Small business financial services tools provider Wave announced this week it partnered with Visa to help small business owners iron out their cash flow.

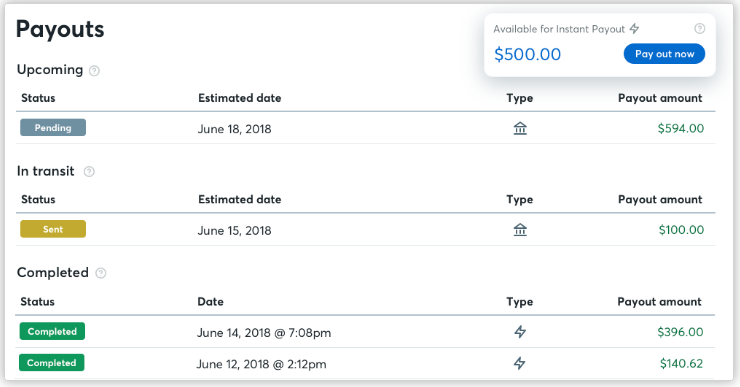

The two have teamed up to launch Instant Payouts, a tool that allows businesses to access the money they’ve earned as soon as they’ve earned it. Without having to wait for typical payment processing times, small businesses can use their funds immediately to grow their businesses or pay invoices.

“Small businesses depend on cash flow to survive,” said Les Whiting, Chief Financial Services Officer at Wave. “Often they have to wait two banking days or more for their payments to process through traditional banking methods.”

Instant Payouts integrates Wave’s invoicing and accounting tools with Visa Direct to give small business clients access to funds when they need them– even in the evening, on weekends, and on holidays. With Instant Payouts, customers with Visa and Mastercard debit cards will have access to their funds within 30 minutes.

Businesses that choose to take advantage of Instant Payouts can redeem any amount of pending funds over $25. Wave charges a 1% fee for the service in addition to its standard processing fee of 2.9% + $0.30.

Instant Payouts was launched in beta to a select group of small business owners at the start of 2019. Wave will roll it out to more clients in the U.S. and Canada later this year.

Founded in 2010 and headquartered in Canada, Wave demonstrated its financial management software for small businesses in conjunction with Royal Bank of Canada at FinovateFall 2017.

Presenter

Presenter