As Finovate goes increasingly global, so does our coverage of financial technology. Finovate Global: Fintech News from Around the World is our weekly look at fintech innovation in developing economies in Asia, Africa, the Middle East, Latin America, and Central and Eastern Europe.

Asia-Pacific

- MoneyTap, DLT-based payment app developed by SBI and Ripple goes live in Japan.

- Indonesia’s biggest telecommunications company, Telkomsel, picks Kinetica to support its accelerated analytics, location-based visualization and AI.

- Ayondo expands B2B offering in Asia with a new white label deal.

- First Circle, a lending platform for SMEs based in the Philippines, has raised $26 million in new funding.

Sub-Saharan Africa

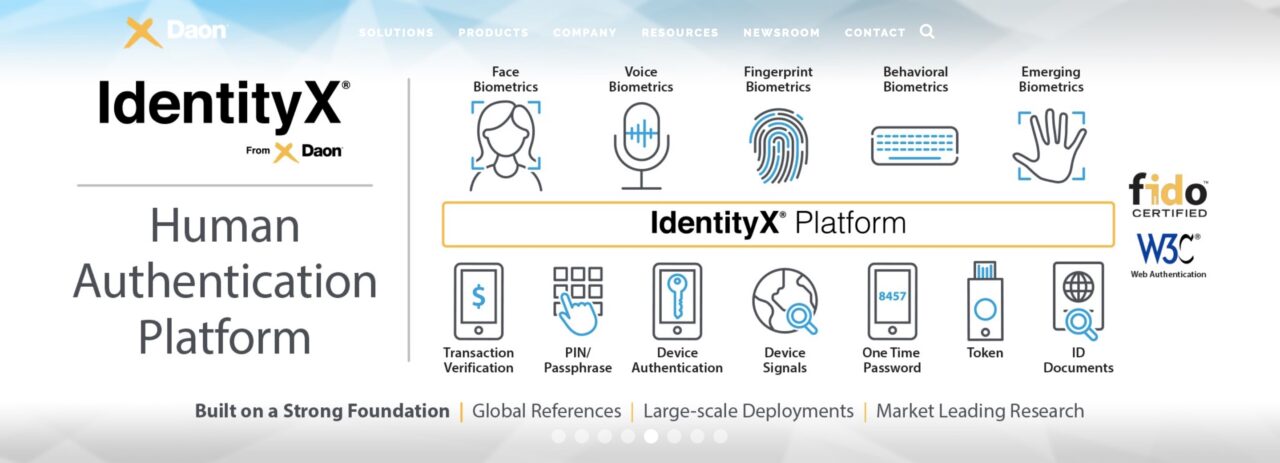

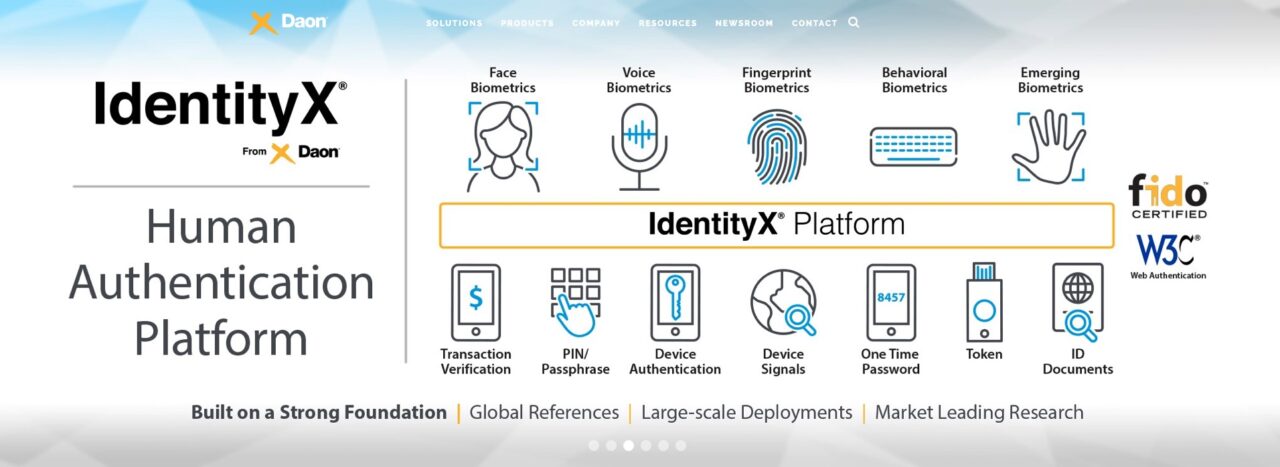

- Daon Inks Deal with South Africa’s Capitec Bank.

- Commercial Bank of Ethiopia deploys UP Retail Payments from ACI Worldwide.

- Ivory Coast subsidiary of Togo-based Banque Atlantique goes live with Temenos’ T24 core banking system.

Central and Eastern Europe

- Sberbank customers can now add “cash postcards” – automated images with sound – to their money transfers.

- Payfone partners with Orange to fight identity fraud in four new global markets, including Poland and Romania.

- Ukraine’s Akhmetov Bank leverages Corezoid’s cloud-based operating system.

Middle East and Northern Africa

- Daon partners with Akbank, making the Turkish bank the first in the country to deploy facial recognition technology for mobile banking authentication.

- Alcazar Capital Limited (ACL) to launch $100 million global fintech fund in collaboration with Fintech Consortium’s InQvest Partners.

- Abu Dhabi Securities Exchange launches Sahmi, a new integrated digital platform for individual investors.

Central and South Asia

- Bank of Punjab, based in Lahore, Pakistan, implements core banking technology from Oracle.

- Entrepreneur.com considers the effect Indian fintechs have made on financial inclusion in India.

- VC Circle looks at the rise in investment in insurtech innovators like India’s PolicyBazaar.

Latin America and the Caribbean

- Brazilian challenger bank Nubank raises $180 million in funding.

- UniBank Panama to implement biometric authentication technology from Ipsidy.

- COK Sodality Co-operative Credit Union (COKCU) of Jamaica to modernize its core processing technology courtesy of a new partnership with Smart Solution.