Global banking company Revolut is further integrating itself into the insurtech industry today. The U.K.-based company launched a pay-per-day travel insurance offering for its users.

The new, flexible policy uses geolocation, automatically turning coverage on and off when users leave and return to their home country. When they sign up for the service, users receive medical and dental coverage, paying as little as $1.38 (£1.00) per day. To protect travelers from overpaying, the coverage is capped at 40 days. For frequent travelers, Revolut offers annual coverage of $41.50 (£30) per year.

https://youtu.be/LulptJxTklM

With the Revolut app, users can select insurance options, such as adding coverage for a companion or adding winter sports coverage, to tailor it to their needs. In the event a user experiences a serious illness or bodily injury on their trip, Revolut will cover up to £15,000,000 (or emergency dental treatment up to £300) after the traveler pays the first £75.

The travel insurance currently covers all Revolut users in the European Economic Area, with the exception of Swiss residents. To qualify, travelers must be younger than 84 years of age, be registered under their country’s healthcare system, and not be traveling against medical advice.

This isn’t Revolut’s first foray into insurance offerings. Last September, the startup began offering device insurance coverage for cell phones. Users can insure their device for $1.38 (£1) per week or $58 (£42) per year.

This expansion of services is indicative of an industry trend many analysts predicted would spread in 2018– the “rebundling of fintech.” In an attempt to compete with banks, some startups are becoming more “bank-like” by acting as a one-stop shop for many of consumers’ financial needs. SoFi is a great example of this– what started out as a very specific student lending startup, has evolved into a larger company that now offers a range of seven borrowing options, wealth management, and life insurance.

Founded in 2013, Revolut debuted at FinovateEurope 2015 in London. The company’s CEO and founder Nikolay Storonsky showed off the app’s money transfer capabilities that help users avoid banking fees without actually using a bank.

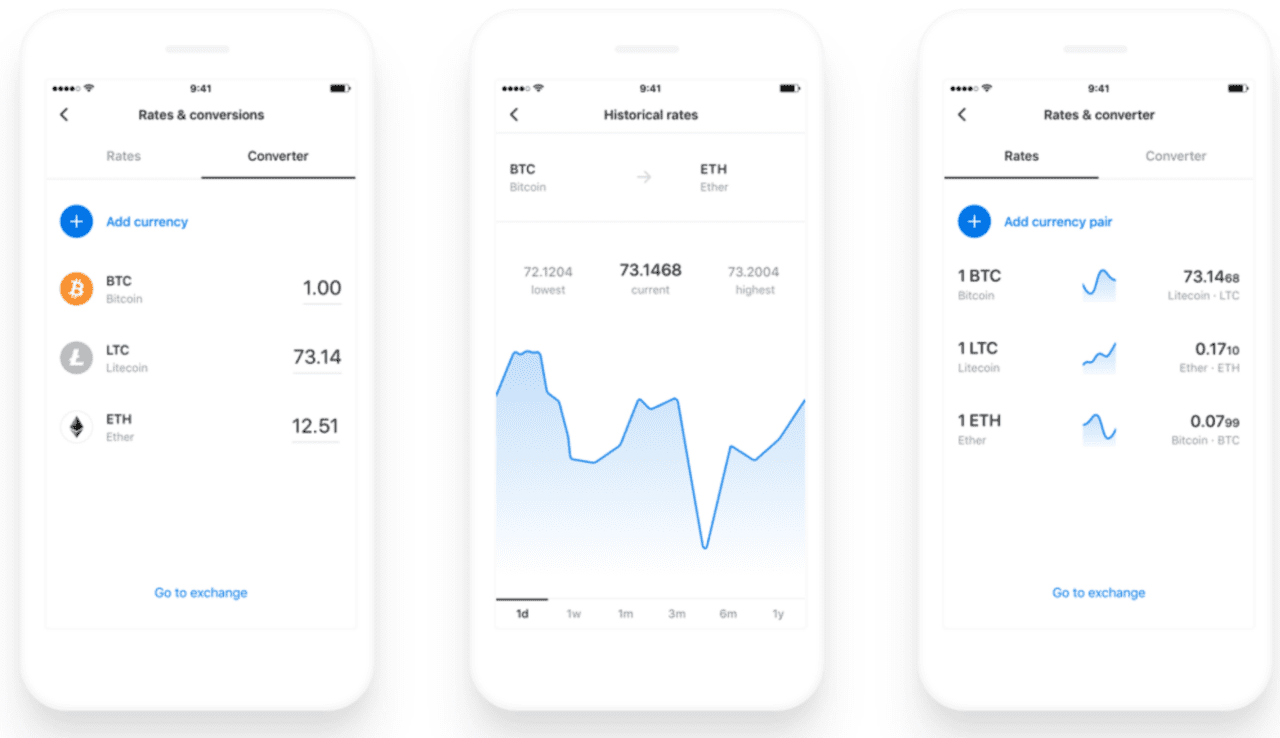

Over the past two years, Revolut has processed 42 million transactions for 1 million users in Europe, tallying up $160 million in savings on foreign transaction fees. Last month, the company launched cryptocurrency trading and in November revealed plans to expand to Singapore.