With $4.4 billion in assets, North Carolina-based First Bank is the first community bank in the U.S. to choose CRMNEXT to “transform its branches” and empower bank associates with technology that enables superior customer service across channels. A full-service community bank, founded in 1935, First Bank has 95 bank branches in North and South Carolina, and more than 300,000 customers.

“We believe that when customers have big financial questions, they want to talk to someone rather than chat over the phone with a support associate or send messages through an app,” First Bank EVP Cathy Dudley said. “To better serve those customers who want that consultative support, the branch experience has to change and improve as well. This is the heart of what a community bank does: serve the customer quickly and on a personal level.”

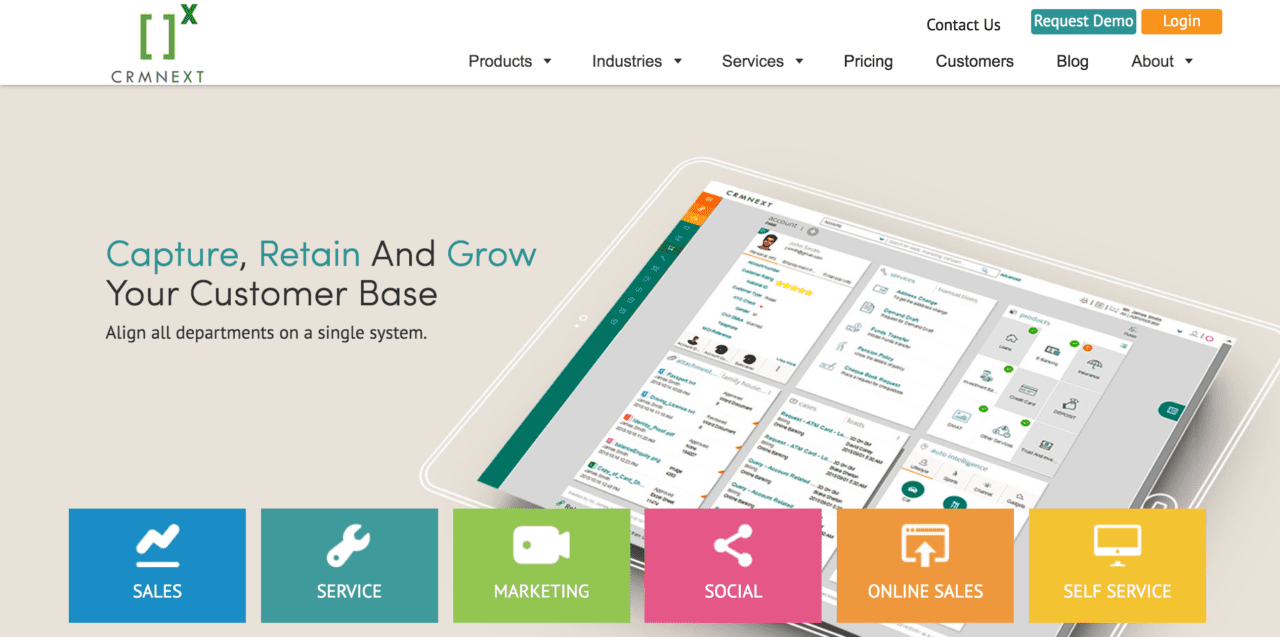

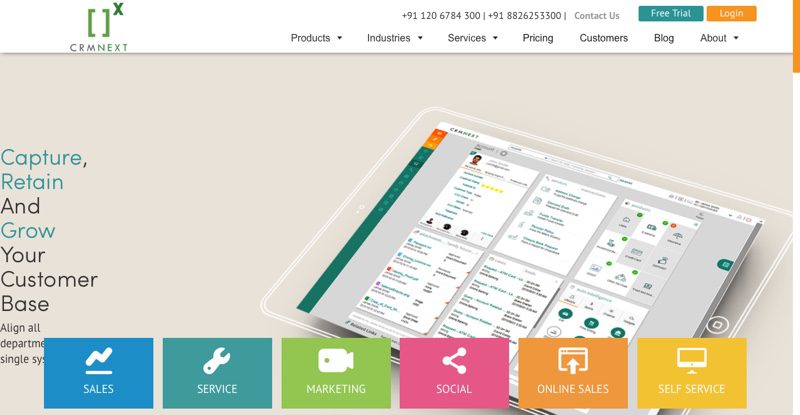

left to right: CEO Joe Salesky and VP for Sales Consulting Ed Ponte demonstrating the CRMNEXT platform at FinovateFall 2016.

“A great customer experience is about eliminating the artificial barriers between human and digital channels, and enabling world class, personalized interactions – both online and at the branch,” CRMNEXT CEO Joe Salesky explained. He pointed out that better customer experiences have often been sacrificed on the altar of ”uncovering operational efficiencies” or “digitizing interactions.” Instead, Salesky said, banks like First Bank are leveraging tools like CRMNEXT to set “new expectations for how financial institutions must engage with customers to be innovative and profiable.”

This was especially important to First Bank, which was specifically looking for solutions that would enhance, rather than replace, human interaction and conversation. CRMNEXT simplifies and automates processes that typically required upwards of 15 minutes to complete. This includes everything from new customer onboarding to replacing lost or stolen cards.

CRMNEXT also makes it easy for associates to provide truly omni-channel customer service, for example, spotting an incomplete application for an auto loan during an assisted interaction for another service. This enables associates to provide more assistance more effectively and gives banks the opportunity to gain leads and increase revenues.

“With 80% of customer interactions on digital, assisted interaction on phone and in person are a shrinking opportunity to wow your customers,” Salesky said during his Finovate demo last fall. “That’s why our customers are using CRMNEXT today on 70 percent of their desktops.”

Founded in 2001 and headquartered in Sausalito, California. CRMNEXT demonstrated its customer engagement platform at FinovateFall 2016. The company’s technology lowers the average length of customer transactions by 90 percent, increases employee productivity by 60 percent, and contributes to bottom line revenue by as much as 40 percent. With the world’s biggest banking CRM implementation in the world, CRMNEXT’s platform supports more than a million financial associates and a billion customers.

Joe Salesky, CEO, North America

Joe Salesky, CEO, North America Ed Ponte, VP Sales Consulting

Ed Ponte, VP Sales Consulting