On Finovate.com

- SocietyOne Appoints New CEO as it Nears $500 Million in Total Lending.

- Dublin’s Leveris Picks Up Investment from Link Asset Services.

Around the web

- Coinbase rebrands its crypto wallet Toshi as Coinbase Wallet; announces acquisition of Distributed Systems.

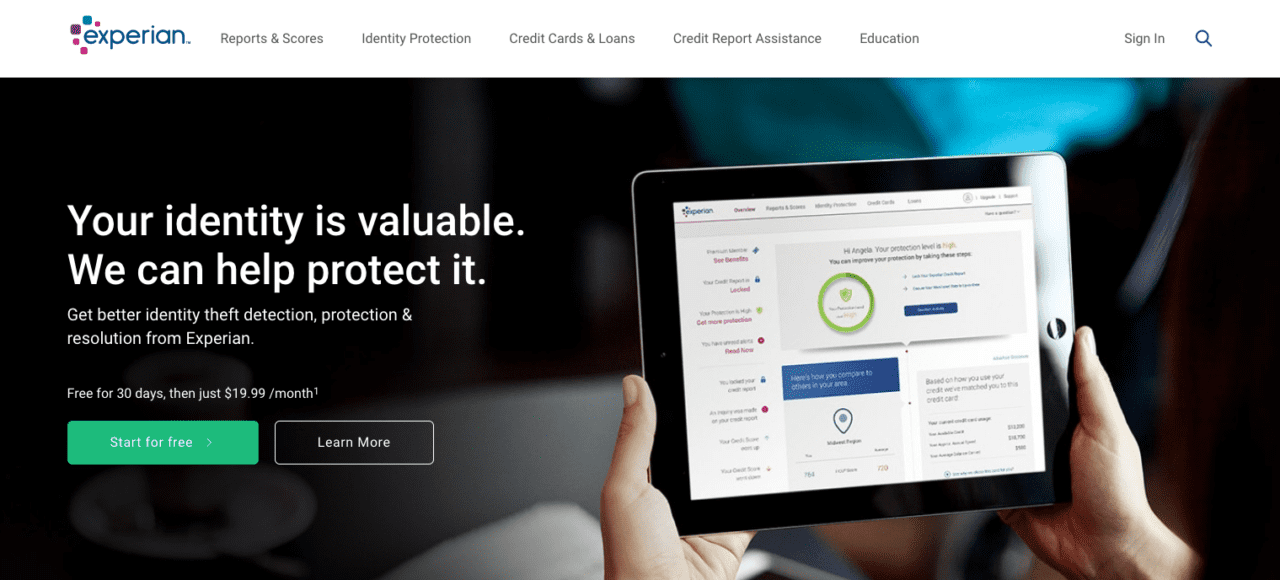

- Experian unveils new integrated data and analytics platform, Ascend Analytics on Demand.

- ID.me to provide its digital credentialing service to government agencies and healthcare organizations as a white label offering in 2019.

- Kofax earns spot on the Constellation ShortList for Robotic Process Automation.

- Biometric Update features Jumio, Mitek, and Onfido in a review of digital identity verification providers.

- Breaking Banks highlights EverSafe in a conversation on how fintech is meeting the needs of an aging population.

- CIO Applications features Exate.

- Ad Exchanger: Cardlytics Says It Hopes To Expand Beyond Bank-Owned Media.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.