On Finovate.com

- Xignite to Power WealthSimple’s New Stock Trading App.

- Kony Secures $37 Million in Financing from BMO.

- Sezzle Raises $30 Million in IPO.

- Vymo Reels in $18 Million for its Intelligent Sales Assistant.

Around the web

- Deal sealed: Fiserv completes acquisition of First Data.

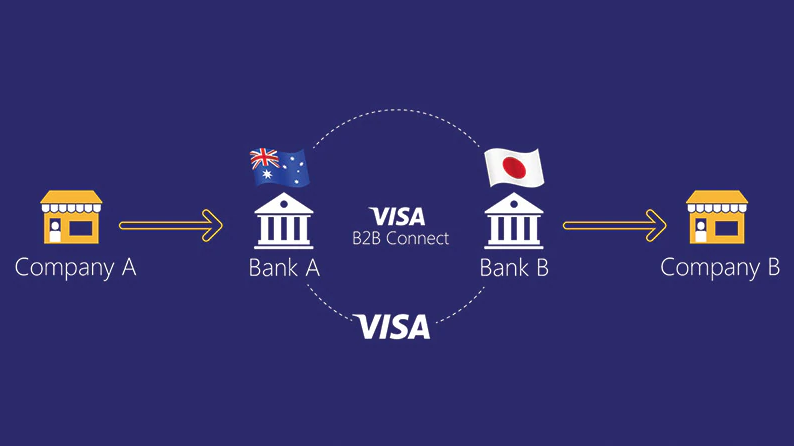

- Visa announces strategic partnership with SME banking service Open.

- eToro enables retail customers to invest in drone technology via its latest portfolio.

- iGTB to enhance trade finance operations for two Raiffeisen banks, Niederosterreich-Wien and Landesbank Steiermark.

- CREALOGIX to power new consumer digital investment platform from MeDirect Group.

- JP Morgan Chase ends loan origination partnership with OnDeck.

- ThetaRay brings on Idan Keret as Chief Customer Success Officer.

- GreenDot offers customers 3% cash back on online and in-app purchases and a savings account paying 3% APY.

- Fintech Finance interviews Olga Feldmeier, Smart Valor CEO.

- Redrock Biometrics secures a perfect score in Level 1 Presentation Attack Detection confirmation testing by iBeta.

- SpyCloud expands into Europe, the Middle East, and Africa.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.