Is there a fintech company having a more impressive summer than Klarna? The e-commerce innovator has forged strategic partnerships with and secured investments from Brightfolk, Visa, and Permira in the past two months. In June, the company added a full banking license to its assets, making Klarna “one of Europe’s largest banks” in the words of CEO Sebastian Siemiatkowski.

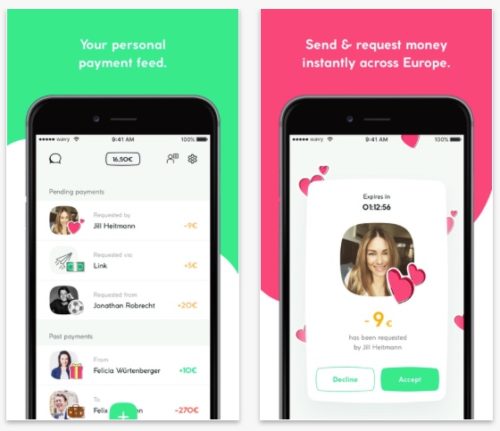

By comparison, today’s unveiling of Wavy, a new, free P2P payments service is a relatively more modest move. Available in iOS and Android as well as online, the free app enables users in more than 30 European markets to transfer Euros between friends and family. Users connect their bank or credit card accounts to Wavy, and make transfers by generating a payment link which can be delivered over social media or to another Wavy account. That said, recipients can receive and redeem payments via their bank accounts without having to sign up for the Wavy service. Users can pay requests for payment with EU-issued credit cards or SOFORT Überweisung.

Wavy is the product of Klarna’s collaboration with the developers of P2P payment app Cookies, who joined Klarna late last year in the wake of Cookies’ filing for bankruptcy. At the time, Klarna praised the app for its combination of social features and user-friendly interface, and credited Cookies for being both one of the first PFM apps to focus on younger users as well as the first to bring “near-realtime” money transfers to Germany. Lamine Cheloufi, Cookies co-founder and current Product Director at Klarna, called Wavy “the most accessible peer-to-peer payment service in Europe.”

To that end, and taking stock of the crowded market for P2P payment options, TechCrunch’s Romain Dillet suggested that Wavy might get an initial boost from Klarna’s popularity in its native Sweden. But listening to Siemiatkowski, it almost seems as if Europe is just a first stop. “There are no borders in an online context, why should there be in payments?” Siemiatkowski said. “Klarna was founded with the goal to make online payments safe, simple, and smooth. Wavy is another step on that journey.”

Providing single-click purchase experiences that enable direct payments, pay after delivery, installment plans and more, Klarna demonstrated its technology at FinovateSpring 2012. The company was founded in 2005 in Sweden, and is currently headquartered in Columbus, Ohio. Klarna’s solutions are used by more than 60 million consumers and more than 70,000 merchants in 18 markets globally.

Klarna CEO and co-founder Sebastian Siemiatkowski (pictured) put the new investment in the context of its recent

Klarna CEO and co-founder Sebastian Siemiatkowski (pictured) put the new investment in the context of its recent

Highlighting the company’s history as a e-commerce innovator and its future as a “consumer-oriented, product driven, and technology intensive bank,” Siemiatkowski trained his sights on retail banking itself. “We will … (provide) solutions that ensure a smooth customer experience, help people streamline their financial lives and continue to support businesses by solving the complexity in handling payments,” he said, adding, “the opportunities are tremendous, it is a thrilling prospect.”

Highlighting the company’s history as a e-commerce innovator and its future as a “consumer-oriented, product driven, and technology intensive bank,” Siemiatkowski trained his sights on retail banking itself. “We will … (provide) solutions that ensure a smooth customer experience, help people streamline their financial lives and continue to support businesses by solving the complexity in handling payments,” he said, adding, “the opportunities are tremendous, it is a thrilling prospect.”