We talked so much about the Buy Now Pay Later (BNPL) revolution in ecommerce that we are starting to sound like a broken record (someone please explain that reference to the younger millennials in the room). But the no-interest financing strategy is quickly becoming a must-offer feature for merchants, card issuers, and other players in the ecommerce ecosystem.

This week brings news that Zip Co, a digital retail financing and payments services company based in Australia, has agreed to acquire New York based Buy Now Pay Later company QuadPay in a deal valued at $269 million. One of the biggest BNPL companies in the U.S, QuadPay will enable Zip to expand its reach to five countries (Australia, New Zealand, South Africa, the U.S., and the U.K.), a combined annualized revenue of $182 million (AU$250 million) and 3.5 million customers.

Aside from the company’s co-founders, Adam Ezra and Brad Lindenberg, Zip was the largest shareholder in QuadPay. Ezra and Lindenberg will join Zip’s global leadership team post-acquistion with the responsibility of scaling business in the U.S.

Hungry for good news on the fintech funding front? Gaze no further than Latin America where a new report from KoreFusion highlights growth in smartphone ownership, ecommerce adoption, and dissatisfactioin with banks as just a few of the reasons why Latin America’s fintech boom is ust beginning.

The study, available for free from the San Francisco, California-based consultancy, is based on a study of more than 1,000 fintechs in Argentina, Brazil, Chile, Colombia, and Mexico. In addition to a survey of the fintech landscape – finding a concentration in the payments category with lending and B2B-based fintechs coming in second and third, respectively – the report underscores other areas – such as remittances and foreign exchange – where it believe major opportunities remain.

Read more in KoreFusion’s 2020 Latam Fintech Report.

Here is our look at fintech around the world.

Central and Eastern Europe

- German regtech 4Stop partners with payment service provider emerchantpay.

- ACI Worldwide announces that its technology helps power 75% of real-time payments in Hungary.

- German P2P lender auxmoney raises $177 million (150 million euros) in growth capital.

Middle East and Northern Africa

- Edenred UAE introduces mobile banking app, C3Pay.

- Hakbah, an alternative financial savings app based in Saudi Arabia, forges a partnership with Visa.

- Switzerland’s Additiv opens new regional headquarters in Dubai.

Central and Southern Asia

- Google Pay launches its NFC-based contactless payment offering in India.

- India’s Kotak Mahindra Bank introduces cardless cash withdrawals at ATMs.

- Singapore-based fintech Atlantis goes live with neobank targeting millennials and GenZ customers in India.

Latin America and the Caribbean

- Neon Pagamentos, a neobank based in Brazil, has raised $300 million in a Series C round led by General Atlantic.

- Brazil’s Central Bank says it will rollout a central bank digital currency by 2023.

- Nubank, a Brazilian challenger bank and the country’s second-largest credit card issuer, has secured $300 million in new funding.

Asia-Pacific

- Vietnam-based e-payments provider NextPay announces plans to raise up to $100 million early next year via a private placement.

- China’s UnionPay goes live with its digital bankcard.

- Malaysia’s securities commission inks a financial technology cooperation agreement with Indonesia’s financial services regulator Otoritas Jasa Keuangan.

Sub-Saharan Africa

- South Africa-based Entersket partners with NuData Security, bringing behavioral analytics to real-time risk scoring.

- Pan-African challenger bank Union54 announces plans for a 2021 launch.

- The National Agency for Social & Economic Inclusion (ANIES) of Guinea selects security services company Idemia fo its welfare cash transfer program.

Derrick Loi, Global Head of Orange Cloud for Business (International)

Derrick Loi, Global Head of Orange Cloud for Business (International) Thomas Achhorner, Global Head of Solutions

Thomas Achhorner, Global Head of Solutions

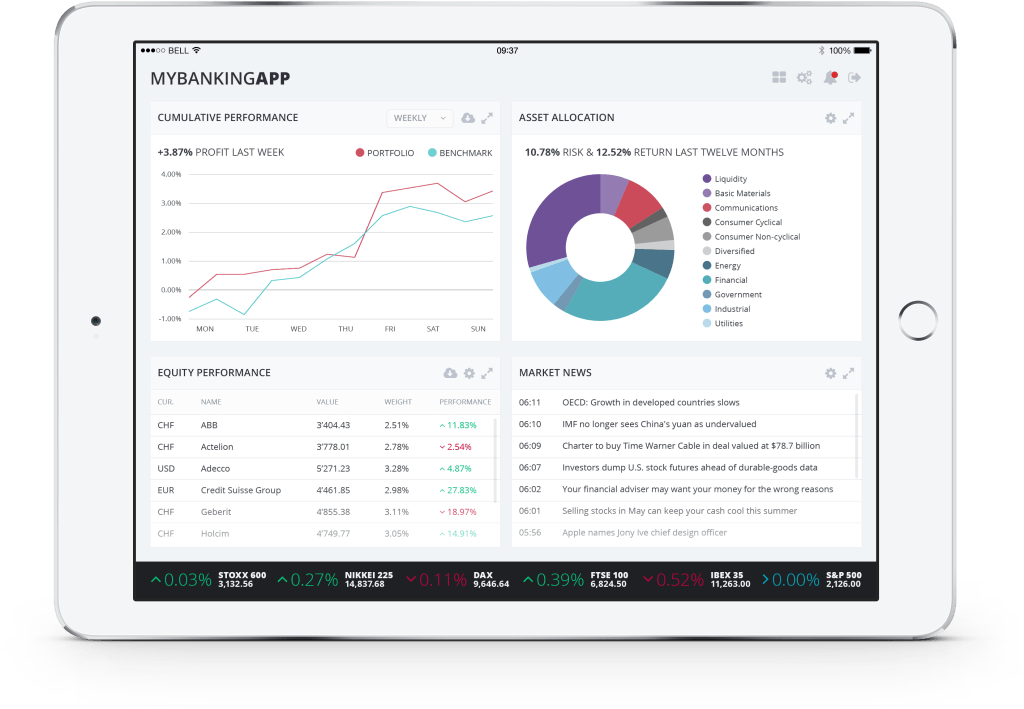

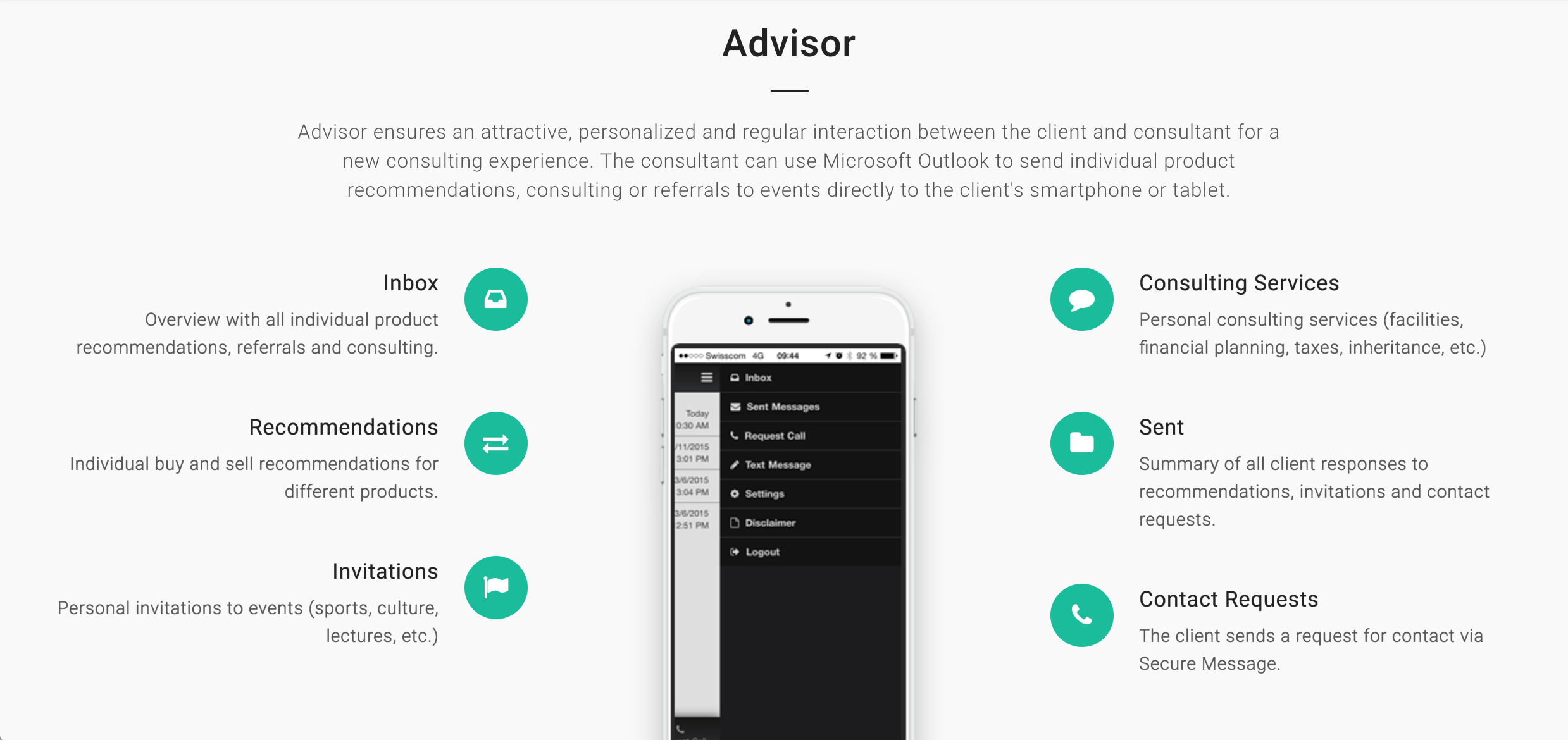

Founded in 1998, additiv offers a digital financial suite, robo advisor and advisor services, as well as digital mortgage tools. At FinovateEurope 2016, the company’s CEO and founder, Michael Stemmle, along with Adriano Lucatelli and Marc Sauter from Descartes Finance,

Founded in 1998, additiv offers a digital financial suite, robo advisor and advisor services, as well as digital mortgage tools. At FinovateEurope 2016, the company’s CEO and founder, Michael Stemmle, along with Adriano Lucatelli and Marc Sauter from Descartes Finance,

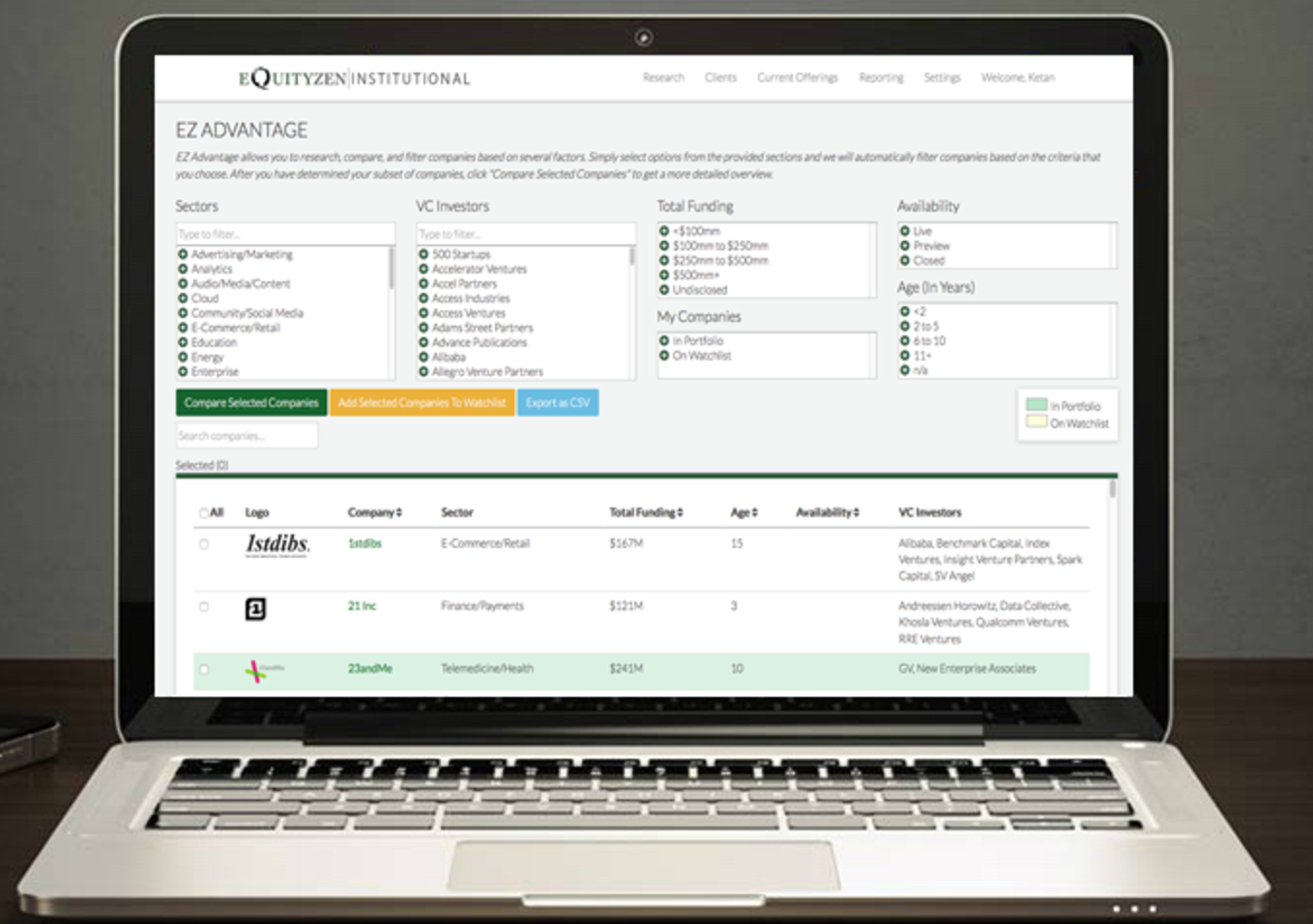

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

Michael Stemmle, Owner and CEO

Michael Stemmle, Owner and CEO Adriano B. Lucatelli, Entrepreneur, Founder of Descartes AG

Adriano B. Lucatelli, Entrepreneur, Founder of Descartes AG