personalcapital.com | techblog.personalcapital.com | @PersonalCapital

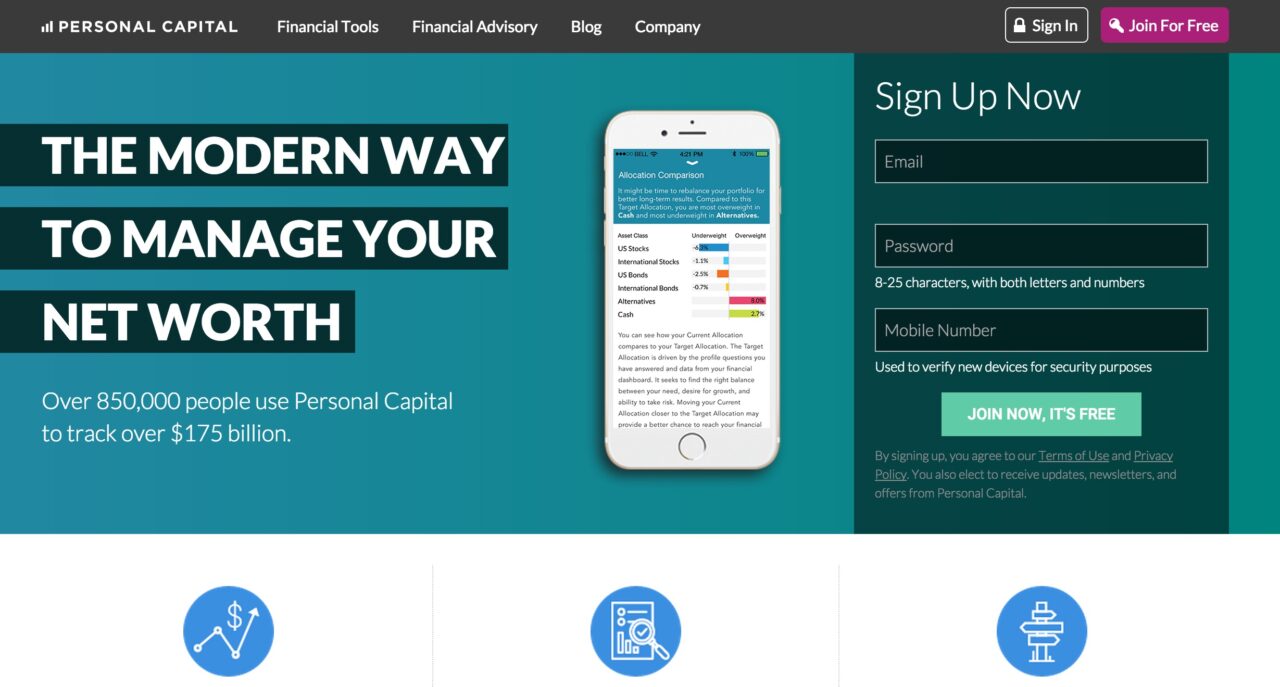

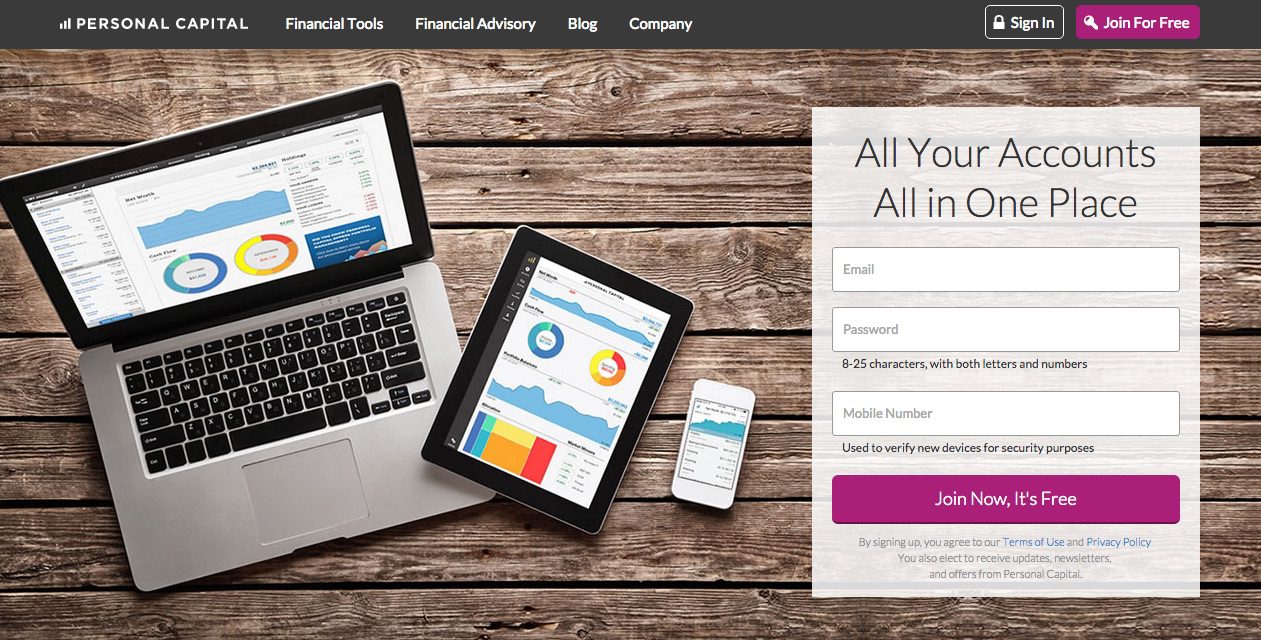

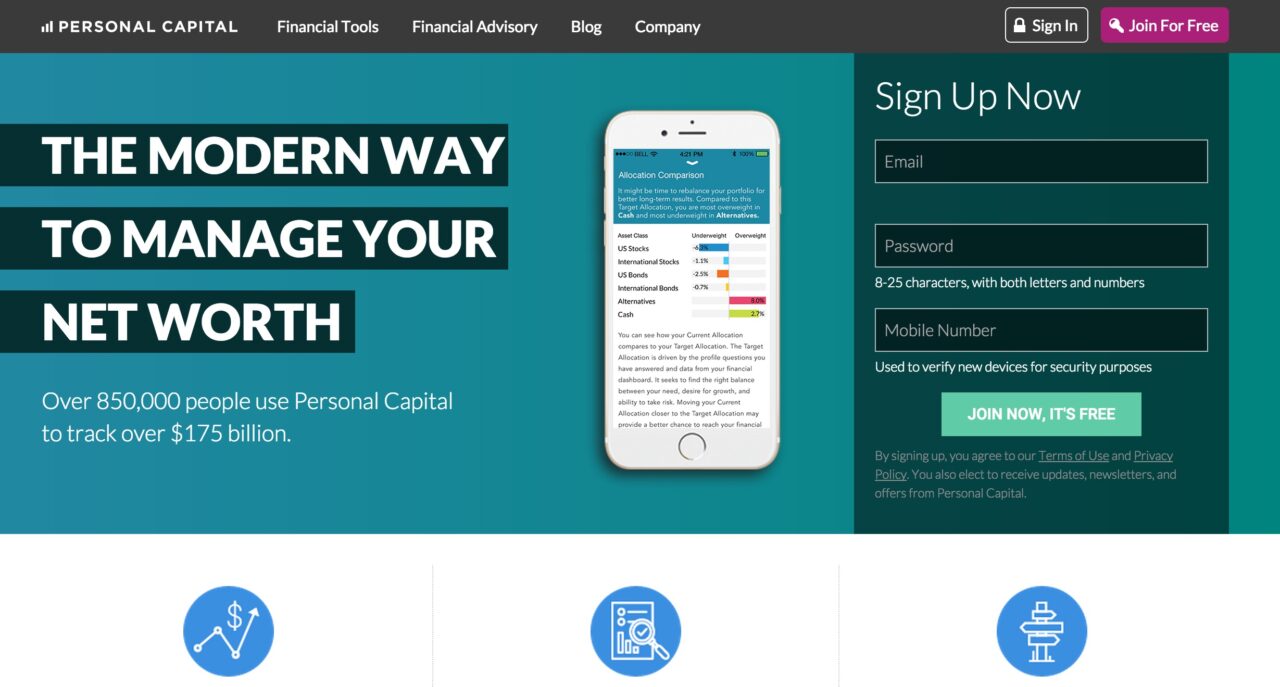

Personal Capital is a next-generation financial adviser, named by CNBC as a “Top Disruptor” for our innovative approach to wealth management. Our award-winning free tools and mobile apps give clients a complete picture of their net worth, and we offer comprehensive financial advisory services previously available only to the ultra-wealthy. This combination of high-tech and high-touch drives our ability to deliver truly personal and objective wealth management for the internet and mobile age. We believe this is the best way to empower individuals and their money.

Personal Capital is a next-generation financial adviser, named by CNBC as a “Top Disruptor” for our innovative approach to wealth management. Our award-winning free tools and mobile apps give clients a complete picture of their net worth, and we offer comprehensive financial advisory services previously available only to the ultra-wealthy. This combination of high-tech and high-touch drives our ability to deliver truly personal and objective wealth management for the internet and mobile age. We believe this is the best way to empower individuals and their money.

Data-driven retirement planning

We are presenting the inner workings of a truly data-driven retirement planner created by leveraging a user’s aggregated financial data, enhanced by machine learning and personalized by user’s life events and goals. We will discuss how the investing and financial planning strategies are triggered to update as the user moves through different stages of her life and makes changes to her spending and saving behaviors. Finally, we will show how this functionality is visualized through a UI that makes sophisticated algorithms and complex data easy to use for any user, regardless of investing knowledge.

Key takeaways:

- How we employ machine learning techniques to forecast growth of a user’s portfolio and

estimate available retirement spending

- How we create a connected ecosystem that allows a user and his/her dedicated adviser to collaborate on the same financial data and retirement plan

- How we use AWS infrastructure to supercharge our data-driven retirement planner

Presenters:

Fritz Robbins, CTO

LinkedIn | @fritz_robbins | [email protected]

Fritz Robbins is the CTO of Personal Capital, responsible for definition and execution of the technology roadmap and leadership of the technology teams. He has previously led technology and engineering efforts at Wells Fargo, Excite@Home, RSA Security, and elsewhere.

Ehsan Lavassani, VP Engineering, Founding Engineer

LinkedIn | @EhsanLavassani | [email protected]

Ehsan Lavassani is Personal Capital’s VP engineering and its first employee. He was the architect of Personal Capital’s core systems from the ground up and formed its world-class engineering team. Previously, he was one of the main architects of RSA’s Adaptive Authentication system.

Personal Capital

Personal Capital