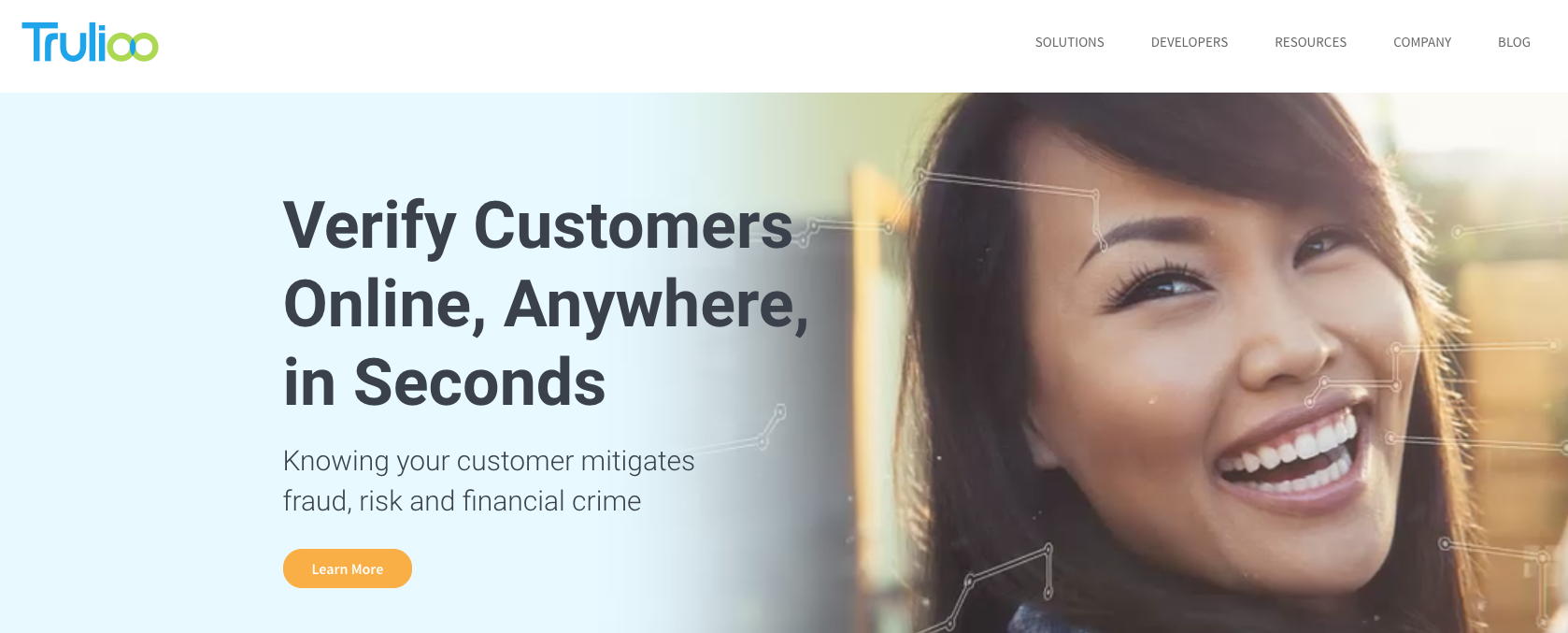

Advanced biometric technologies like facial recognition have their critics. The city of Boston, Massachusetts, just a few weeks ago, became the second community in the world to ban the use of facial recognition technology over concerns of bias against ethnic minorities. And the use of facial recognition in places like China has heightened concerns over the potential privacy-violating aspects of the technology.

Nevertheless, the fact that companies continue to innovate in the biometric authentication space suggests that these issues are more likely to be seen as contemporary challenges rather than permanent obstacles. This is all the more so in a world that is coming more – rather than less – connected, and digital.

Trulioo, a leading global identity verification provider, is one the companies that is helping small businesses take advantage of these technologies. The company announced today that its low-code developer tool, EmbedID, will now feature both facial recognition and document verification functionality. This will enable SMEs to verify new users during the account opening process more efficiently and accurately, and assure that KYC and AML requirements are met.

“Taking a multi-layered approach to identity verification offers businesses the strongest defense against increasingly sophisticated bad actors,” Director of Growth at Trulioo Rutherford Wilson explained. “Adding document verification gives another layer of protection to help reduce risk, especially when combined with reliable identity verification.” Wilson credited the combination of these features for providing businesses with the “increased confidence in knowing the user is tied to a real identity and that they are who they claim to be online.”

Small businesses can use the technology by copying a snippet of code and pasting it on their website. This will automatically generate a stylized registration form that is prewired to Trulioo’s GlobalGateway to provide instant verification of personal identification information. Via the connection to GlobalGateway, small businesses can verify the authenticity of government-issued ID documents and leverage facial recognition technology – equipped with liveness detection – to establish that the individual opening the account is the same person in the photo on the ID document.

“In an age of ongoing digital transformation, it’s essential for SMBs to be able to access the same identity verification solutions used by large organizations to protect their business and scale their company,” Wilson added. He cited cost as the main barrier for most small businesses when it comes to accessing “bank-grade” technology and security. This leaves them more vulnerable to fraudsters than their larger rivals, and makes it more difficult for them to compete.

“We designed EmbedID to help level the playing field to allow for accelerated innovation, customer acquisition, and competition in the marketplace,” Wilson said.

Founded in 2011 and headquartered in Vancouver, British Columbia, Canada, Trulioo has been a Finovate alum since 2014 and most recently demonstrated its technology at our European conference in February. Named to CNBC’s 2020 Disruptor 50 roster in June, Trulioo was featured in our look at Canadian fintech innovators on Canada Day earlier this month.