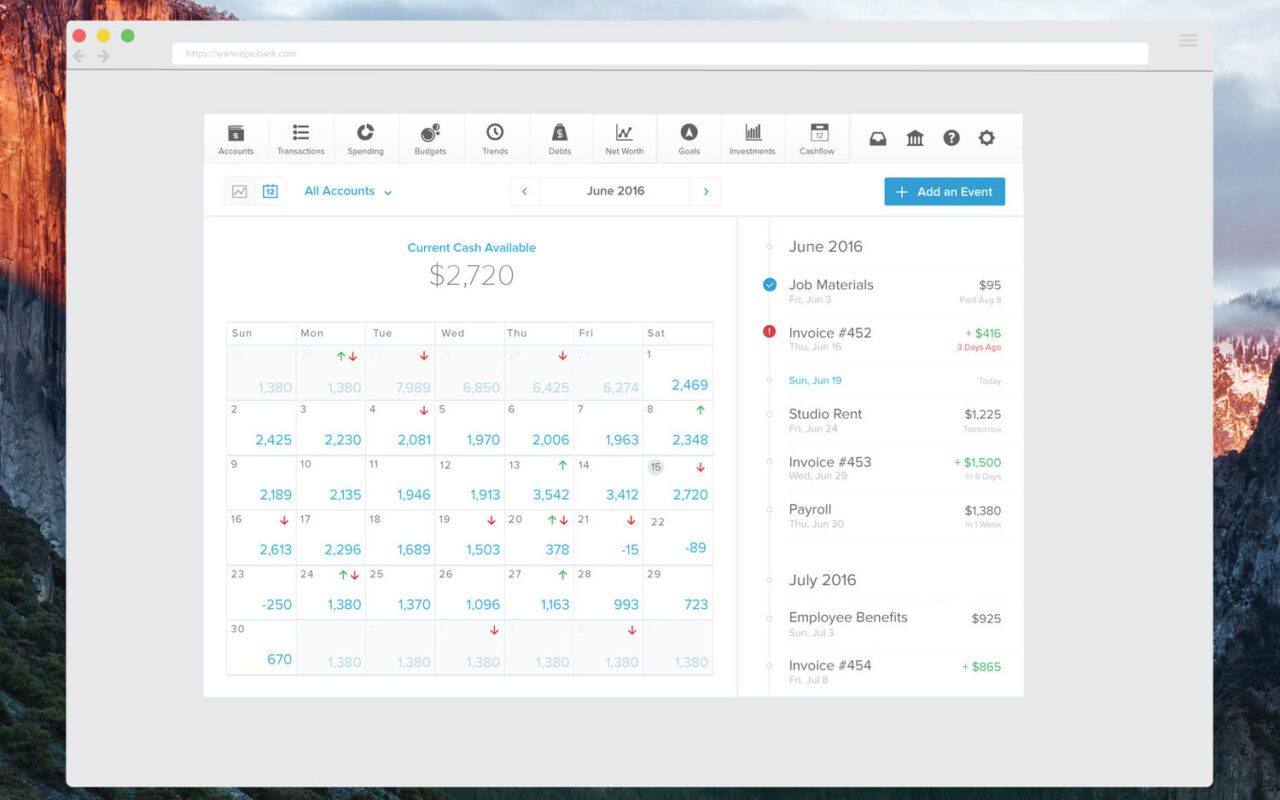

Money-management solutions provider MX launched a new feature to bolster its suite of MoneyDesktop offerings, which include budgeting, account aggregation, transaction history, etc. The new addition is called Cash Flow and offers a better way for users to visualize how money moves in and out of their account throughout the month.

Cash Flow combs a user’s transaction history for deposits into and payments out of their accounts that occur on a regular basis. Both the calendar and line graph views of the tool show a future-cast of their projected balance each day and help them see the impact of additional recurring payments. The Utah-based company’s CEO Ryan Caldwell said that the new technology offers customers “the ability to not only track data, but also take action on their own financial data.”

Highlights of Cash Flow include:

- Quickly capture recurring debits and credits (rent, mortgage, utility bills, paychecks)

- Match transactions to specific events to help predict account behavior

- View transactions on a line graph or calendar

- View financial trajectory on a monthly or yearly basis

Founded in 2010, MX is a five-time Best of Show winner at Finovate. The company most recently demoed at FinovateFall 2014 where it launched Helios, a cross-platform framework for fintech. The company partners with 650 financial institutions and 35 digital, online, and mobile banking providers.

MX has also been successful in presenting at the FinDEVr developers conference. At FinDEVr San Francisco 2015, the company’s CTO Brandon Dewitt gave a presentation titled, How You Build Something Is More Important Than What You’re Building.

We’re

We’re

PFM and banking-software company

PFM and banking-software company