Cloud accounting platform FreeAgent teamed up with Starling Bank this week. The partnership aims to make business banking easier for Starling’s business and freelancer clients.

As Roan Lavery, FreeAgent co-founder and CPO said in the announcement, “This integration allows Starling customers to link their bank account with FreeAgent, pulling in transactions on a daily basis. From there, these transactions can be reconciled as normal.”

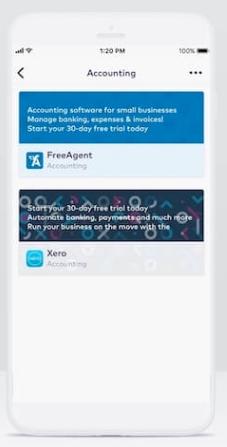

Starling said the impetous of the partnership was the increased demand for business banking services the bank experienced after a successful integration with FreeAgent competitor Xero in November of last year. Starling said it hopes the new integration will reduce stress levels for small businesses, which can sync their Starling business bank accounts with FreeAgent as of this week.

Here’s how it works– once businesses give FreeAgent consent, data associated with the business’ Starling account, including transaction time, spending category, and transaction name, is pulled over to the FreeAgent platform. By syncing both historic and current transaction data automatically, businesses can spend less time on manual data entry and benefit from more accurate reports.

Founded in 2007, FreeAgent offers cloud accounting services to help small businesses and freelancers manage their accounts. The U.K.-based company provides an API for easy integration, and works with existing startups such as Basecamp, Stripe, PayPal, and Xpenditure. The company also has an offering for accountants, a sales tax reporting tool, a fully-integrated payroll system, and freelancer tools such as time tracking and a project profitability estimator.

FreeAgent CEO Ed Molyneux debuted FreeAgent’s Financial Health Insights at FinovateEurope 2013 in London. In 2016, the company went public and, last year, was acquired by RBS in an offer valued at $75 million (£53 million).