-time liquidity as a bonus,” said Linqto CEO Bill Sarris.

The rebrand marks the second change in the company’s brand identity since it was founded in 2010 as a digital banking technology company that provided software-as-a-service to fintechs. In 2020, two years after Linqto acquired investment trading platform PrimaryMarkets for $33 million, the company pivoted to serve as a direct-to-consumer investment platform.

Since then, Linqto has amassed 150,000 members across 110 countries and has facilitated $220 million in investments across almost 50+ portfolio companies.

Matt Kirchharr, Innovation Development Coordinator at LEVERAGE

Matt Kirchharr, Innovation Development Coordinator at LEVERAGE

Linqto

Linqto

FinDEVr Previews

FinDEVr Previews