Courtesy of a new partnership with Sigma Securities and Trove Technologies, global digital trading technology specialist DriveWealth is launching a new digital U.S. equities trading product for retail investors in Nigeria.

“Making U.S. securities available to investors of any size in countries all around the globe is an essential element of the mission of DriveWealth,” company CEO Robert Cortright said. “We are delighted to work with Sigma Securities and Trove Technologies on this effort to democratize investing in Nigeria by bringing to its retail investors the largest and most liquid, transparent financial market.”

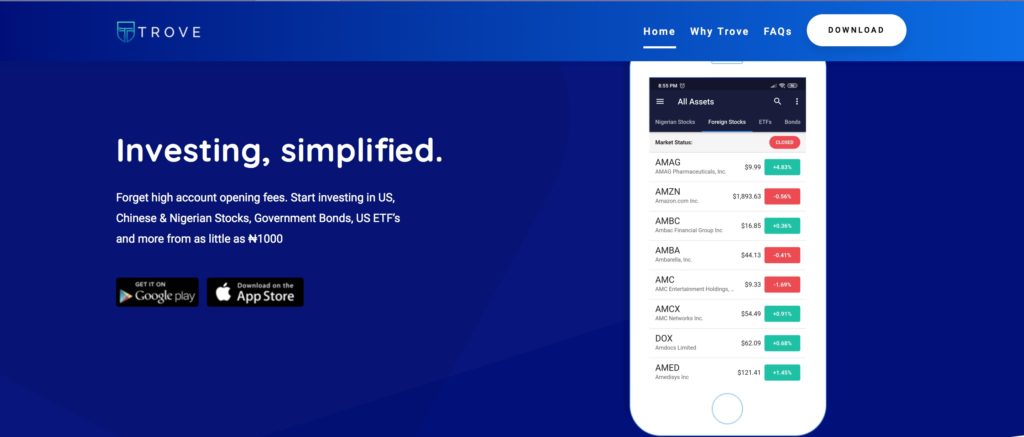

Sigma Securities is a leading Nigerian brokerage firm, founded in 1995 and headquartered in Lagos. Trove Technologies is a financial app developer based in Nigeria that offers investors the ability to purchase stakes in U.S., Chinese, and Nigerian stocks, as well as government bonds and U.S. exchange-traded funds with as little as $2.80 (NGN1,000).

Leaders from both Sigma Securities and Trove Technologies highlighted the way the partnership would help “(break) through the trading barriers” in the words of Sigma Securities CEO Dunama Balami and “eliminate the longstanding bottlenecks” according to Trove Technologies CEO Oluwatomi Solanke. “Our partnership with DriveWealth and Sigma Securities brings the world’s largest stock market to Nigerian investors, regardless of spending power,” Solanke said. Balami referred to the partnership as “a groundbreaking feat” for the Nigerian capital markets.

Founded in 2012 and headquartered in Chatham, New Jersey, DriveWealth demonstrated its platform at FinovateAsia 2016, following its Best of Show winning demo at FinovateEurope earlier that year. The company provides a suite of APIs that enable global investors to participate in the U.S. stock market at a reasonable cost, including the ability to purchase fractional shares. DriveWealth offers both digital investment products to help brokerages around the world provide broader options for their clients, as well as dollar-based, real-time investing via its brokerage service.

Recent headlines for DriveWealth include a collaboration with Investor Cash Management announced in May, in which DriveWealth will power new white-label cash management accounts that are linked to government money market and ultra-short term bond funds. DriveWealth began the year with an announcement that it would expand its partnership with Stake to bring commission-free trading in U.S. stocks and ETFs to investors in South America.

With clients and partners in more than 140 countries around the world, DriveWealth has raised $29.4 million in funding. The company includes Route 66 Ventures, Raptor Group, SBI Group, and Point72 Ventures among its investors.