On Finovate.com

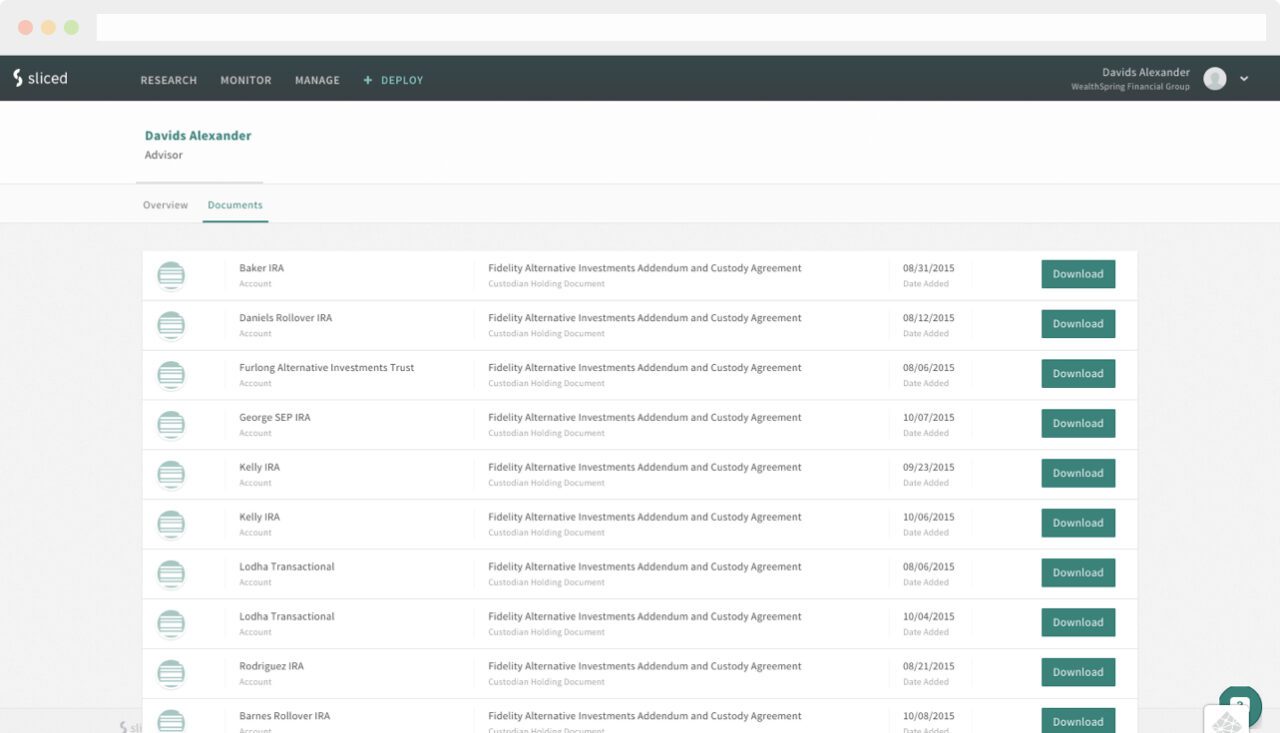

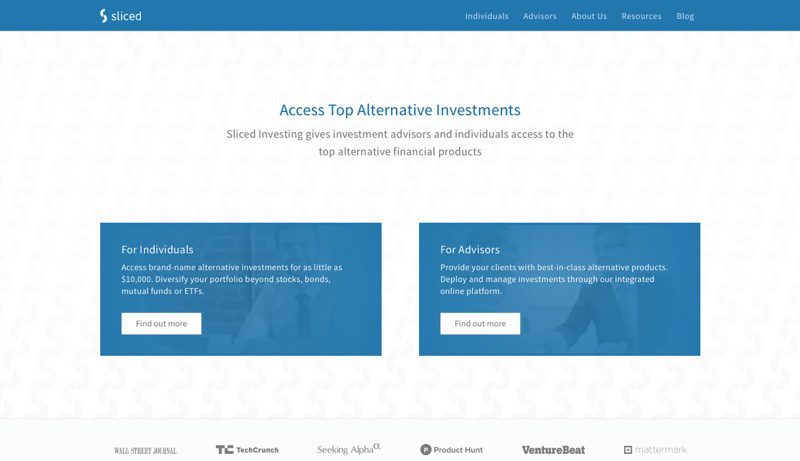

- “Finovate Debuts: Sliced Investing Provides Advisers with Access to Alternative Investments”

- “Narrative Science Introduces Anti-money Laundering Solution, Quill for AML“

- “Yodlee’s Ynext Unveils New Incubator Class”

Around the web

- TechInAsia features SayPay.

- Thomson Reuters unveils latest version of its tax technology platform, Thomson Reuters ONESOURCE.

- Re/code looks at ShopKeep POS’s growth and newly hired COO, Michael DeSimone.

- Currency Cloud partners with API-driven Fidor Bank to provide new SEPA Direct Debit functionality.

- Hedgeable to take part in Yodlee’s Ynext Launchpad.

- Business Insider lists eToro, BehavioSec, Klarna, and Fidor, as “companies we wish were big the U.S.”

- Silicon Slopes Podcast hosts Ryan Caldwell, MX CEO, as he discusses how to improve online banking.

- RTN Federal Credit Union re-ups with Fiserv’s XP2 account-processing platform.

- Meniga to power Santander’s PFM.

This post will be updated throughout the day as news and developments emerge. You can also follow alumni news headlines on the Finovate Twitter account.

Akhil Lodha, CTO, Co-founder

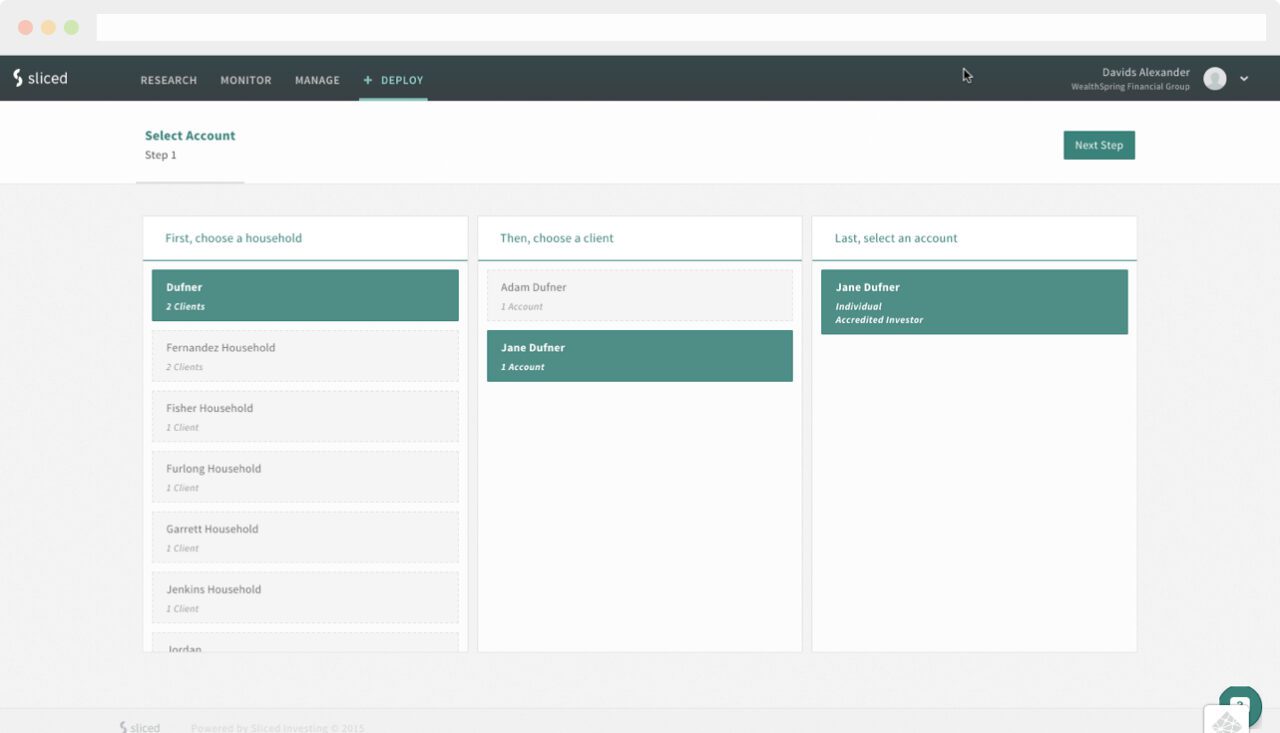

Akhil Lodha, CTO, Co-founder Mike Furlong, CEO, Co-founder

Mike Furlong, CEO, Co-founder