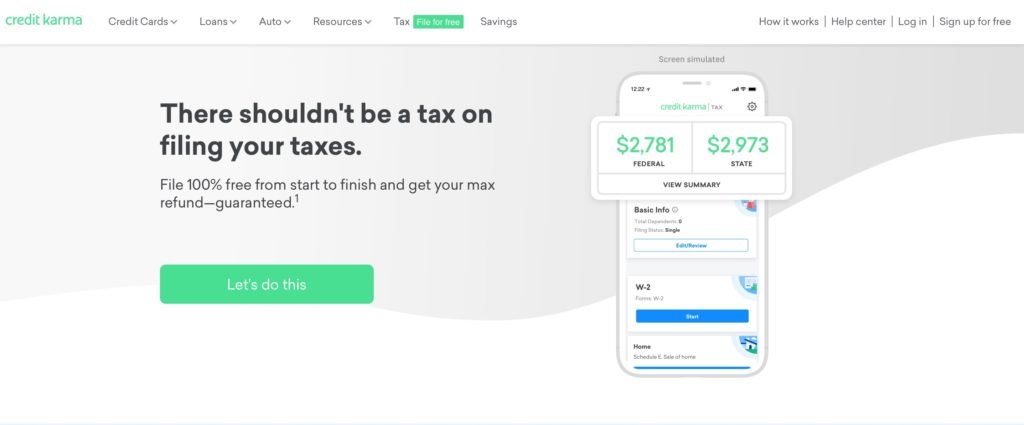

How’s $7 billion for good karma? One of Finovate’s earliest alums Credit Karma is reportedly the target of what would be Intuit’s biggest acquisition to date. According to The Wall Street Journal, the cash and stock deal could be announced as early as Monday.

Credit Karma will continue to function as an independent company with founder and CEO Kenneth Lin at the helm. The acquisition gives Intuit, maker of online tax filing service TurboTax, another contact point with the online personal finance world. Credit Karma provides its members with access to their credit scores and borrowing histories, helps them monitor their accounts for security breaches and, perhaps most relevantly, has offered a free online tax preparation service since 2017.

If the deal holds up, Intuit will be paying a significant premium for Credit Karma. The personal financial wellness company was last valued at $4 billion, based on a 2018 private market transaction.

With another Finovate conference in the books, our Finovate Best of Show ranks has a new set of members. Congratulations to Dorsum, Glia, Horizn, iProov, Sonect, and W.UP for taking home top honors earlier this month at FinovateEurope!

The victory may have been especially sweet for Sonect, whose Best of Show award-winning demo was also the company’s Finovate debut. The Switzerland-based start-up offers what it calls “the world’s first social cash network” that enables consumers to access cash without having to visit a bank branch or ATM. Sonect offers merchants the ability to grow their business via increased traffic and gives financial institutions a way to extend their ATM networks without the cost of additional hardware.

The Best of Show win was also a first for Horizn. The company, which made its Finovate debut three years ago at FinovateEurope, offers a platform that helps employees and customers maximize the opportunities of digitized financial services. Horizn uses simulator microlearning, as well as gamification and advanced analytics, to promote digital adoption across channels.

And last but not least, a special tip of the hat to Dorsum, Glia, iProov, and W.UP, all of whom won Best of Show honors at FinovateEurope for a second year in a row.

Here’s a round up of recent news from our Finovate alumni.

- Larky enters reseller agreement with Access Softek.

- Bison Bank in Lisbon, Portugal selects PSD2-ready software from ndigit.

- Techround interviews Tradeshift co-founder Mikkel Hippe Brun.

- Bremer Bank leverages Backbase’s digital-first banking platform to fuel digital transformation.

- Paysend’s multi-currency global account launches in Europe.

- Kinetica launches Kinetica Cloud.

- Futurex taps ISARA to bring quantum-safe cryptography and crypto-agility into its Key Management Enterprise Server (KMES) Series 3.

- With new FCA license, Meniga seeks to expand product offering.

- StrategyCorps and Digital Onboarding partner to help banks grow checking account relationships.

- Baker Hill renews partnership with Washington Trust Bank to streamline loan origination and portfolio risk management.

- Aire launches Credit Insight Suite to improve access to credit.

- Coinbase becomes Visa principal to offer more feature for Coinbase Card customers.

- InComm partners with Eezi to launch Poundland’s gift card program.

- Enveil secures $10 million in Series A funding for secure data collaboration.

- Trulioo adds image capture SDK to Trulioo GlobalGateway.

- Amaiz taps ValidSoft for voice authentication.

- OurCrowd expands focus on growing early stage tech companies.

Finovate Alum Features and Profiles

eToro’s Evolution – Social trading and investment platform eToro has never been one to stand still for very long. The company’s development cycle is fast enough to make even the most sprightly fintech jealous.

Lending Club Snaps Up Radius Bank for $185 Million – When Lending Club was founded in 2007, the startup aimed to serve as a place to help borrowers avoid dealing with banks. In a somewhat ironic move today, that same startup is becoming a bank itself.

Breach Clarity’s New Offering Provides Consumers Personalized Protection – Fraud detection and prevention company Breach Clarity announced this week it has developed a new platform to help financial service providers offer personalized protection for their customers.

New SumUp Card Empowers SMEs as Business Payment Makers and Takers – The company that has helped bring fintech innovation to e-commerce with its mobile point-of-sale (mPOS), card reading solutions now offers merchants a card of their own.