Sometimes a partnership is not enough and only a full-fledged union will suffice.

This is the approach taken by Cairngorm Capital, a U.K.-based private equity firm that announced this week that it had acquired FinovateMiddleEast alum Munnypot – along with investment management services provider Whitefoord – in order to launch a new digital wealth management firm, Verso Wealth Management.

“Our firm believes that the parallel trends of the increased complexity of consumers’ advice needs, their growing adoption of digital services and rising automation in wealth management will endure over the long term,” Cairngorm Capital’s Neil McGill explained. “The combination of award winning technology, high quality advice, and an exceptional management team ensures that the Verso Group is well placed to capitalize on this.”

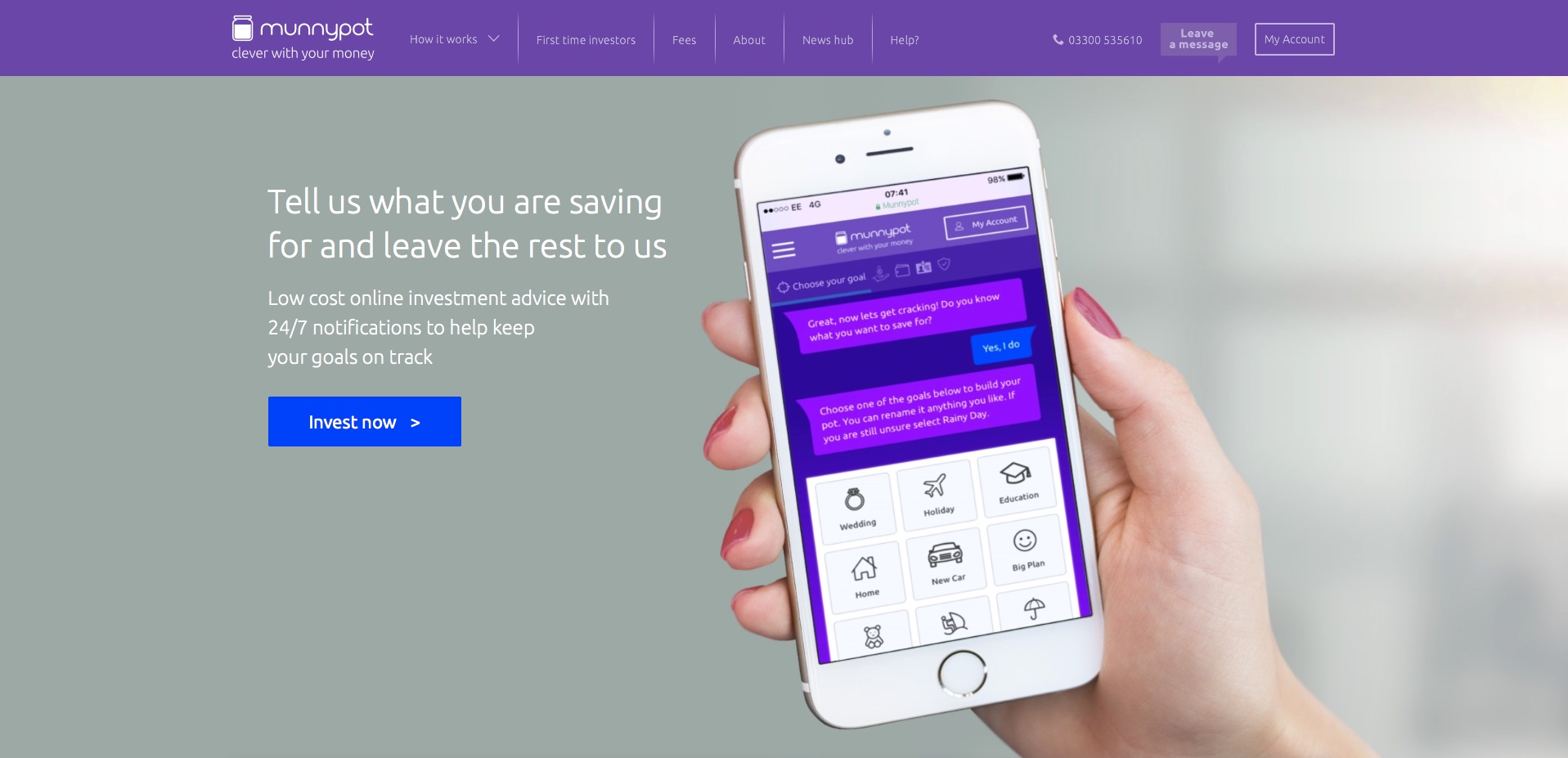

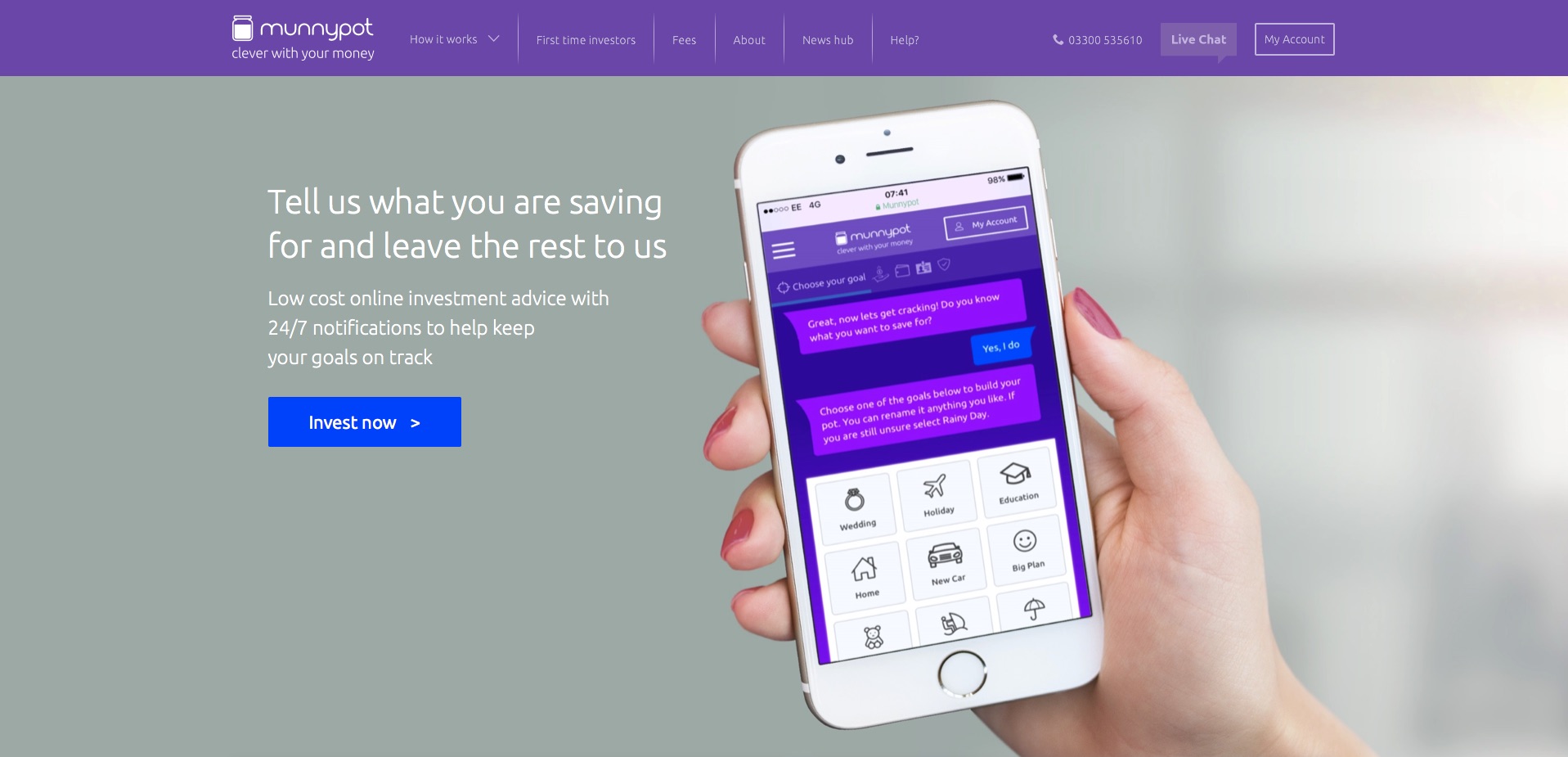

Founded in 2015 and making its Finovate debut three years later in Dubai, Munnypot was developed to serve both mass market investors who struggle to secure traditional financial advice, as well as existing investors looking for a goal-based, low-cost, digital alternative. Munnypot offers Individual Savings Accounts (ISAs), General Investment Accounts (GIAs), and Junior ISAs (JISAs) that enable parents to make investments on behalf of their children. Designed for investment and savings goals that are at least five years in the future, Munnypot analyzes the investor’s objectives and other key details to provide tailored advice on the most suitable investment plan to meet those goals

The new firm will be run by Munnypot CEO Andrew Fay and Managing Director Simon Redgrove, who will take identical positions in leadership for Verso. Also joining Verso’s executive ranks will be Whitefoord Chief Executive Vince Whitefoord who will lead the firm’s discretionary investment management business. Verso will operate as a combination of human expertise from its client advisors and investment professionals with an automated investment advice capability. This approach is designed to appeal to a broader range of potential customers, including small savers and those new to equity investing.

“Verso will make it far easier for advisors to maximize efficiency, reduce compliance risk and increase revenue,” Fay said. “Our goal is to become the leading digitally driven IFA consolidator and there’s no limit to our ambition.”

Photo by Miguel Á. Padriñán from Pexels

Presenter

Presenter