On Finovate.com

- “Ciright One Purchases Stratos Card”

- “2015: A Year in Finovate Alumni Mergers and Acquisitions”

Around the web

- TechTarget interviews Vantiv CSO Kim Jones on “creating a culture of security.”

- Moneystream announces plans to close its doors in February 2016.

- Nostrum Group earns a spot in Deloitte 2015 Technology Fast 500 for the EMEA region.

- Zopa CEO Jaidev Janardana explains why 2016 will be the year P2P lending hits the mainstream.

- Holvi is featured in this look at the top 10 startups in Finland.

- TopFunded interviews BankersLab CEO Michelle Katics. See BankersLab at FinovateEurope 2016 in London in February 2016.

- Credit Karma wins a spot on Fast Company’s 2015 Silicon Valley “Nice” list.

- Emerging Prairie looks at how a local RIA is integrating Motif Investing into his business.

- SwipeStox launches new features. Check out SwipeStox at FinovateEurope 2016.

- Personal Capital Debuts First eBook: A Better Financial Life.

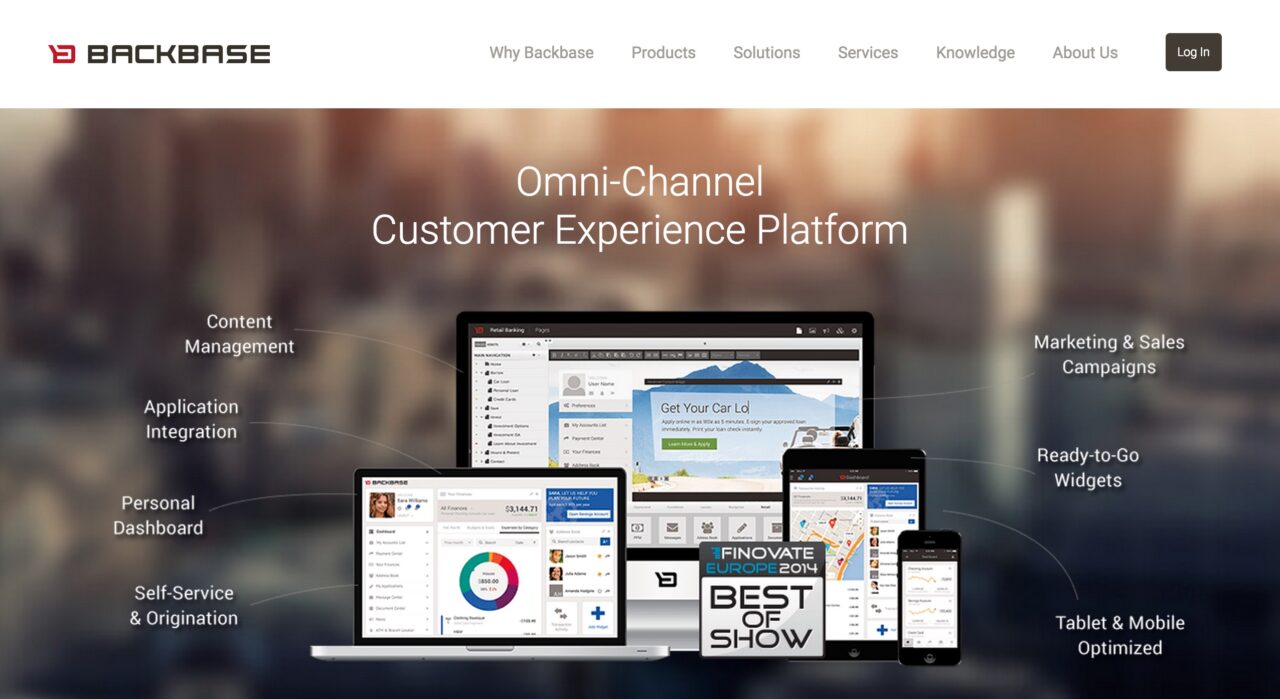

- Backbase awarded accolades in Gartner report, Critical Capabilities for Horizontal Portals. Backbase will demo at FinovateEurope 2016.

This post will be updated throughout the day as news and developments emerge. You can also follow alumni news headlines on the Finovate Twitter account.

FinDEVr Previews

FinDEVr Previews