Everyone, including fintechs, gets by with a little help from their friends. That must be what digital banking solutions provider Kony and financial data expert MX were thinking when they joined forces this week.

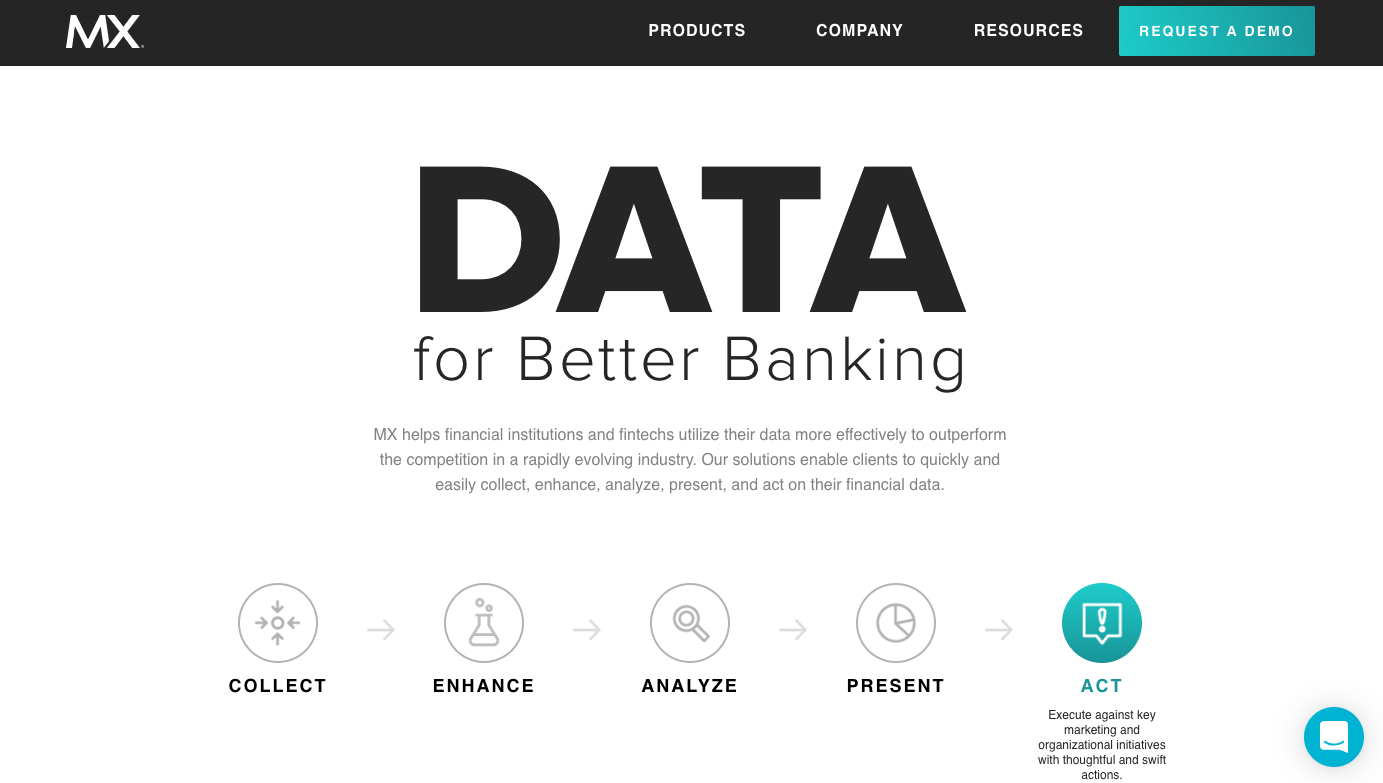

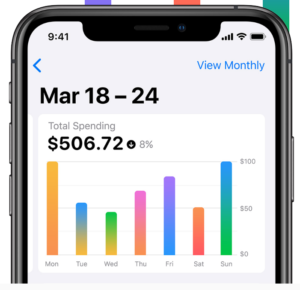

Under the agreement, Kony will leverage MX’s PFM expertise to bolster Kony DBX, its digital banking experience product. Specifically, Kony will use MX’s data services for PFM and tap into the company’s solutions for spending categorization and classification.

Explaining the decision to partner, Kony DBX SVP and GM Jeffery Kendall described access to clean, actionable financial data as “critical” for banks and credit unions to meet customer expectations. “We are excited to collaborate with MX to deliver valued-added data services for Personal Financial Management and spending categorization and classification solutions that will give consumers a clear view of their financial health. In addition, banks and credit unions can also gain insight so they can better tailor their digital banking offerings to their customers and members,” said Kendall.

Don Parker, EVP of partnerships at MX added, “Together, and through Kony’s expansive partner network, we will help more banks, credit unions and fintech developers grow faster, reduce costs, and deliver exceptional experiences to their customers.”

The first client of the joint solution is CommonWealth One Federal Credit Union, a 33,000 member credit union with branches in Northern Virginia; Washington, D.C.; and Harrisonburg, VA. “By having access to clean, relevant and categorized data, we will be able to better serve and meet our members’ financial needs, and our members will also be able to aggregate and see all of their accounts in one place, said Larry Flory, CIO of CommonWealth One Federal Credit Union. “Having improved insight into their finances will enable our members to make better financial decisions.”

This is Kony’s second major enhancement this month to the Kony DBX platform. A little over a week ago the company partnered with Micronotes to bring Micronotes’ personalized conversation solution to Kony DBX’s bank customers.

Kony’s CTO Bill Bodin and Product Marketing Manager Antonio Sanchez showcased the company’s digital banking platform at FinovateFall 2017. Kony was founded in 2007 and is headquartered in Austin, TX.

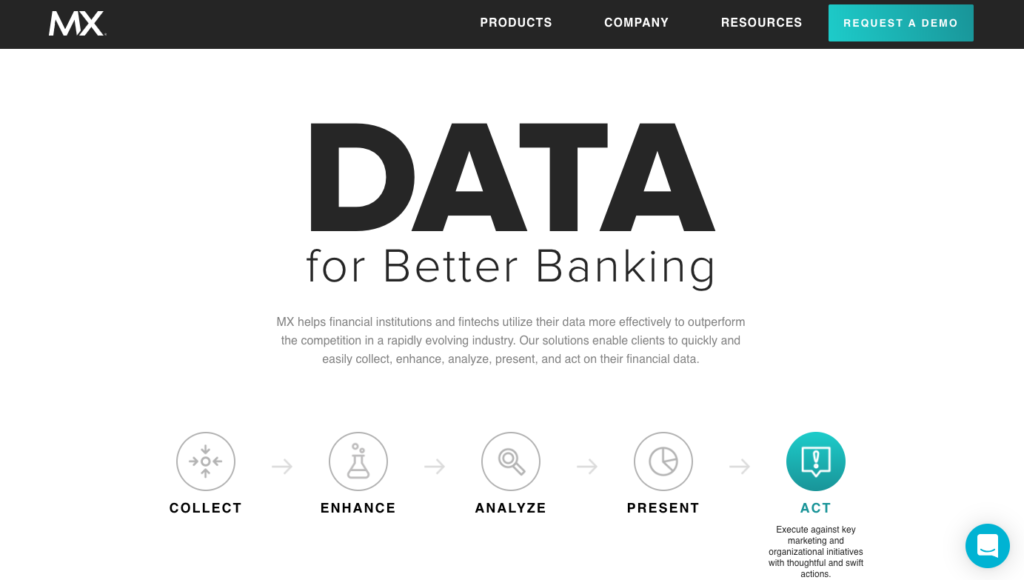

MX was founded in 2010 and is partnered with more than 1,800 financial institutions and 43 of the top 50 digital banking providers. Headquartered in Lehi, Utah, MX is a six-time Finovate Best of Show winner, having most recently presented at FinovateFall 2017, where it demoed Discovered Accounts.

PFM

PFM