Alternative ecommerce payments company Sezzle made its public debut this week. The Minneapolis, Minnesota-based company listed on the Australian Stock Exchange (ASX) under the ticker SZL.

Within two hours of listing, Sezzle was being traded 82% above its opening price of $0.83 (AUD $1.22). The company was ultimately able to raise $30 million on its first day of trading. Sezzle will use the funds to attract more retailers to its platform, which currently boasts just over 5,000 merchants. The company will also enhance support for its 430,000 clients.

Why Australia? Sezzle is the first one to admit it has no plans of operating in Australia in the near future. The company’s reasoning for listing on the ASX is that the country’s investors are more familiar with Sezzle’s buy now, pay later model since one of its rivals, Afterpay, is based in Melbourne. Sezzle CEO Charlie Youakim explained this in further detail during an interview with Bloomberg yesterday.

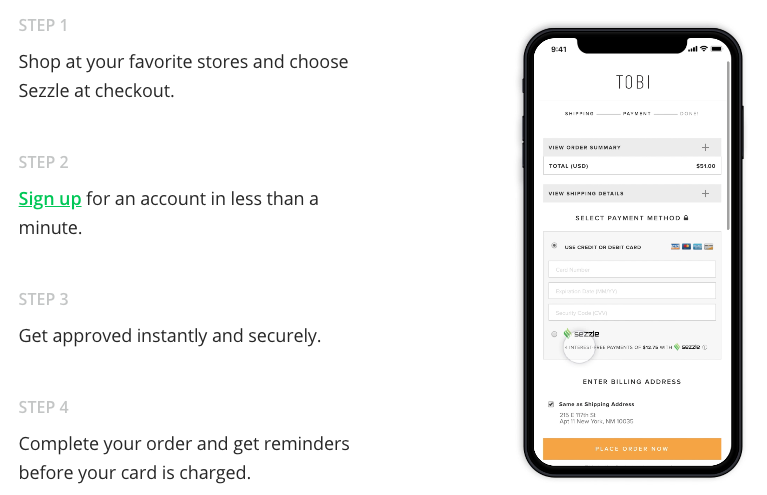

Sezzle’s technology, which allows customers to split their ecommerce purchases into four installments with only 25% down and no fees, is only available for shoppers in the U.S. and, as the company just announced this week, Canada. It is also available for merchants regardless of their location across the globe as they seek to expand their North American customer base.

When asked about international expansion, Youakim told Bloomberg in an interview, “The product lends itself to expanding internationally,” he said. “We’re researching new markets but the vast majority of our focus is in North America.”

The company makes money not by billing users, but by charging merchants, which face a 6% + $0.30 fee on each transaction. And the model seems to be working. From March 2018 to March 2019, Sezzle’s merchant sales grew by 16x to $28.3 million. In exchange for the fee, merchants are paid upfront and don’t inherit the risk of the customer not paying back all of their installments.

Sezzle demoed its alternative payment platform at FinovateFall 2018. Prior to today’s IPO the company had raised almost $117 million.