On Finovate.com

- Roostify Powers TD Bank’s Digital Mortgage Experience.

- Modo Receives $13 Million Investment.

Around the web

- iQuantifi launches RoboPlanner roboadvisory tool for millennials.

- Nummo selects MX to power user account aggregation.

- Signicat digitizes in-store signing of credit agreements for Resurs Bank retail partners.

- Kony helps PSECU deliver an updated digital banking application to enhance the digital user experience.

- InComm partners with Japanese pharmacy chain Welcia to launch four mobile barcode payment solutions in its stores.

- Trustly introduces InBanner Pay N Play.

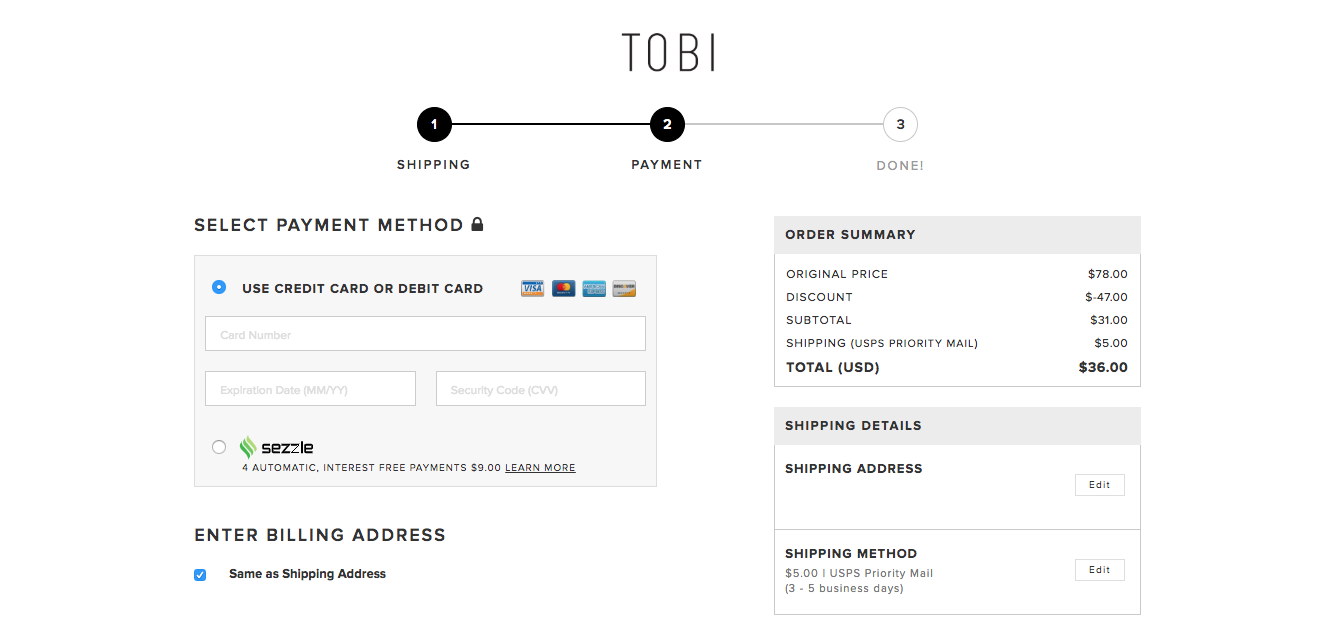

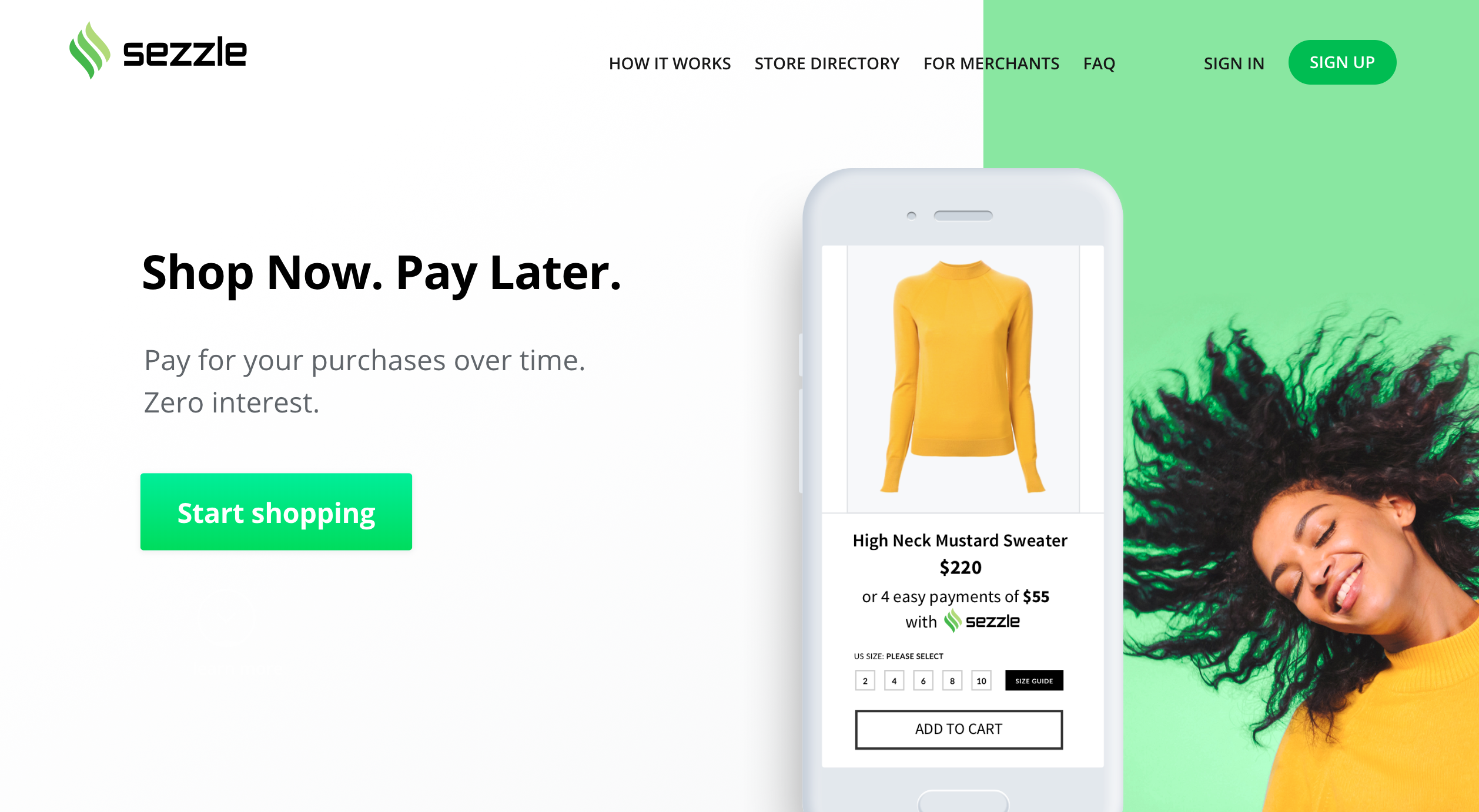

- Sezzle adds ShipStation as client.

- Ocurrency interviews Radoslav Albrecht, Founder & CEO of Bitbond.

- Insuritas partners with Sound Community Bank to launch bank-owned digital insurance agency platform.

- Bill.com partners with First National Bank of Omaha (FNBO) to offer enhanced digital business payments solutions.

- Lighter Capital’s investment in Springboard Retail reaches $1.1 million.

- Provident Bank chooses Gro Solutions to boost mobile-first user-experience and drive account growth.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.