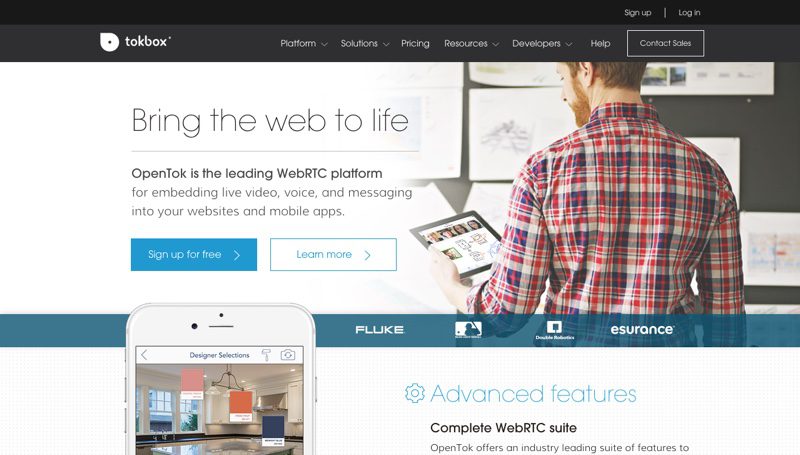

tokbox.com | tokbox.com/blog | @tokbox

TokBox, a Telefonica company, develops and operates OpenTok, the leading cloud platform for embedding real-time video, voice, messaging, and screen sharing into websites and mobile applications. Our comprehensive API offers a suite of advanced capabilities, including interoperable mobile and web SDKs, archiving, security, 1:1 and multiparty calls, and more.

TokBox, a Telefonica company, develops and operates OpenTok, the leading cloud platform for embedding real-time video, voice, messaging, and screen sharing into websites and mobile applications. Our comprehensive API offers a suite of advanced capabilities, including interoperable mobile and web SDKs, archiving, security, 1:1 and multiparty calls, and more.

The first platform to incorporate support for WebRTC, OpenTok caters to enterprises, entrepreneurs, and developers with powerful APIs. OpenTok has been used to add real-time communications by companies including Mozilla, Royal Bank of Scotland, Valspar, MLB, Ford, Doritos, Bridgestone Gold & Double Robotics.

How to use WebRTC to build engaging fintech applications

For all the efficiency and convenience that technologies have brought to financial services, a key challenge continues to be their impact on customer satisfaction rates. How can organizations provide topnotch service when most customers, especially millennials, experience services through a website or mobile application and have never set foot in a branch?

Enter WebRTC, the HTML5 standard making it possible to embed secure live video, voice, and text communications directly into the context of your website or application. Learn about the development challenges, best practices, and how fintech companies are already integrating WebRTC into OTT services today.

Key takeaways:

- What WebRTC is and how it can transform fintech applications

- How financial service companies can leverage WebRTC to bring the same high-quality customer service from brick-and-mortar stores online

- The development challenges and best practices for building with WebRTC

Presenter:

Badri Rajasekar, CTO

@baddn

Rajasekar is the CTO and SVP of engineering at TokBox, the provider of OpenTok, the leading real-time communications platform. He leads the core engineering and operations teams and is responsible for end-to-end service delivery, including product development, quality engineering, and customer solutions.