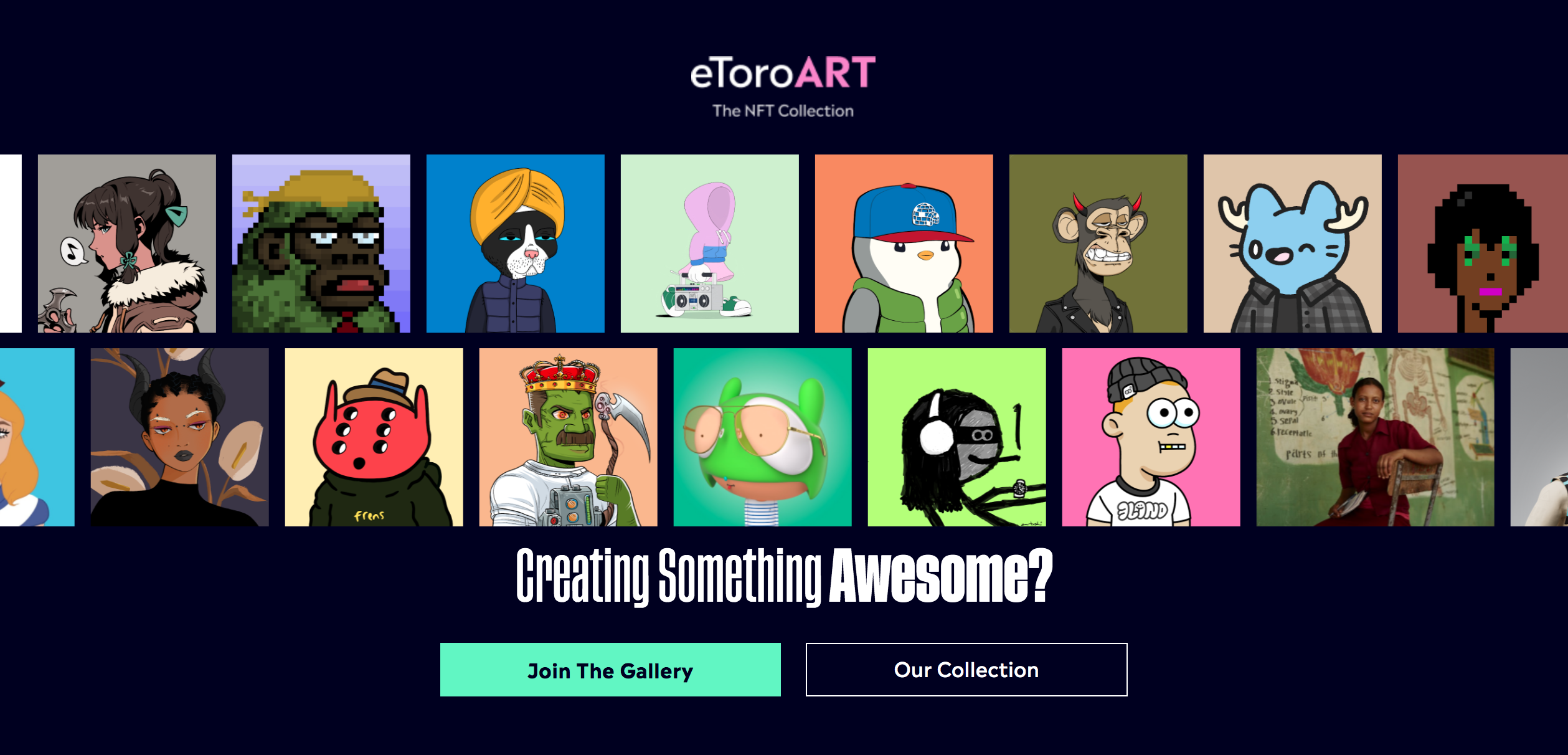

- Social investing platform eToro is launching eToro Art, a $20 million fund to support NFT creators.

- Once the company’s $20 million collection of NFTs is complete, eToro will be one of the world’s leading NFT collectors.

- eToro has made it clear that, while its new project supports creators, it is not an NFT marketplace.

When it comes to trends in fintech, NFTs are red hot. To capture some of this heat, social trading and investment network eToro is launching etoro Art, a $20 million fund to support NFT creators, agencies, and brands by purchasing blue chip NFTs and investing in emerging creators and NFT projects.

As part of etoro Art, the Israel-based company has amassed its own collection of NFTs, which includes projects from Bored Ape Yacht Club, CryptoPunks, World of Women, and pieces from emerging artists. After eToro spends the full $20 million on NFTs, the company will be one of the world’s leading NFT collectors. This week, eToro will debut its NFT collection during an event at the Bass Contemporary Art Museum in Miami.

eToro Cofounder and CEO Yoni Assia said that the company’s entrance into the NFT space “is only natural” and that the move will serve as the bridge to bring its community of 27 million registered users into NFTs and the metaverse. “We’re incredibly excited to see the developments in this space over the coming months,” Assia added.

As part of today’s move, eToro will spend an additional $10 million to support up-and-coming creators and brands on new, emerging projects. Creators simply fill out an intake application and, if they are selected to participate, eToro will offer “a range of support and services” to help them bring their project to fruition.

“As the leading social investing platform, eToro is well positioned to lead this space,” said eToro Art Managing Director Guy Hirsch. He added, “eToro.art will bring creators and investors together through technology, uniting communities around art.”

The company is making it clear that it is not launching an NFT marketplace. “No NFTs may be purchased through eToro by use of the services provided by eToro, and eToro is not responsible for any trading activity in NFTs which may occur on any third-party platforms to which eToro may direct its customers,” the company said in a statement. Instead, eToro Art is simply an aggregation platform with referral to third-party platforms.

Founded in 2007, eToro went public in a $10 billion SPAC last year. The company was an early adopter of cryptocurrency, having purchased 100 bitcoin in 2012.

Photo by Andrey Metelev on Unsplash