Alternative SME financing pioneer CAN Capital has a new captain: Edward Siciliano, a commercial financing veteran with more than 30 years experience, will join the company as its new Chief Executive Officer.

“CAN Capital’s experience, brand recognition, data, and partner relationships make it uniquely positioned to support the expansion of the small businesses that drive the U.S. economy,” Siciliano said. “I look forward to building a leadership team and working together to expand our offerings, invest in talent and technology, and help our customers grow.”

Siciliano comes to CAN Capital after serving as Chief Operating Officer, Interim CEO and EVP, and Chief Sales Officer for commercial financial and depository product provider Marlin Business Solutions. He previously worked at Xerox Corporation, AppliedTheory  Corporation, and ALK Technologies. CAN Capital’s Executive Chairman praised Siciliano as a “proven leader” who has “served the needs of small businesses while building loyal teams that deliver innovative products and a great customer experience.”

Corporation, and ALK Technologies. CAN Capital’s Executive Chairman praised Siciliano as a “proven leader” who has “served the needs of small businesses while building loyal teams that deliver innovative products and a great customer experience.”

The new CEO is the latest big headline for CAN Capital. Last fall, the company announced that it had boosted its capital capacity by up to $287 million courtesy of a transaction with Varadero Capital. Varadero played a key role in CAN Capital’s return to funding in the summer of 2017.

Siciliano’s arrival marks CAN Capital’s second C-level hire in a year; the company appointed financial services industry veteran Tom Davidson as Chief Financial Officer last spring. In December of 2017, CAN Capital added a trio of executives in technology, business development, and modeling and analytics.

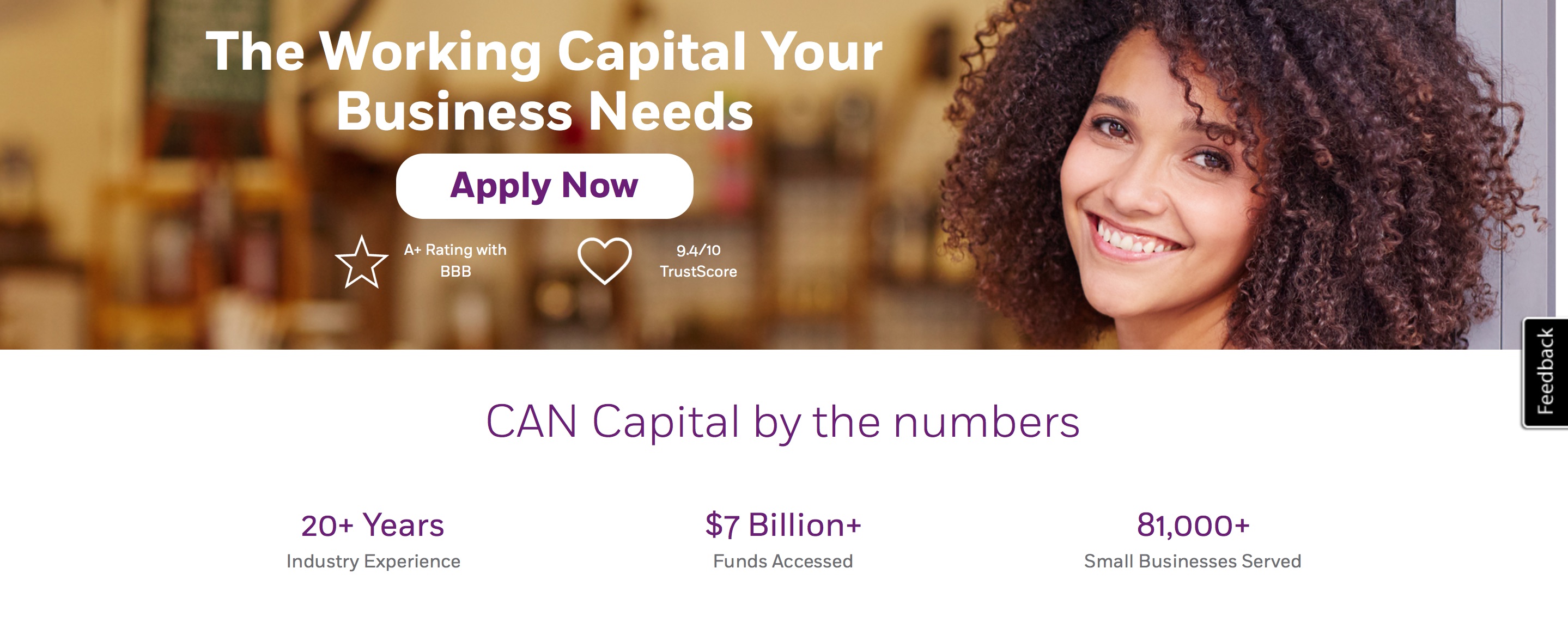

CAN Capital demonstrated its Mobile Funder solution at FinovateFall 2013. Mobile Funder is a tablet-based tool that helps highly-mobile financial sales professionals sell alternative capital products to SMEs. With more than $7 billion in funds accessed and 81,000+ small businesses served, CAN Capital was founded in 1998 and is based in Kennesaw, Georgia.